WASHINGTON

,

September 26, 2022

(press release)

–

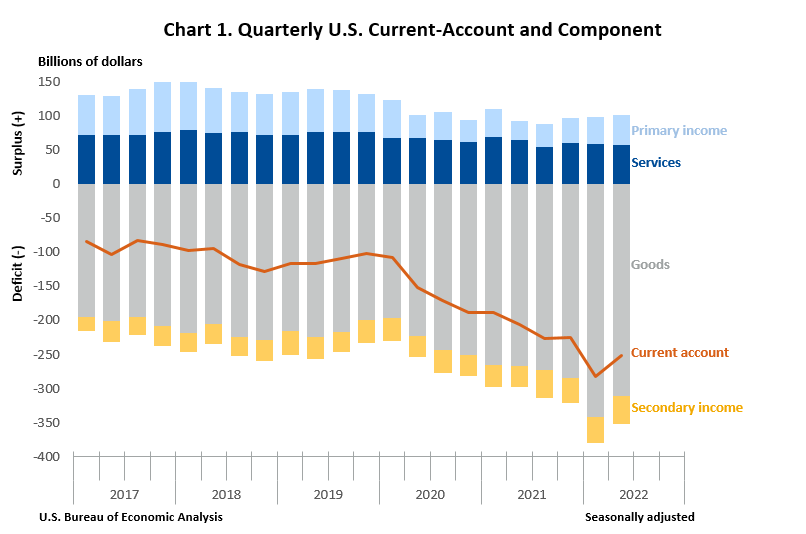

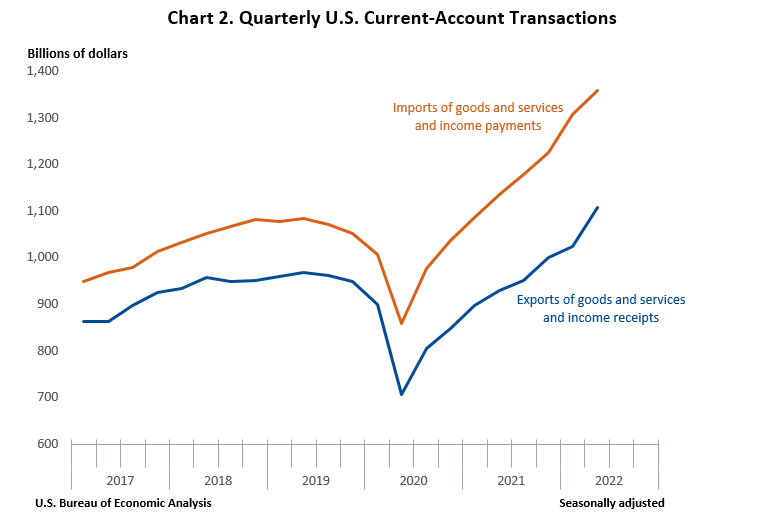

Current-Account Deficit Narrows by 11.1 Percent Current-Account Balance The U.S. current-account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, narrowed by $31.5 billion, or 11.1 percent, to $251.1 billion in the second quarter of 2022, according to statistics released today by the U.S. Bureau of Economic Analysis. The revised first-quarter deficit was $282.5 billion. The second-quarter deficit was 4.0 percent of current-dollar gross domestic product, down from 4.6 percent in the first quarter. The $31.5 billion narrowing of the current-account deficit in the second quarter mostly reflected a decreased deficit on goods. Current-Account Transactions (tables 1-5) Exports of goods and services to, and income received from, foreign residents increased $82.8 billion to $1.11 trillion in the second quarter. Imports of goods and services from, and income paid to, foreign residents increased $51.3 billion to $1.36 trillion. Trade in goods (table 2) Exports of goods increased $52.0 billion to $539.9 billion, and imports of goods increased $20.8 billion to $850.4 billion. The increases in both exports and imports mostly reflected an increase in industrial supplies and materials, primarily petroleum and products. Trade in services (table 3) Exports of services increased $8.4 billion to $225.2 billion, and imports of services increased $10.2 billion to $168.2 billion. The increases in both exports and imports mainly reflected increases in travel, mostly other personal travel, and in transport, mostly air passenger transport. Primary income (table 4) Receipts of primary income increased $21.1 billion to $299.1 billion, and payments of primary income increased $16.2 billion to $255.5 billion. The increases in both receipts and payments reflected increases in all major components. The increase in receipts was led by direct investment income, primarily earnings, and the increase in payments was led by other investment income, primarily interest. Secondary income (table 5) Receipts of secondary income increased $1.4 billion to $43.6 billion, mostly reflecting an increase in general government transfers, primarily fines and penalties. Payments of secondary income increased $4.0 billion to $84.9 billion, reflecting increases in general government transfers, mostly international cooperation, and in private transfers, mostly insurance-related transfers. Capital-Account Transactions (table 1) Capital-transfer payments increased $1.9 billion to $3.8 billion in the second quarter, mostly reflecting an increase in U.S. government investment grants. Financial-Account Transactions (tables 1, 6, 7, and 8) Net financial-account transactions were −$159.5 billion in the second quarter, reflecting net U.S. borrowing from foreign residents. Financial assets (tables 1, 6, 7, and 8) Second-quarter transactions increased U.S. residents’ foreign financial assets by $386.2 billion. Transactions increased portfolio investment assets, mostly equity, by $279.8 billion; direct investment assets, mostly equity, by $99.1 billion; other investment assets by $6.1 billion, resulting from partly offsetting transactions in loans and deposits; and reserve assets by $1.2 billion. Liabilities (tables 1, 6, 7, and 8) Second-quarter transactions increased U.S. liabilities to foreign residents by $499.8 billion. Transactions increased portfolio investment liabilities, primarily long-term debt securities and equity, by $433.5 billion, and direct investment liabilities, primarily equity, by $67.0 billion. Transactions decreased other investment liabilities by $0.7 billion, primarily resulting from offsetting transactions in loans, deposits, and trade credit and advances. Financial derivatives (table 1) Net transactions in financial derivatives were –$45.9 billion in the second quarter, reflecting net U.S. borrowing from foreign residents. Table A. Updates to First-Quarter 2022 International Transactions Accounts Balances [Billions of dollars, seasonally adjusted] U.S. Bureau of Economic Analysis Goods Transferred via Presidential Drawdown Authority With this release of the U.S. International Transactions Accounts, beginning with the first quarter of 2022, exports of goods include military goods that were transferred from U.S.-owned stockpiles to Ukraine via the Presidential Drawdown Authority. Previously, these goods were recorded in exports of government goods and services n.i.e. (not included elsewhere). These goods are recorded through a new balance-of-payments adjustment, “military goods transferred through grants,” and are reflected on line 9 of “Table 2.4. U.S. International Trade in Goods, Balance of Payments Adjustments.” Next release: December 21, 2022, at 8:30 a.m. EST

Preliminary estimate

Revised estimate

Current-account balance

–291.4

–282.5

Goods balance

–342.2

–341.7

Services balance

58.5

58.9

Primary income balance

33.4

38.8

Secondary income balance

–41.0

–38.6

Net financial-account transactions

–277.5

–235.7

U.S. International Transactions, 3rd Quarter 2022

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.