April 17, 2024

(press release)

–

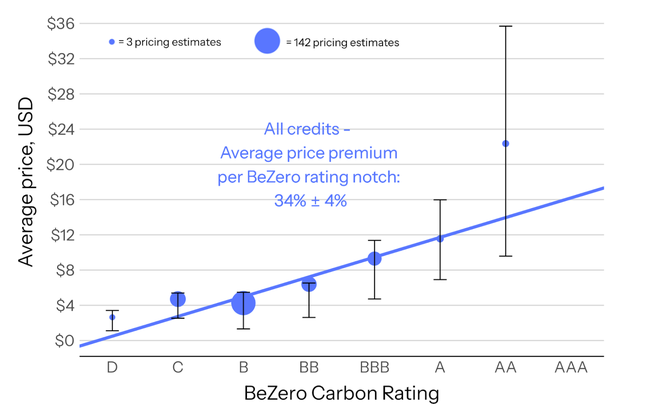

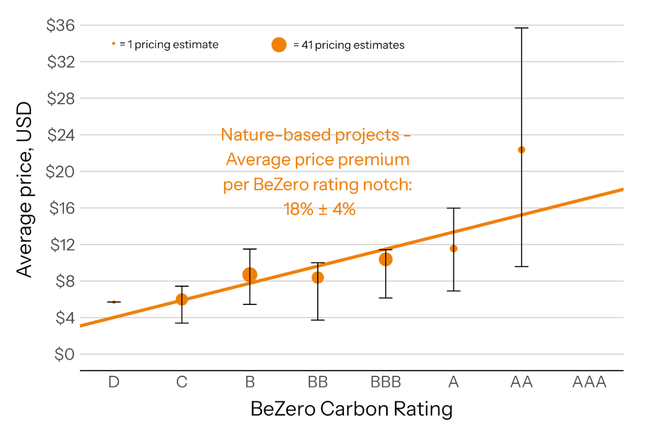

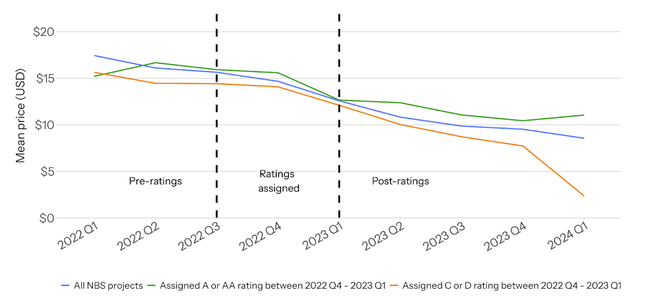

Here are some key takeaways Our analysis reveals that each BeZero Carbon ratings notch added an average premium of around 30% to the price a credit commanded in the market. This study utilises Viridios AI prices and corroborates our previous findings using a different dataset. This relationship between price and ratings exists at a sectoral level and is particularly evident for Nature-Based Solutions (NBS) projects, which had an average 20% premium for each BeZero rating notch. Among NBS projects, the Improved Forest Management (IFM) sector exhibited the largest price divergence between higher- and lower-rated projects, although this conclusion is based on a small sample size. Furthermore, we find evidence of a direct causal link between the assigning of ratings and price/demand for NBS credits. Projects assigned lower ratings had larger price declines than the NBS average, while projects assigned higher ratings maintained their value. Additionally, projects assigned higher ratings witnessed a considerable increase in demand in recent months. Contents Introduction Earlier this year, we published our first report examining the relationship between BeZero Carbon Ratings and prices for carbon credits on the voluntary carbon market (VCM). Our findings revealed a statistically significant relationship between ratings and price, with this relationship strengthening over time since the public launch of BeZero Carbon Ratings in April 2022. This report follows up on our previous analysis, now using a different pricing dataset sourced from Viridios AI. The dataset includes prices for BeZero-rated projects at quarterly intervals from Q1 2022 to Q1 2024. Viridios AI collects this data daily from various market participants, including brokers, corporations and project developers, cleanses the data, and applies a well-defined pricing methodology to compute prices at the project/vintage level. Viridios AI’s pricing methodology does not account for project ratings. Therefore, any observed relationship between price and rating is not influenced by the pricing model itself but instead reflects inherent market dynamics. The analysis presented in this report uses prices for 2020 vintage credits. We have excluded prices not derived from market data specific to the project. Hence, none of the pricing data included in the analysis is purely modelled. This report primarily focuses on projects in the Nature-Based Solutions sector group, which includes the Forestry, Soil Carbon & Agriculture, and Blue Carbon sectors. This sector group represents the largest segment of the VCM in terms of available, unretired credits, providing us with the most extensive dataset of prices for analysis. We intend to conduct further research on other sector groups in future reports. Using a new pricing dataset, we again find a meaningful correlation between BeZero ratings and price Figure 1. The mean price per BeZero Carbon Rating notch for all vintage 2020 credits priced by Viridios AI with depth level 1 or 2, for the dates 8 March 2024 and 29 December 2023, with linear regression line.¹ The size of each circle represents the number of price estimates for each rating level. Error bars indicate the interquartile range of price for each rating level. Total number of price estimates included in the analysis: 292. We find that, on average, the price difference between credits separated by one BeZero rating notch (e.g. ‘BBB’ and ‘A’ or ‘C’ and ‘B’) has been around 30%. This is in line with the result obtained in our previous report on this topic using data from Xpansiv’s CBL exchange, where we found the price difference between credits separated by one BeZero rating notch was around 25%. Focussing on nature-based projects only, we continue to find a meaningful correlation between rating and price Figure 2. The mean price per BeZero Carbon Rating notch for all nature-based vintage 2020 credits priced by Viridios AI with depth level 1 or 2, for the dates 08 March 2024 and 29 December 2023, with a linear regression line. The size of each data point represents the number of price estimates for each rating level. Error bars indicate the interquartile range of price for each rating level. Total number of price estimates included in the analysis: 134. Using the same dataset as above, but only focussing on projects in the nature-based solutions sector group, we find that the average price difference between credits separated by one BeZero rating notch (e.g. ‘BBB’ and ‘A’ or ‘C’ and ‘B’) has been around 20%. A slight reduction in the strength of the relationship between ratings and price when focussing on a specific sector group is expected, as there is a degree of correlation between sector and rating (i.e. some sectors, on average, have higher ratings than others). The fact that there remains a clear and statistically meaningful price-ratings relationship in a particular sector group is indicative of the growing sophistication of the market in recognising quality at a project level. Even within specific nature-based sectors, higher-rated projects tend to attract higher prices on average Figure 3. The median price of vintage 2020 credits with a BeZero rating of BB and lower or BBB and higher for four nature-based sectors, using Viridios AI prices of depth level 1 or 2, for the dates 08 March 2024 and 29 December 2023.² Moving into further detail by considering prices within specific nature-based solutions sectors, we continue to find evidence of a price-ratings relationship. This is most apparent in the Avoided Deforestation, Improved Forest Management (IFM) and Soil Carbon & Agriculture sectors. For IFM, the price premium for higher-rated projects is substantial at almost 400% above lower-rated projects, though this is based on just one price estimate of a higher-rated project. Nature-based projects assigned lower ratings have seen prices fall more than those assigned higher ratings Figure 4. The mean price of three sets of nature-based carbon credits at quarterly intervals from 2022 Q1 to 2024 Q1: (i) All nature-based credits priced by Viridios AI; (ii) All nature-based credits with Viridios pricing estimates from 2022 Q1 newly assigned an ‘A’ or ‘AA’ BeZero Carbon Rating between 2022 Q3 - 2023 Q1 (four projects³); (iii) All nature-based credits with Viridios pricing estimates from 2022 Q1 newly assigned a C or D rating by BeZero between 2022 Q3 - 2023 Q1 (13 projects⁴). To go deeper and examine the causal link between BeZero rating and price for nature-based carbon credits, we have tracked the prices of two groups of credits which were newly assigned BeZero ratings between 2022 Q3 and 2023 Q1. The first group comprises all of the nature-based projects that received one of the highest BeZero rating levels of ‘A’ or ‘AA’ in that period, while the second group comprises all of the nature-based projects that received one of the lowest BeZero rating levels of ‘C’ or ‘D’ in that period. We find that the mean price of the two sets of credits was fairly similar through the pre-ratings period and the period during which ratings were assigned, with the mean price of the credits which received a higher rating tracking slightly above that of the credits which received a lower rating. In the post-ratings period, there are some signs of a growing divergence in price through 2023, before a significant price difference emerged in the first quarter of 2024. Overall, the mean price of the higher-rated credits has held up at around USD 10 while that of the lower-rated credits has collapsed to around USD 3. While not representing conclusive proof of a causal link, this is the strongest quantitative evidence we have seen of the assignment of a rating leading to a change in relative price. Nature-based projects assigned higher ratings have seen demand rise considerably in recent months Figure 5. Total retirements by quarter, indexed to 2022 Q1 = 100, for (i) All nature-based credits; (ii) All nature-based credits with Viridios pricing estimates from 2022 Q1 newly assigned an ‘A’ or ‘AA’ rating by BeZero between 2022 Q3 - 2023 Q1 (4 credits⁵); (iii) All nature-based credits with Viridios pricing estimates from 2022 Q1 newly assigned a ‘C’ or ‘D’ rating by BeZero between 2022 Q3 - 2023 Q1 (13 credits⁶). Covers retirements of credits accredited by the American Carbon Registry, Cercarbono, Climate Action Reserve, Gold Standard, Puro.Earth, and Verra. We have also tracked retirements for the two groups of credits described above to further probe the causal link between BeZero rating and price for nature-based carbon credits. We find limited growth in retirements of the higher-rated and lower-rated groups through the pre-ratings period, ratings assignment period, and the first two quarters of the post-ratings period. However, in 2023 Q4 and 2024 Q1, demand for the set of higher-rated credits has risen considerably by a factor of 2-3 over the 2022 Q1 level, while demand for the set of lower-rated credits has been below the 2022 Q1 level, despite overall demand for nature-based credits rising. This adds further credence to the evidence of a causal link between ratings assignment and price/demand. Concluding remarks This report adds to our growing body of research demonstrating the relationship between ratings and price/demand in the voluntary carbon market (VCM). We have demonstrated that the relationship holds even when we focus on a specific sector. Furthermore, by tracking prices and retirements for two sets of credits assigned higher and lower BeZero Carbon Ratings, we have begun to draw out evidence of a causal link between ratings and price/demand. We acknowledge that there are limitations to this analysis. We have focussed on pricing estimates which are as close as possible to real market observations (i.e. “level 1” and “level 2” Viridios AI prices). This ensures that our analysis is not reliant on prices that are largely modelled but does mean that we are working with a relatively small dataset, particularly when considering specific sectors and rating categories. Furthermore, we have focussed on one sector group (nature-based solutions). Therefore, while the analysis may be indicative of trends in other sectors, it cannot be directly applied, and further research is necessary to examine this. We will continue to publish research on this topic over the coming months using new datasets, examining new sectors, and applying different analytical techniques. If you would like to make any suggestions for BeZero’s research pipeline on this topic, please get in touch. Depth level 1 means that a market indication pertaining to this project/vintage was obtained within the previous 10 business days. Depth level 2 signifies that either a market indication for this project/vintage was received more than 10 days ago and was evolved by our internal model, or it was derived through interpolation/extrapolation from one or more liquid vintages for this project. The sectors in this graph are the four nature-based sectors with Viridios AI depth 1 or 2 prices on 08/03/2024 or 29/12/2023 for projects with both BeZero ratings of BBB and higher and BB and lower. GS10220, VCS1477, VCS1899, VCS674 VCS981, VCS977, VCS868, VCS832, VCS594, VCS2293, VCS1689, VCS1686, VCS1329, ACR459, ACR398, ACR386, ACR376 GS10220, VCS1477, VCS1899, VCS674 VCS981, VCS977, VCS868, VCS832, VCS594, VCS2293, VCS1689, VCS1686, VCS1329, ACR459, ACR398, ACR386, ACR376

Notes:

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.