January 11, 2024

(press release)

–

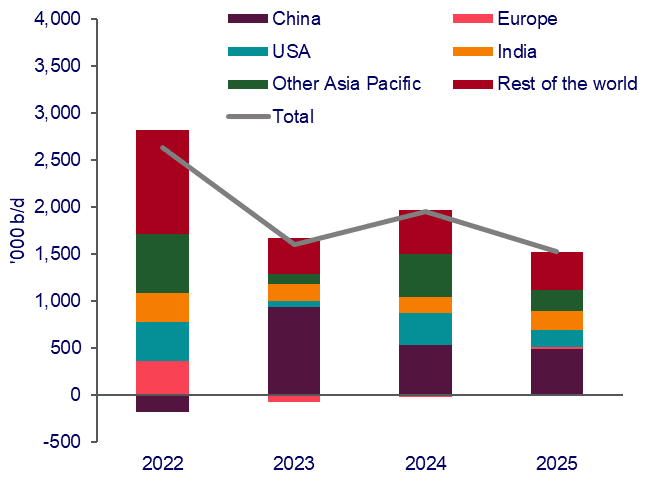

Global oil demand is due to rise by almost 2 million barrels a day (b/d) in 2024, with China accounting for over 25% of that increase according to a report by Wood Mackenzie.

The report, ‘Oil & Chemicals: Five things to watch in 2024’, published in December, states that alongside China, other key markets for growth include three emerging markets in Asia, Indonesia, Vietnam and Thailand as well as the US.

“Much of the growth [in oil demand] will be coming in the second half of the year,” says Alan Gelder, Senior Vice President of Research at Wood Mackenzie. “This will be fuelled by improving economic growth and lower interest rates.”

Wood Mackenzie forecasts total oil demand of 103.5 million b/d for 2024,

Global oil demand annual changes year-on-year

Source: History – IEA, JODI, EIA, National Statistics; Forecast – Wood Mackenzie

The report adds that oil supply will lag demand growth as OPEC+ supply cuts slow growth across 2024. However, it adds that without this production restraint the market could tilt into oversupply, especially if demand growth is below expectations.

Refineries will continue to be middle distillates led

With 2024 refining capacity additions set to be modest, the report states that demand growth of 600 thousand b/d will be met with high utilisation rates and the successful ramp up of Middle East capacity.

The key factor in any refined product supply outlook is our assumptions that Nigeria’s Dangote refinery will be ramped up successfully to full capacity of 650,000 b/d by the end of the second quarter of the year.

“As OPEC+ production returns the refinery yield of middle distillates, such as jet and diesel/gasoil, will rise from a heavier global crude slate,” Gelder says. “However, the easing of interest rates and re-balancing of GDP are critical to distillate demand growth.”

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.