April 16, 2024

(press release)

–

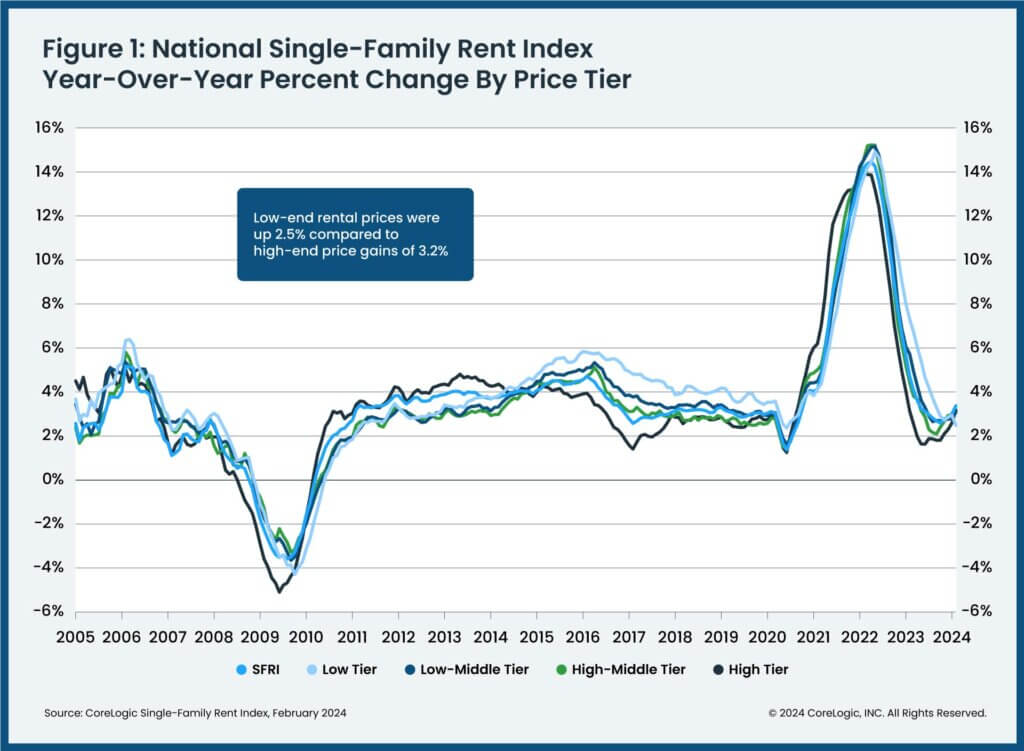

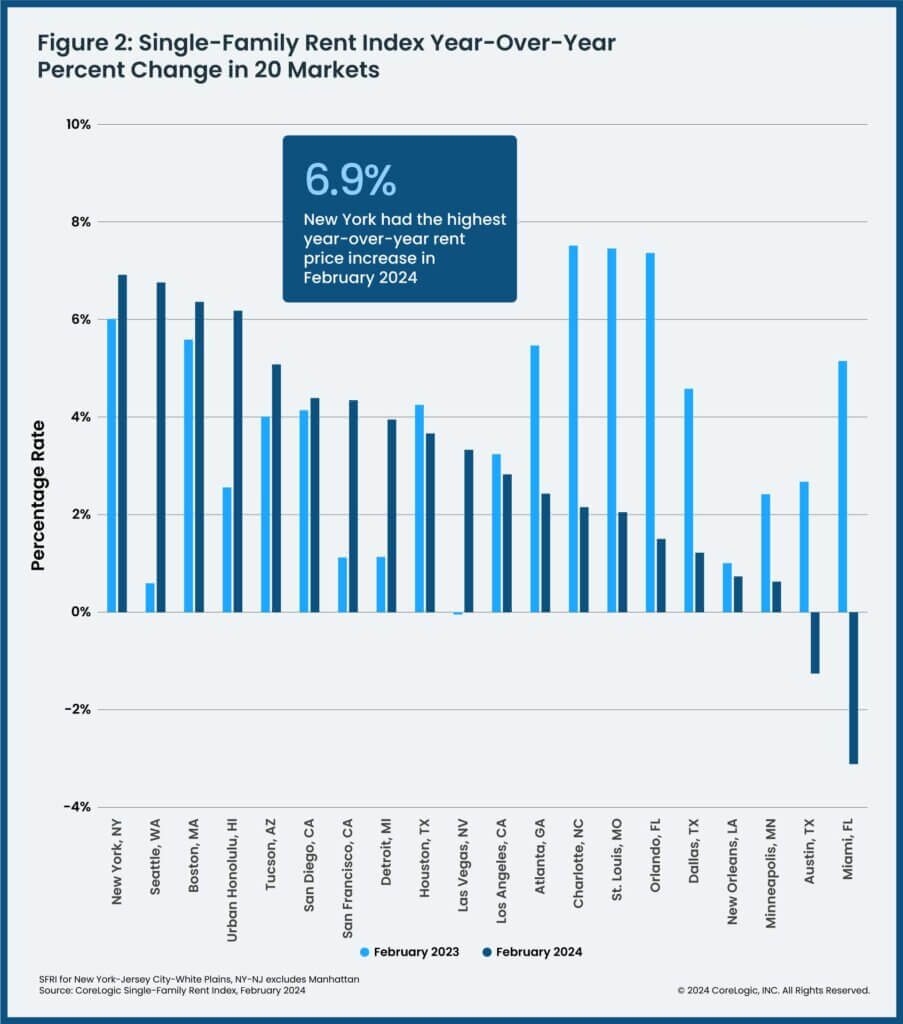

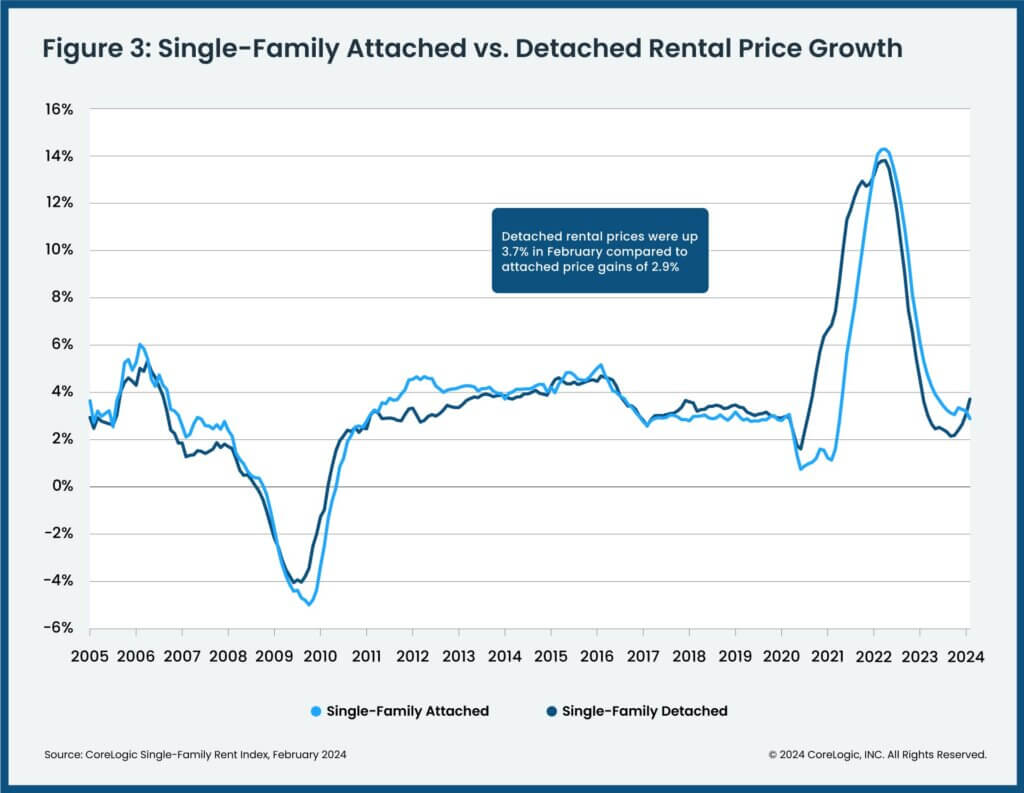

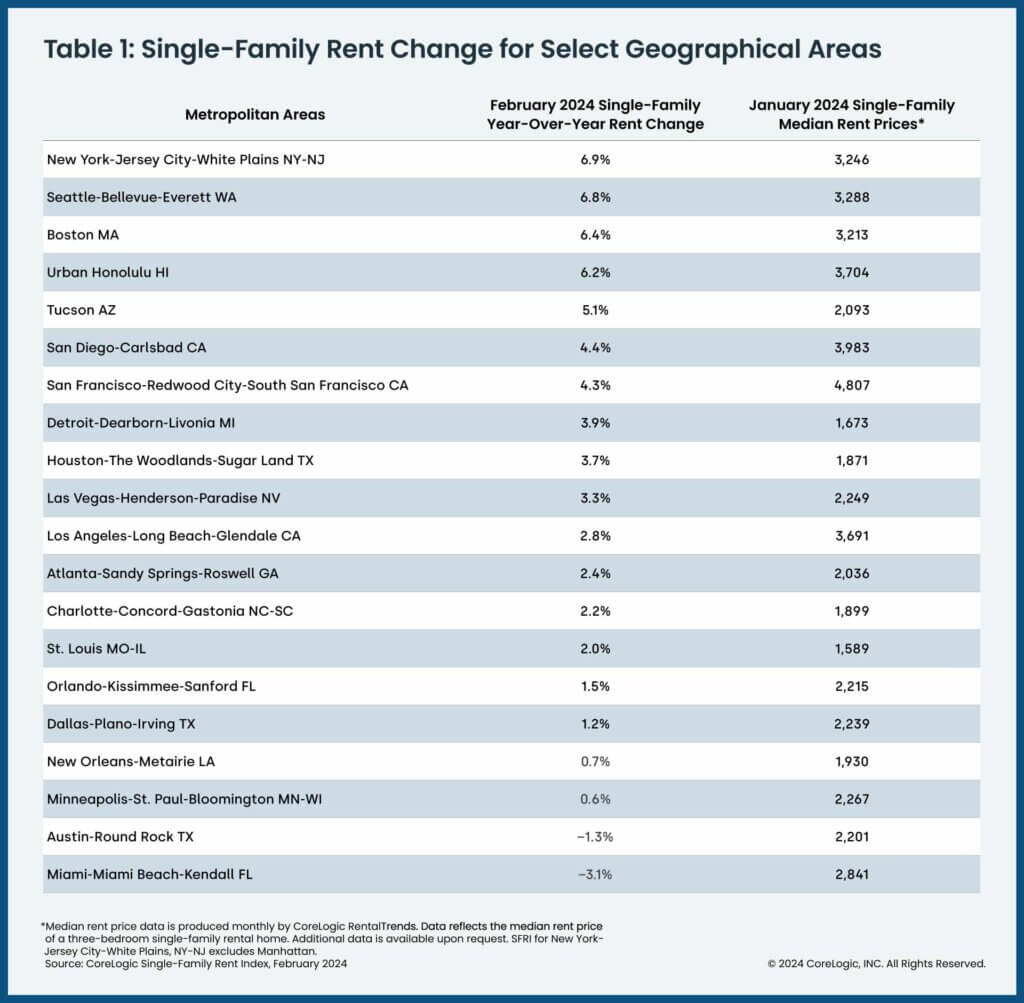

IRVINE, Calif., April 16, 2024—CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. On a regional level, February’s annual rental cost increases could again signal that Americans are slowly migrating back to larger, more expensive coastal metros. New York saw the nation’s highest year-over-year rental price gain, followed by Seattle and Boston. Those metros had January median rent prices of more than $3,200 for a three-bedroom property, compared with the U.S. median of about $2,100. By contrast, in February 2023, less expensive metros led the country for rent growth, including St. Louis; Charlotte, North Carolina and Orlando, Florida. “Single-family rent growth regained strength in February, posting the highest annual appreciation since April 2023,” said Molly Boesel, principal economist for CoreLogic. “Monthly rent growth also picked up in February and was higher than what is typically recorded in winter months. Lower-priced properties had the smallest annual rent growth in February, which should be welcome news to renters. However, properties in this price range have seen gains of more than 30% over the past four years, a slightly larger increase than those in the higher-priced range.” To gain a detailed view of single-family rental prices across different market segments, CoreLogic examines four tiers of rental prices and two property-type tiers. National single-family rent growth across those tiers, and the year-over-year changes, were as follows: Of the 20 metros shown in Table 1, New York posted the highest year-over-year increase in single-family rents in February 2024, at 6.9%. Seattle registered the second-highest annual gain at 6.8%, followed by Boston at 6.4%. Miami (-3.1%) and Austin, Texas (-1.3%) posted annual rental price losses. The next CoreLogic Single-Family Rent Index will be released on May 21, 2024, featuring data for March 2024. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog: www.corelogic.com/intelligence. Methodology The single-family rental market accounts for half of the rental housing stock, yet unlike the multifamily market, which has many different sources of rent data, there are minimal quality adjusted single-family rent transaction data. The CoreLogic Single-Family Rent Index (SFRI) serves to fill that void by applying a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service. The rental listings used to calculate the index include both attached and detached single-family homes, as well as condominiums. CoreLogic constructed the SFRI for close to 100 metropolitan areas — including 43 metros with four value tiers — and a national composite index. The indices are fully revised with each release to signal turning points sooner. The CoreLogic Single-Family Rent Index analyzes data across four price tiers: Lower-priced, which represent rentals with prices 75% or below the regional median; lower-middle, 75% to 100% of the regional median; higher-middle, 100%-125% of the regional median; and higher-priced, 125% or more above the regional median. Median rent price data is produced monthly by CoreLogic Rental Trends. Rental Trends is built on a database of more than 11 million rental properties (over 75% of all U.S. individual owned rental properties) and covers all 50 states and 17,500 ZIP codes. Source: CoreLogic The data provided is for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data contact Robin Wachner at newsmedia@corelogic.com. For sales inquiries, please visit https://www.corelogic.com/support/sales-contact/. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources. About CoreLogic CoreLogic is a leading provider of property insights and innovative solutions, working to transform the property industry by putting people first. Using its network, scale, connectivity and technology, CoreLogic delivers faster, smarter, more human-centered experiences that build better relationships, strengthen businesses and ultimately create a more resilient society. For more information, please visit www.corelogic.com. CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.