WASHINGTON

,

April 28, 2022

(press release)

–

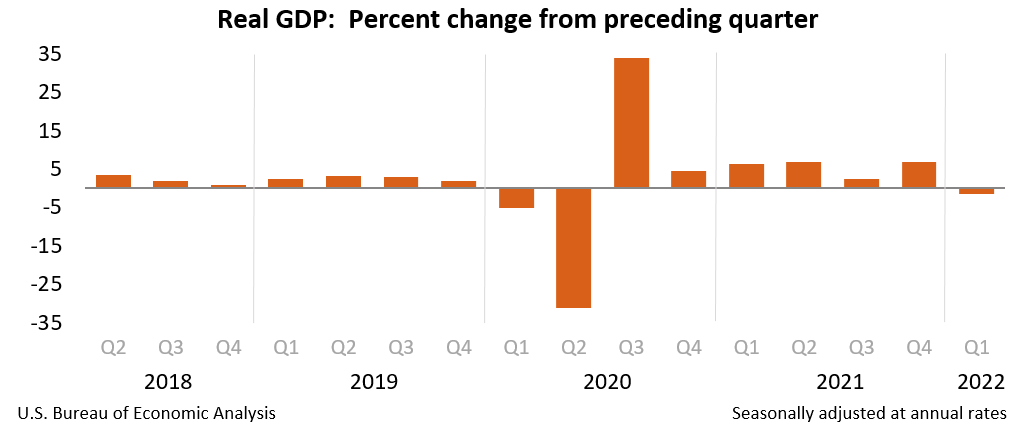

Real gross domestic product (GDP) decreased at an annual rate of 1.4 percent in the first quarter of 2022 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 6.9 percent. The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency (refer to "Source Data for the Advance Estimate" on page 3). The "second" estimate for the first quarter, based on more complete data, will be released on May 26, 2022 The decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased. Personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment increased (table 2). COVID-19 Impact on the First-Quarter 2022 GDP Estimate The increase in PCE reflected an increase in services (led by health care) that was partly offset by a decrease in goods. Within goods, a decrease in nondurable goods (led by gasoline and other energy goods) was partly offset by an increase in durable goods (led by motor vehicles and parts). The increase in nonresidential fixed investment reflected increases in equipment and intellectual property products. Current‑dollar GDP increased 6.5 percent at an annual rate, or $379.9 billion, in the first quarter to a level of $24.38 trillion. In the fourth quarter, GDP increased 14.5 percent, or $800.5 billion (table 1 and table 3). The price index for gross domestic purchases increased 7.8 percent in the first quarter, compared with an increase of 7.0 percent in the fourth quarter (table 4). The PCE price index increased 7.0 percent, compared with an increase of 6.4 percent. Excluding food and energy prices, the PCE price index increased 5.2 percent, compared with an increase of 5.0 percent. Personal Income Current-dollar personal income increased $268.0 billion in the first quarter, compared with an increase of $123.9 billion in the fourth quarter. The increase primarily reflected an increase in compensation that was partly offset by a decrease in government social benefits (table 8). In the first quarter, government assistance payments in the form of social benefits to households decreased as provisions of several federal programs expired or continued to taper off. Disposable personal income increased $216.6 billion, or 4.8 percent, in the first quarter, compared with an increase of $20.1 billion, or 0.4 percent, in the fourth quarter. Real disposable personal income decreased 2.0 percent, compared with a decrease of 5.6 percent. Personal saving was $1.21 trillion in the first quarter, compared with $1.39 trillion in the fourth quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 6.6 percent in the first quarter, compared with 7.7 percent in the fourth quarter. Source Data for the Advance Estimate Annual Update of the National Economic Accounts Next release, May 26, 2022, at 8:30 A.M. EDT

In the first quarter, an increase in COVID-19 cases related to the Omicron variant resulted in continued restrictions and disruptions in the operations of establishments in some parts of the country. Government assistance payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households all decreased as provisions of several federal programs expired or tapered off. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the first quarter because the impacts are generally embedded in source data and cannot be separately identified. For more information, refer to the Technical Note and Federal Recovery Programs and BEA Statistics.

The decrease in private inventory investment was led by decreases in wholesale trade (mainly motor vehicles) and retail trade (notably, "other" retailers and motor vehicle dealers). Within exports, widespread decreases in nondurable goods were partly offset by an increase in "other" business services (mainly financial services). The decrease in federal government spending primarily reflected a decrease in defense spending on intermediate goods and services. The increase in imports was led by increases in durable goods (notably, nonfood and nonautomotive consumer goods).

Information on the source data and key assumptions used in the advance estimate is provided in a Technical Note that is posted with the news release on BEA's website. A detailed "Key Source Data and Assumptions" file is also posted for each release. For information on updates to GDP, refer to the "Additional Information" section that follows.

BEA will release results from the 2022 annual update of the National Economic Accounts, which includes the National Income and Product Accounts as well as the Industry Economic Accounts, on September 29, 2022. This update will present revised statistics for GDP, GDP by Industry, and gross domestic income that cover the first quarter of 2017 through the first quarter of 2022. Refer to BEA's recent blog post, "National, Industry, and State Annual Updates Will Be United in 2022," for additional detail. More information on the 2022 annual update will be included on BEA's website as well as in a forthcoming Survey of Current Business article, "GDP and the Economy."

Gross Domestic Product (Second Estimate), Corporate Profits (Preliminary Estimate), First Quarter 2022

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.