February 13, 2024

(press release)

–

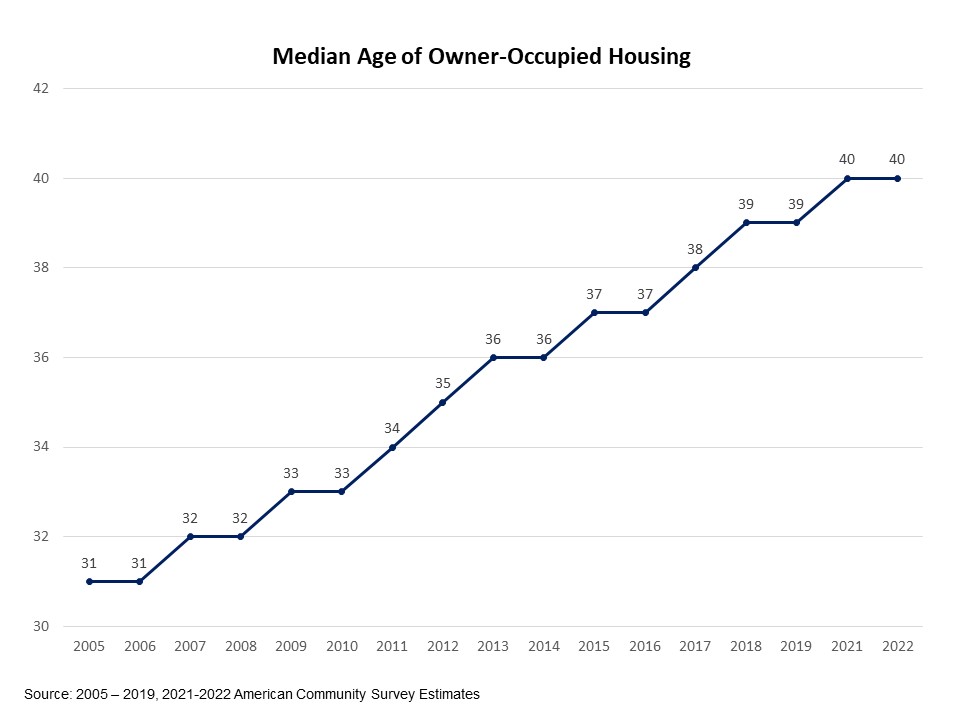

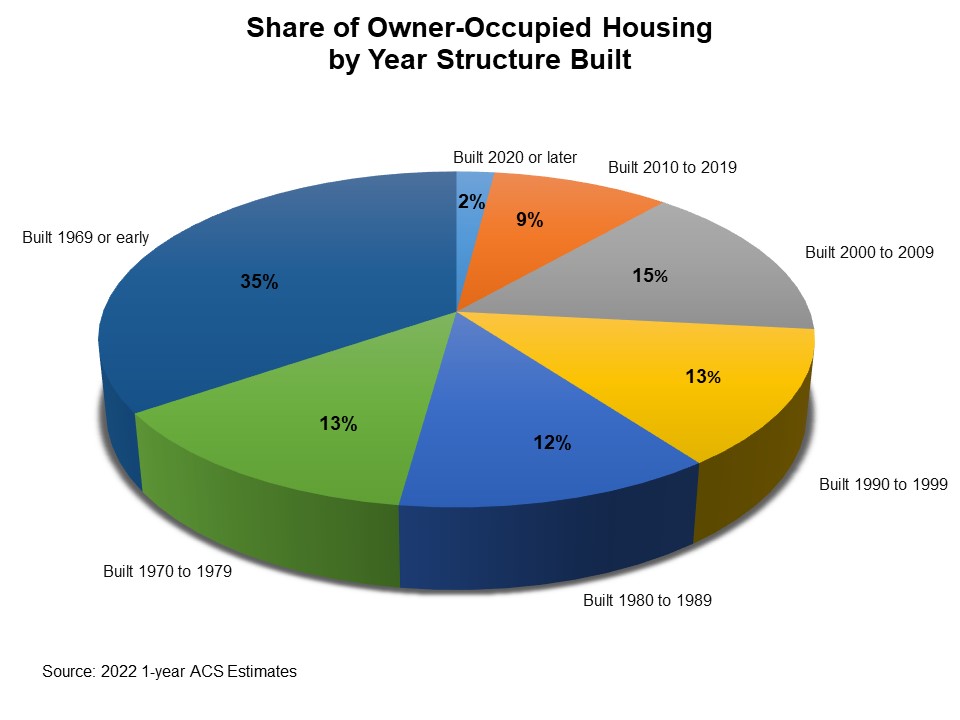

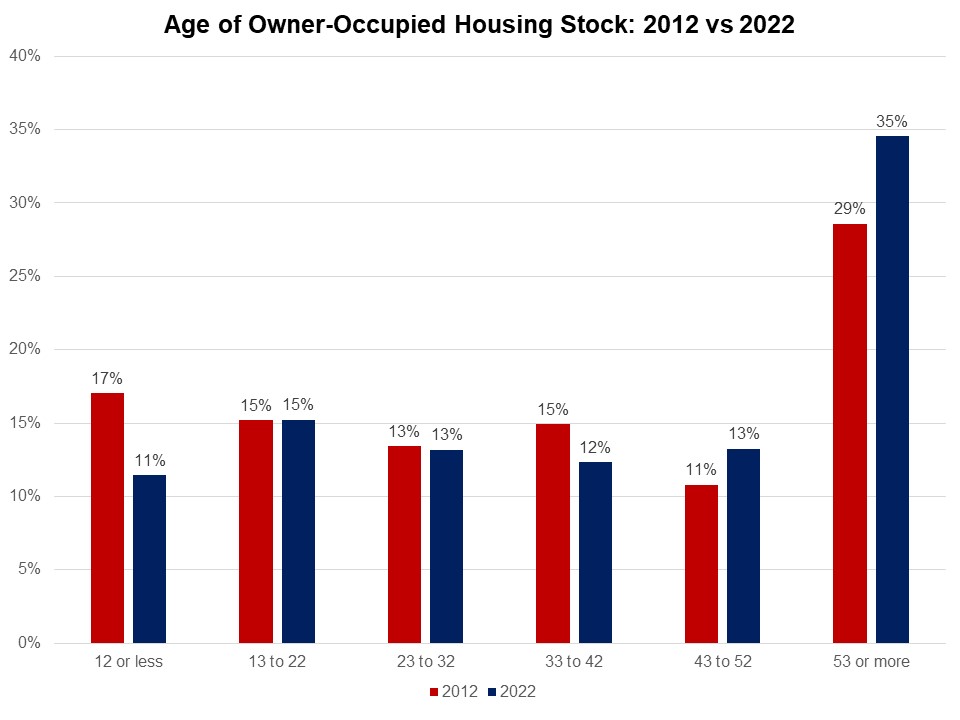

The median age of owner-occupied homes is 40 years old, according to the latest data from the 2022 American Community Survey[1]. The U.S. owner-occupied housing stock is aging rapidly especially after the Great Recession, as the residential construction continues to fall behind in the number of new homes built. New home construction faces headwinds such as rising material costs, labor shortage, and elevated interest rates nowadays. With a lack of sufficient supply of new construction, the aging housing stock signals a growing remodeling market, as old structures need to add new amenities or repair/replace old components. Rising home prices also encourage homeowners to spend more on home improvement. Over the long run, the aging of the housing stock implies that remodeling may grow faster than new construction. New construction added nearly 1.7 million units to the national stock from 2020 to 2022, accounting for only 2% of owner-occupied housing stock in 2022. Relatively newer owner-occupied homes built between 2010 and 2019 took up around 9%. Owner-occupied homes constructed between 2000 and 2009 make up 15% of the housing stock. The majority, or around 60%, of the owner-occupied homes were built before 1980, with around 35% built before 1970. Due to modest supply of housing construction, the share of new construction built within the past 12 years declined greatly, from 17% in 2012 to only 11% in 2022. Meanwhile, the share of housing stock that is at least 53 years old experienced a significant increase over the 10 years ago. The share in 2022 was 35% compared to 29% in 2012. [1] : Census Bureau did not release the standard 2020 1-year American Community Survey (ACS) due to the data collection disruptions experienced during the COVID-19 pandemic. The data quality issues for some topics remain in the experimental estimates of the 2020 data. To be cautious, the 2020 experimental data is not included in the analysis.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.