September 27, 2022

(press release)

–

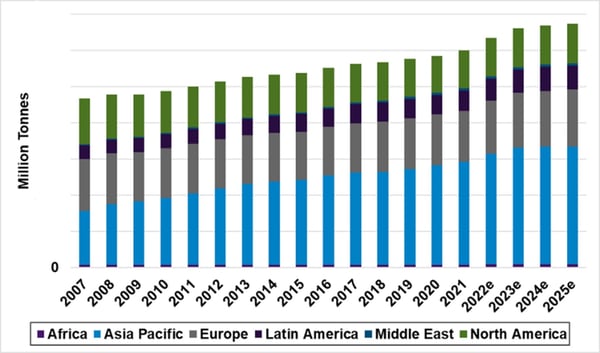

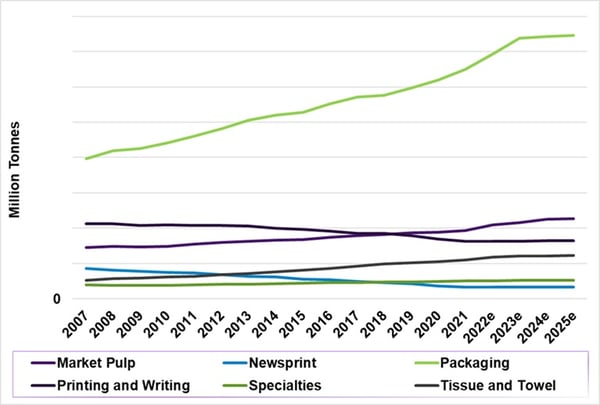

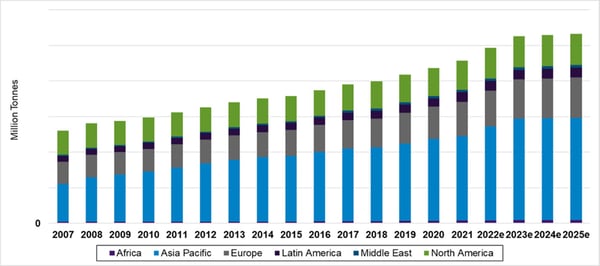

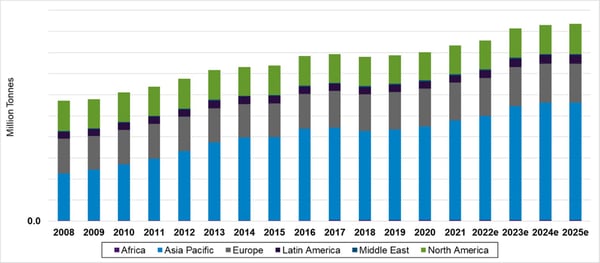

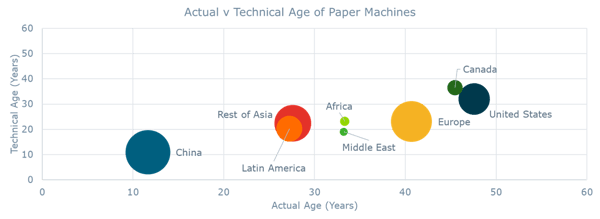

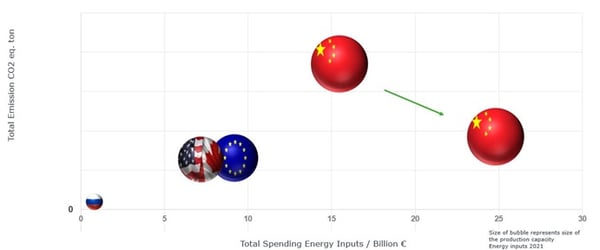

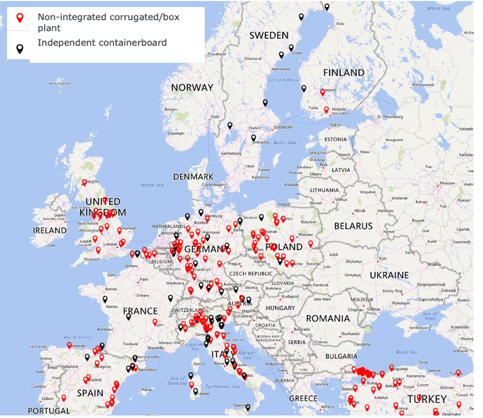

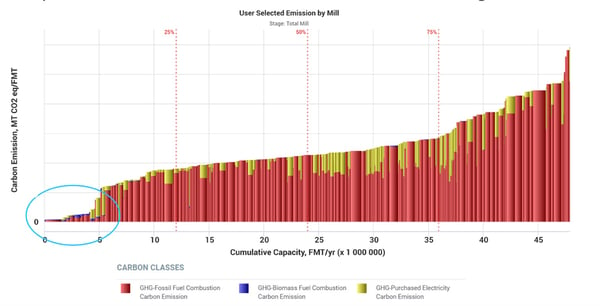

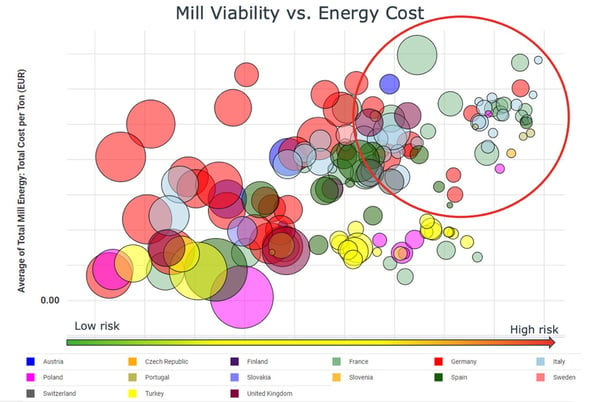

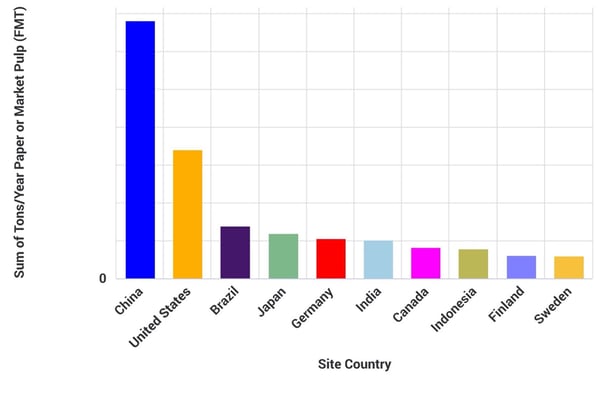

A heightened sense of uncertainty continues to plague various aspects of our lives as global geopolitical trade flows and economic structures remain stressed. As we continue to wonder what the market will look like in 2023, it’s first important to have a solid understanding of where the current global Pulp and Paper industry is now before aiming to predict where it will be in 6 months, a year, or longer. Below are 10 interesting facts about the current state of the global pulp and paper industry. Global Market Pulp, Paper and Tissue Capacity (Actual and Announced) Global Market Pulp, Paper and Tissue Capacity (Actual and Announced) Global Containerboard Capacity Source: FisherSolve Global Cartonboard Capacity Source: FisherSolve Source: FisherSolve European Containerboard Mills Carbon Emissions According to EU ETS Source: FisherSolve Top 10 Producing Countries Source: FisherSolve For further insight into these various trends, talk with an expert at Fisher International who can help your business formulate an actionable plan with a high degree of accuracy to ensure you’re prepared to handle the volatile market that is to come in the near future. About the Author Marko Summanen is a career paper industry professional with over 20 years of experience across strategic, tactical, engineering, and sales functions as well as a worldwide scope that includes China, Southeast Asia, the U.S., Canada, and several European countries. Throughout his career, Marko has championed the transformative power of data-driven management. At Fisher, he uses his deep solutions-focused understanding of paper making operations to help clients improve performance and address the particular challenges faced by European players.

Source: FisherSolve

Source: FisherSolve

Source: FisherSolve

Source: FisherSolve

Source: FisherSolve

Source: FisherSolve

Source: FisherSolve

Source: FisherSolve

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.