WASHINGTON

,

December 18, 2023

(press release)

–

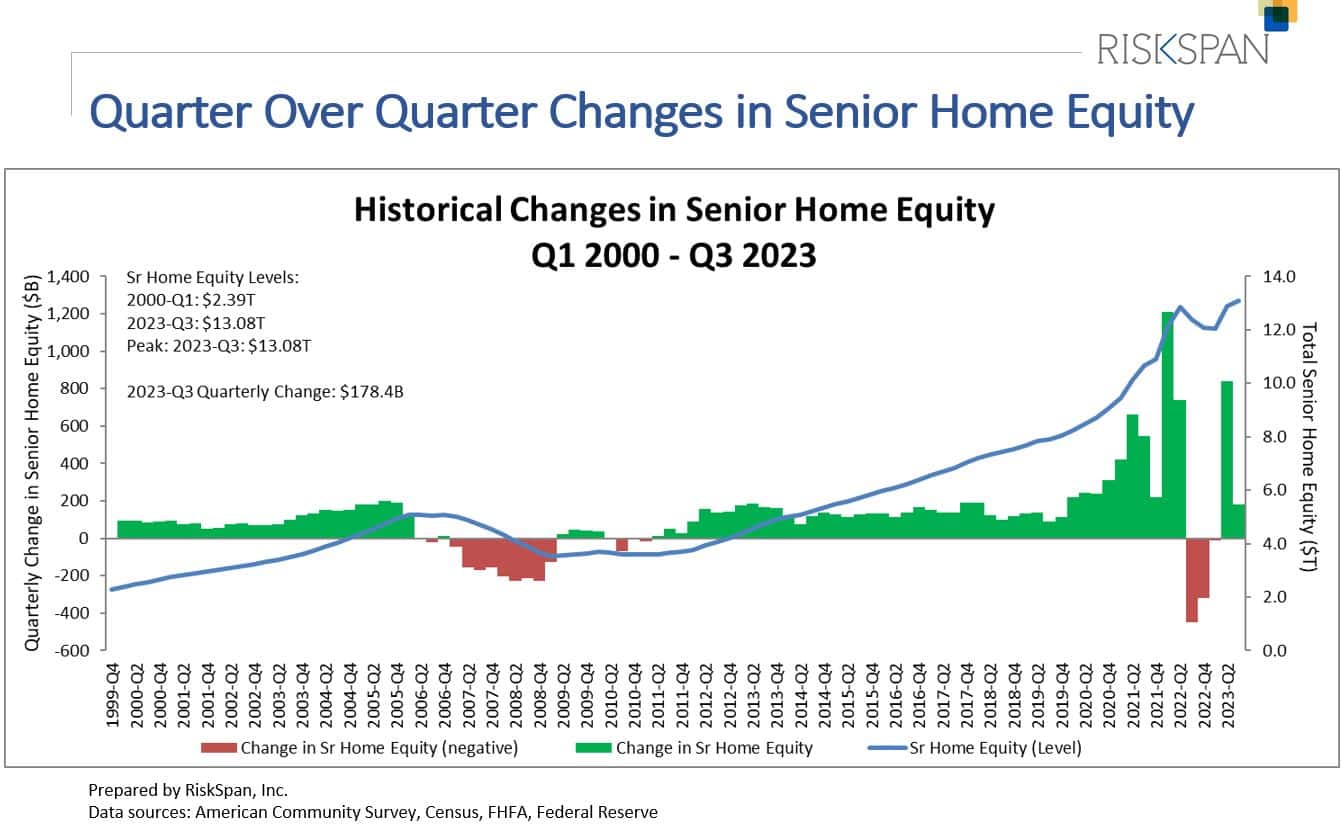

Homeowners 62 and older saw their housing wealth grow by $178.4 billion in the third quarter to a record $13.08 trillion, according to the latest quarterly release of the NRMLA/RiskSpan Reverse Mortgage Market Index. The NRMLA/RiskSpan Reverse Mortgage Market Index (RMMI) rose in Q3 2023 to 457.36, an all-time high since the index was first published in 2000. The increase in older homeowners’ wealth was mainly driven by a record increase in home values, which reached $15.39 trillion, offset by a record $2.32 trillion in senior-held mortgage debt. These peaks in home equity, home values and mortgage debt coincide with lower supply of new homes and higher demand compared to Q2, according to RiskSpan. “A recent report from the Harvard Joint Center for Housing Studies concluded that the United States is ill-equipped to provide adequate housing and supportive services to the 17 million households that will be headed by a person aged 80 and over by the year 2040,” said NRMLA President Steve Irwin. “That same report noted that leveraging home equity could provide a potential solution to cover the costs of care.” About Reverse Mortgages To date, more than 1.3 million households have utilized an FHA-insured reverse mortgage to help meet their financial needs. For more information, please visit www.ReverseMortgage.org About the National Reverse Mortgage Lenders Association About RiskSpan, Inc.

Reverse mortgages are available to homeowners who are 62 and older with significant home equity. They are a versatile financial tool that seniors can use to borrow against the equity in their home without having to make monthly principal or interest payments as with a traditional “forward” mortgage or a home equity loan. Under a reverse mortgage, funds are advanced to the borrower, and interest accrues, but the outstanding balance is not due until the last borrower leaves the home, sells, or passes away.

The National Reverse Mortgage Lenders Association (NRMLA) is the national voice for the industry and represents the lenders, loan servicers, and housing counseling agencies responsible for more than 90 percent of reverse mortgage transactions in the United States. All NRMLA member companies commit themselves to a Code of Ethics & Professional Responsibility. Learn more at www.nrmlaonline.org.

RiskSpan offers end-to-end solutions for data management, risk management analytics, and visualization on a highly secure, fast, and fully scalable platform that has earned the trust of the industry’s largest firms. Combining the strength of subject matter experts, quantitative analysts, and technologists, the RiskSpan platform integrates a range of data-sets–including both structured and unstructured–and off-the-shelf analytical tools to provide you with powerful insights and a competitive advantage. Learn more at www.riskspan.com.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.