WASHINGTON

,

April 18, 2022

(press release)

–

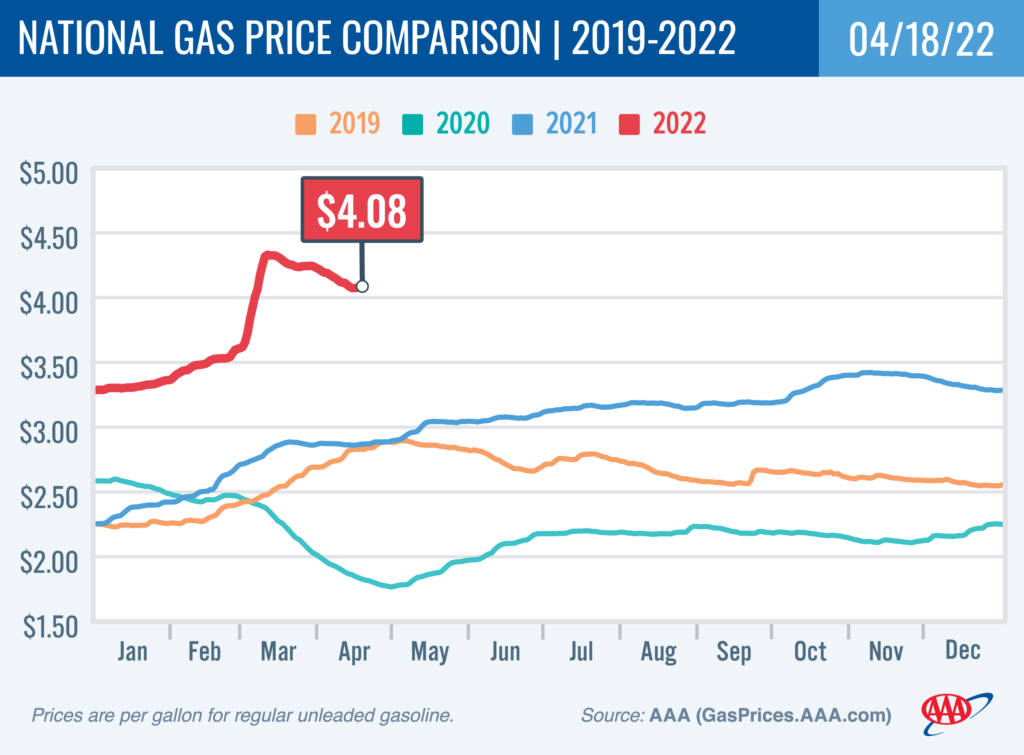

The slide in gas prices slowed to a crawl over concerns about increased global oil prices and the return of seasonal domestic gas demands. The war in Ukraine and fear of less Russian oil entering the market caused the price of crude to creep back above $100 a barrel. Meanwhile, as more places in the U.S. see pump prices fall below $4 a gallon, demand is ticking back up. Domestically, the national average for a gallon of gas has fallen to $4.08. “As the days get longer, the weather gets warmer, and pump prices dip from their record highs, consumers feel more confident about hitting the road,” said Andrew Gross, AAA spokesperson. “But these lower pump prices could be temporary if the global price of oil increases due to constrained supply.” According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks decreased by 3.5 million bbl to 233.1 million bbl last week. Gasoline demand increased slightly from 8.5 million b/d to 8.73 million b/d. Although supply and demand factors would have typically supported elevated pump prices, the fluctuating oil price continues to be the main factor influencing prices at the pump. Pump prices will likely face downward pressure if oil prices remain near $100 per barrel. Meanwhile, consumers will enjoy a tasty gas price–related treat courtesy of Krispy Kreme Doughnuts. For the next three Wednesdays, Krispy Kreme will lower the price of a dozen Original Glazed donuts to the national average that AAA reports each Monday. The offer runs through Wednesday, May 4th. A dozen glazed doughnuts typically cost around $12. This Wednesday’s dozen should cost $4.08, not including sales tax, only in shop, drive-thru, and online pickup. Today’s national average for a gallon of gas is $4.08, which is 19 cents less than a month ago, and $1.21 more than a year ago. Quick Stats The nation’s top 10 largest weekly decreases: Ohio (−7 cents), Delaware (−7 cents), Florida (−6 cents), Indiana (−6 cents), California (−5 cents), Georgia (−5 cents), Pennsylvania (−5 cents), Kentucky (−4 cents), Virginia (−4 cents) and West Virginia (−4 cents). The nation’s top 10 least expensive markets: Kansas ($3.66), Missouri ($3.66), Arkansas ($3.69), Georgia ($3.70), Oklahoma ($3.71), Texas ($3.71), South Carolina ($3.74), Mississippi ($3.77), Ohio ($3.77) and Iowa ($3.78). Oil Market Dynamics At the close of Thursday’s formal trading session, WTI increased by $2.70 to settle at $106.95. According to EIA’s weekly report, U.S. commercial crude oil inventories increased by 9.4 million barrels from the previous week to reach 421.8 million barrels. Despite reports of increased inventory, crude oil prices jumped last week as the European Union announced they are drafting plans to ban Russian oil imports, a move that could tighten global supply as member countries look for new sources for crude oil in an already tight market. Additionally, the most recent Oil Market Report from the International Energy Agency (IEA) forecasts that Russian oil output will shrink by about 1.5 million barrels per day this month as the result of financial and export sanctions. The crude oil market will likely remain volatile this week and could continue to fluctuate if concerns about supply persist. Drivers can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.