WASHINGTON

,

March 7, 2022

(press release)

–

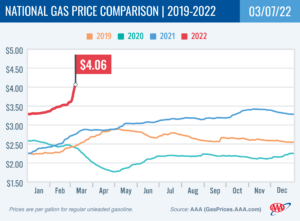

As the conflict between Russia and Ukraine continues, crude prices soar, leading to higher pump prices in the U.S. The national average for a gallon of gas is $4.06, a staggering 45 cents more than a week ago, 62 cents more than a month ago and $1.30 more than a year ago. The national average has not been this high since July 2008. Last week, the International Energy Agency (IEA) announced a coordinated release of crude oil from its 31 member countries’ strategic reserves, including the U.S., Germany, Canada, South Korea, and Mexico, to help counter the impact of rising crude prices. On Friday, IEA said member states committed to releasing a total of 61.7 million bbl from their strategic reserves to reassure markets roiled by the fallout from Russia’s invasion of Ukraine. This amount—half of which is expected to come from the U.S.—is the largest coordinated release since IEA was founded in 1974. Despite this announcement, the impact on pricing has been limited given that the amount of oil planned for release is small in comparison to the amount that flows daily from Russia to other countries around the globe. According to IEA, Russia exports approximately 5 million b/d of crude oil, representing about 12% of its global trade. According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks decreased by 500,000 bbl to 246 million bbl last week. Meanwhile, gasoline demand rose slightly from 8.66 million b/d to 8.74 million b/d. The increase in gas demand and a reduction in total supply contribute to rising pump prices. But, increasing oil prices play a leading role in pushing gas prices higher. Consumers can expect the current trend at the pump to continue as long as crude prices climb. Quick Stats The nation’s top 10 largest weekly increases: Rhode Island (+58 cents), Nevada (+57 cents), Connecticut (+56 cents), Kentucky (+56 cents), Alabama (+56 cents), West Virginia (+55 cents), Virginia (+55 cents), Massachusetts (+54 cents), New Hampshire (+52 cents) and New Jersey (+52 cents). The nation’s top 10 most expensive markets: California ($5.34), Hawaii ($4.69), Nevada ($4.59), Oregon ($4.51), Washington ($4.44), Alaska ($4.39), Illinois ($4.30), Connecticut ($4.28), New York ($4.26) and Pennsylvania ($4.23). Oil Market Dynamics At the close of Friday’s formal trading session, WTI increased by $8.01 to settle at $115.68. Crude prices continue to surge in response to the conflict between Russia and Ukraine. As the conflict continues, the oil markets will likely respond by increasing the price of crude oil to reflect more risk of disruption to tight global oil supplies this week. Additionally, EIA reported that total domestic crude stocks decreased by 2.6 million bbl last week to 413.4 million bbl. The current stock level is approximately 15% lower than at the end of February 2021, contributing to pressure on domestic crude prices. Drivers can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.