Bottom line up front: This update is titled “The Backlash of the Bullwhip.” Our industry is experiencing it, yet the way out is clear – and you can be part of the solution by participating in this industry update.

He warned last year that demand looked murky. This turned out to be absolutely true. It has been murky. In this Q2 update, he openly calls out to the industry the need to remedy — and how to do so — beginning at 10:49 where he furthers the Bullwhip Effect and first unveils “the Bullwhip Solution.”

Venture in with Millcraft Executive Vice President and Chief Operating Officer Greg Lovensheimer as he delivers this macro- to micro-level overview of current domestic and global graphic paper industry trends and provides insight, strategy and actionable guidance on navigating a commercial marketplace that remains in a state of flux.

“When we last spoke, end of third quarter,” Greg says, “We recognized there would be this inventory burn that would have to take place, Millcraft recognized around July and August 2022 … we could see that the election and seasonal uptick would create a situation of keeping demand up, but beyond those two two events, the demand looked murky. Turned out to be absolutely true, it has been murky. We told folks in October that things would slow down because of this inventory bubble.”

The Backlash of the Bullwhip Effect

The Bullwhip Effect is characterized as small movements at the front that create larger and larger waves down the supply chain. In terms of the graphic paper industry supply chain, from forest floor to end users and finished goods, the industry is experiencing the backlash — the secondary effects — in Q2, and moving forward.

Imports: Greg says what’s taken place from late Q3 and Q4 of last year to present day is a textbook example of the Bullwhip Effect. Greg shares a slide showing “a huge run-up in volume that arrived on U.S. shores” and notes the large quantities from Asia and Europe.

“The reality is that a lot of this demand was desired to be on-hand during the May, June, and July timeframe in preparation for Q3, but unfortunately producers and importers couldn’t get product on boats and get it to arrive on time, and so it started arriving at the end of October, at the end of the election season and the end of the seasonal print uptick. So, guess what? All that glut of inventory started showing up on merchants floors, on printers floors, around the country. To the point that some importers had to open up third party warehouses to hold this inventory that really didn’t have demand associated with it.”

Greg continues, “China underconsumed coated freesheet by about one million tons in 2022 … because of their Zero Covid Policy and trying to reawaken their economy. What should have been on the shores in China couldn’t arrive, they weren’t consuming it. So guess what? That meant the Koreans were trying to ship it where? The United States. Middle Easterners were trying to ship where? The United States. Europeans, where? The United States. So you saw this onslaught of imports come in because there wasn’t another market for it.”

“Inventory levels at the mill are starting to climb, but how much? It has not gone up in an equitable manner. The reason being, you’ve got a lot of suppliers that are taking market related downtime right now, across the country. Suppliers are adamant that the market related downtime that they’re willing to take has to pay off, it has to provide a dividend in the form of improved pricing when demand does pick up,” Greg says.

Demand: “The concern is, ‘Is current demand real?’ We do not have a good line of sight for what the true demand is for print.” Coated demand shows up 13%, uncoated up 4% – but Q1 shows mill operating rates on par to the depths of Covid and the 2008 recession. How do you rationalize to make it right? Coated freesheet and uncoated freesheet prices are at the highest level on record. Overall demand is down nearly 20%, yet prices are holding.”

In terms of volume of coated freesheet and uncoated freesheet, in 2019 (pre-Covid) the uncoated market was 7.7 million tons. “We got back to 6.8 million tons in 2022, now in Q1 2023 we’re at 5.9 million tons – we’re back at depths of Covid. Same for uncoated, 3.4 million tons in 2019, 3 million in 2022, and now we’re at 2.5. Erratic upswing and now downswing, where’s the real demand? That’s the question that remains unanswered,” Greg says.

The Bullwhip Solution

Listen in closely around 20:00 in the recording, as Greg proposes what he calls the Bullwhip Solution. “Visibility, transparency, and sharing information is the best solution to offset the Bullwhip Effect, mainly from the point-of-sale & inventory levels from end users to manufacturers. Data info sharing absolutely remedies the situation – the issues and effects – from the Bullwhip Effect.”

Greg says “The paper industry is a mature industry, yes, but we share very little information. We’ve got to learn from other mature industries … The auto industry, for example, they do a wonderful job. GM shares info about what they’re selling, what they’ve got on their dealer showroom floors, and all their parts suppliers know this information. Do they not have stockouts? Of course they have stockouts. Do they not have excess inventory? Absolutely they do — but their peaks and valleys are muted compared to what we’re going through. As an industry, that’s what we’ve got to get to, that’s the promised land.”

The goal is to increase sharing of both sales data and inventory data, downstream from customers back to suppliers. Greg says, “This is my call to the industry. We’re in a mature industry, how do we truly partner with our supply chain partnerships and truly share information? The question becomes how much info can you share and how often? Technology is needed to be able to inform, to feed up and down the supply chain.”

Take Part Real-Time

“If I haven’t said it once I’ve said it 1,000 times,” Greg says, “transparency, sharing point of sale and inventory data, results in the lowest total supply chain cost structure.”

Millcraft offers you the opportunity to watch real-time — and to participate in — the remedy of the Bullwhip Effect. Prior to watching the full state of the industry recording, you’ll be given the opportunity to join more than 400 registered participants in answering questions that relay industry-specific data and solutions.

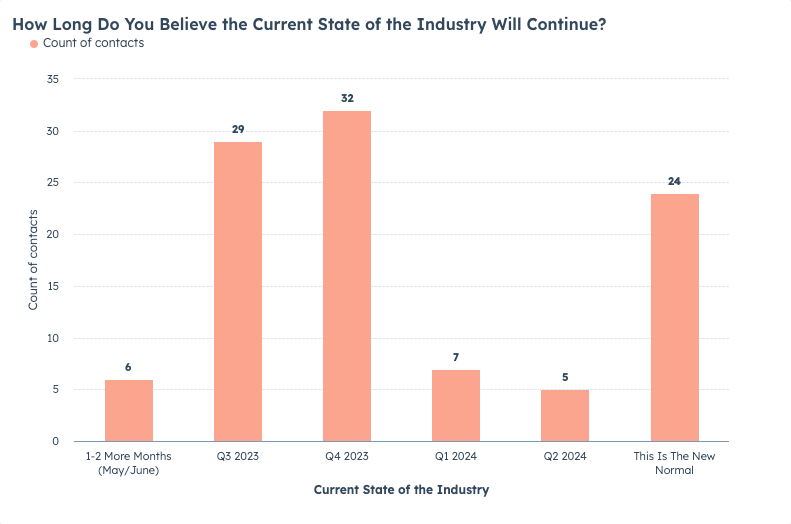

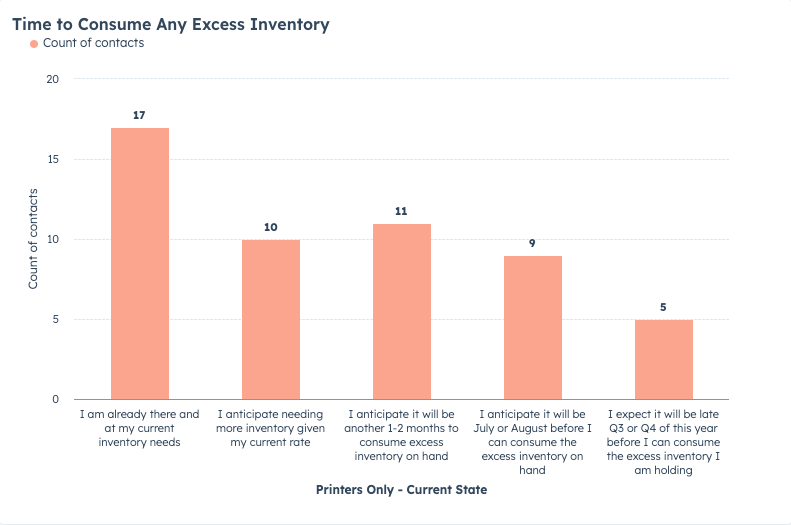

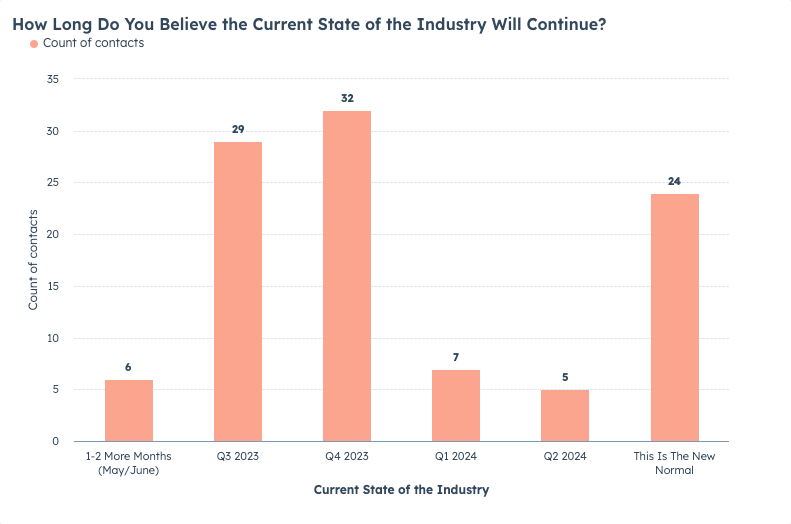

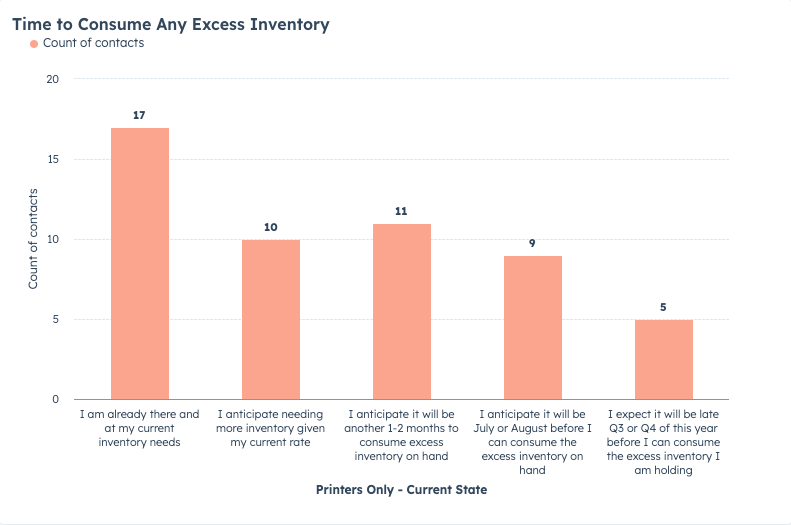

You’ll see fascinating results unfold in front of your eyes as each polled question is addressed during the presentation, live and in real-time. For example, regarding the question posed – At your current operating and purchasing rates, how long until you have consumed any excess inventory that you may have? – Greg says, “Everyone wants to know, ‘Is this a one month thing? A second quarter thing, third quarter, fourth quarter, does it ever end? These answers, this is useful insight and extremely important. This is it, this is the piece of data we all need to understand. How long? How long before we get out and to the other side?”

Take part, real-time, and see clearly how data results play into Greg’s predictions for 2023. *

*Responses continue to come in; as of Tuesday, June 2, 2023, data trends show the following:

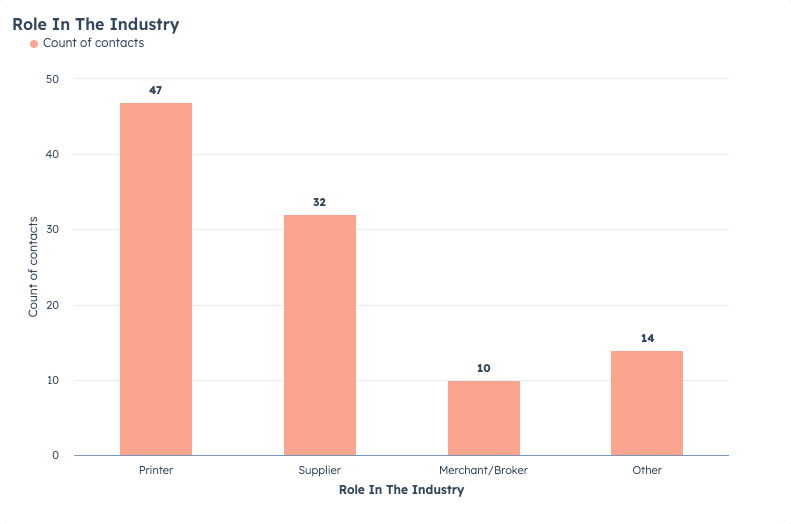

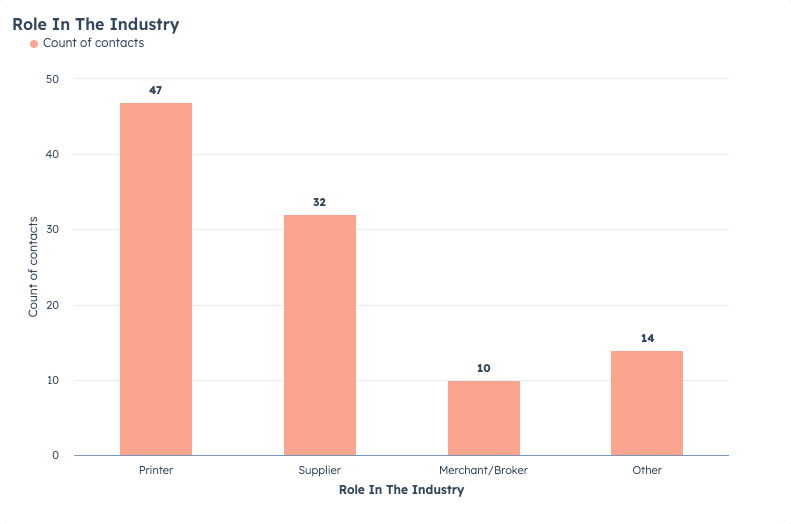

What role best describes your position within the industry?

- Printer 46%

- Supplier 31%

- Merchant/Broker 10%

- Other 13%

Based on your role and vantage point within the industry, how long do you believe the current state of the industry will continue?

- 1-2 More Months (May/June) 5%

- Q3 2023 28%

- Q4 2023 31%

- Q1 2024 8%

- Q2 2024 5%

- This Is The New Normal 23%

PRINTERS ONLY: At your current operating and purchasing rates, how long until you have consumed any excess inventory that you may have?*

- I am already there and at my current inventory needs 33%

- I anticipate needing more inventory given my current rate 19%

- I anticipate it will be another 1-2 months (May/June) to consume excess inventory on hand 21%

- I anticipate it will be July/Aug before I can consume the excess inventory on hand 17%

- I expect it will be late Q3 or Q4 of this year before I can consume the excess inventory on hand 10%

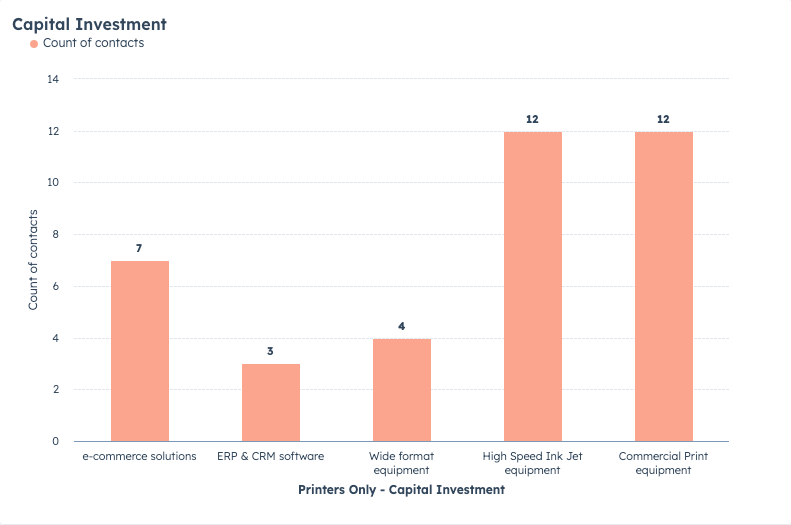

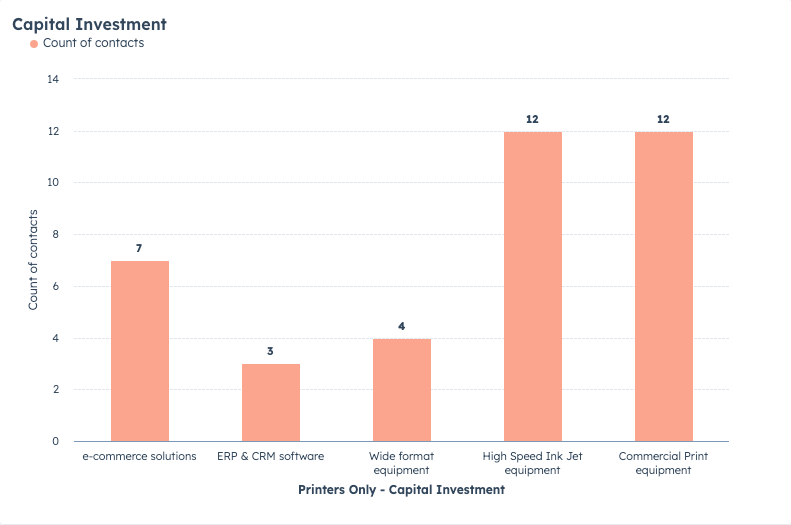

PRINTERS ONLY: In a recent study, 58.1% of printers said they had plans to do new capital investments in equipment and software. Which of these do YOU see as most important for investment over the next 1-2 years?*

- e-commerce solutions 18%

- ERP & CRM software 7%

- Wide format equipment 11%

- High speed inkjet equipment 32%

- Commercial print equipment 32%

- Dye sublimation equipment 0%

- Direct to garment/Direct to film equipment 0%