WASHINGTON

,

July 11, 2022

(press release)

–

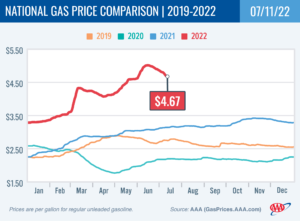

Pump prices declined again, falling another 12 cents since last week to $4.67. The dip in the national average for a gallon of gas occurred despite a slight rise in demand, likely due to robust July 4th holiday automobile travel. AAA forecasted that 42 million people would hit the roads for the holiday weekend, a new record. “Usually, more people buying gas would lead to higher pump prices,” said Andrew Gross, AAA spokesperson. “But the price for oil, the main ingredient in gasoline, has fallen and is hovering around $100 a barrel. Less expensive oil usually means less expensive gas.” According to new data from the Energy Information Administration (EIA), gas demand increased from 8.92 million b/d to 9.41 million b/d ahead of the 4th of July holiday, while total domestic gas stocks decreased by 2.5 million bbl. Typically, these supply/demand trends would put upward pressure on pump prices; however, falling oil prices have contributed to lower pump prices. Today’s national average of $4.67 is 32 cents less than a month ago and $1.53 more than a year ago. Quick Stats The nation’s top 10 largest weekly decreases: Texas (−18 cents), Ohio (−17 cents), Illinois (−17 cents), California (−16 cents), Wisconsin (−15 cents), Indiana (−15 cents), Kentucky (−15 cents), Alabama (−15 cents), Virginia (−14 cents) and Florida (−14 cents). The nation’s top 10 least expensive markets: South Carolina ($4.18), Georgia ($4.18), Mississippi ($4.18), Louisiana ($4.22), Texas ($4.22), Alabama ($4.25), Arkansas ($4.26), Tennessee ($4.28), North Carolina ($4.31) and Kentucky ($4.37). Oil Market Dynamics At the close of Friday’s formal trading session, WTI increased by $2.06 to settle at $104.79. Although the price of crude rose at the end of the week due to increased market optimism as markets rebounded, the price was still down nearly $4 per barrel from the previous week. For this week, crude prices could continue to face strong headwinds if the market remains concerned that a potential recession will reduce demand for crude. If demand declines, crude prices will likely follow suit. Additionally, EIA reported that total domestic crude stocks increased by 8.2 million bbl to 423.8 million bbl, which is nearly 22 million bbl lower than the storage level one year ago. Drivers can find current gas prices along their route using the AAA TripTik Travel planner.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.