WASHINGTON

,

June 9, 2023

(press release)

–

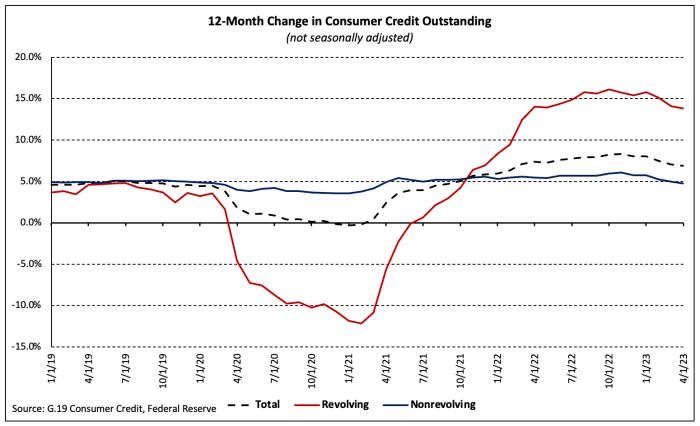

Consumer credit outstanding grew at a seasonal adjusted annual rate of 5.7% in April 2023 per the Federal Reserve’s latest G.19 Consumer Credit report, as revolving and nonrevolving debt grew at 13.1% and 3.2%, respectively (SAAR). Total consumer credit outstanding stands at $4.8 trillion (not seasonally adjusted), with $1.2 trillion in revolving debt and $3.6 trillion in non-revolving debt (NSA). The total balance of consumer credit outstanding grew 6.9% over the 12 months ending April 2023 (NSA). Revolving debt grew 13.8% over the period, nearly three times the growth in nonrevolving debt (4.8%). The 12-month growth rate of revolving debt exceeded 10.0% in March 2022 and has not fallen below that mark since. The last time growth exceeded 10.0% was from November 2000 through June 2001, a period during which unemployment began to rise and the 2001 recession began. Revolving and nonrevolving debt accounted for 24.7% and 75.3% of total consumer debt, respectively. Revolving consumer credit as a share of the total fell to 21.8% in April 2021—the smallest share since 1986. At 24.7%, the share is roughly equal to the 10-year average of 25.1%. Between April 2022 and April 2023, revolving consumer credit outstanding as a share of the total increased 1.5 percentage points.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.