ROCHESTER, New York

,

February 1, 2022

(press release)

–

National small business job growth continued to increase in January as did earnings for workers, according to the Paychex | IHS Markit Small Business Employment Watch. The January data shows the Small Business Jobs Index, which measures the year-over-year rate of employment growth, gained 0.39 percent in January. At 101.33, the national index has increased 7.80 percent over the past year, surpassing its 2014 peak. At 4.43 percent year-over-year, hourly earnings growth maintained its record high set last month (December 2021).

“The pace of small business job growth continued to grow in January, reaching a new record high powered by the return to work in leisure and hospitality,” said James Diffley, chief regional economist at IHS Markit.

“Small businesses are continuing to recover from the job losses experienced at the start of the COVID-19 pandemic. While employment has not returned to pre-pandemic levels, the sustained growth in jobs is certainly positive,” said Martin Mucci, Paychex CEO. “Workers are also continuing to command higher pay. Hourly earnings growth in January matched the peak level set just last month.”

In further detail, the January report showed:

- The national index gained 0.39 percent in January, in line with its average monthly gain in the last six months of 2021.

- At 4.43 percent year-over-year, hourly earnings growth continued to show strength, remaining at its peak level hit in December 2021.

- Hiring in leisure and hospitality (107.25) accelerated further ahead of other sectors, gaining 1.49 percent in January and 23.94 percent since last January.

- Likely due to the COVID-19 omicron variant, one-month annualized weekly hours worked growth dropped nearly eight percent in leisure and hospitality in January.

- Job gains were broad-based as all regions of the U.S. advanced in January, though the West leads all regions at 101.65, improving for the eleventh consecutive month.

- Texas remained the top state for small business hiring and Dallas the top metro.

Paychex business solutions reach 1 in 12 American private-sector employees, making the Small Business Employment Watch an industry benchmark. Drawing from the payroll data of approximately 350,000 Paychex clients with fewer than 50 employees, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity

The complete results for November, including interactive charts detailing all data, are available at www.paychex.com/watch. Highlights are available below.

January 2022 Paychex | IHS Markit Small Business Employment Watch

National Jobs Index

- At 101.33, the national index surpassed its 2014 peak.

- The national index gained 0.39 percent in January, in line with its average monthly gain in the last six months of 2021.

- The small business jobs index continues to improve, though total employment is still well below pre-pandemic levels.

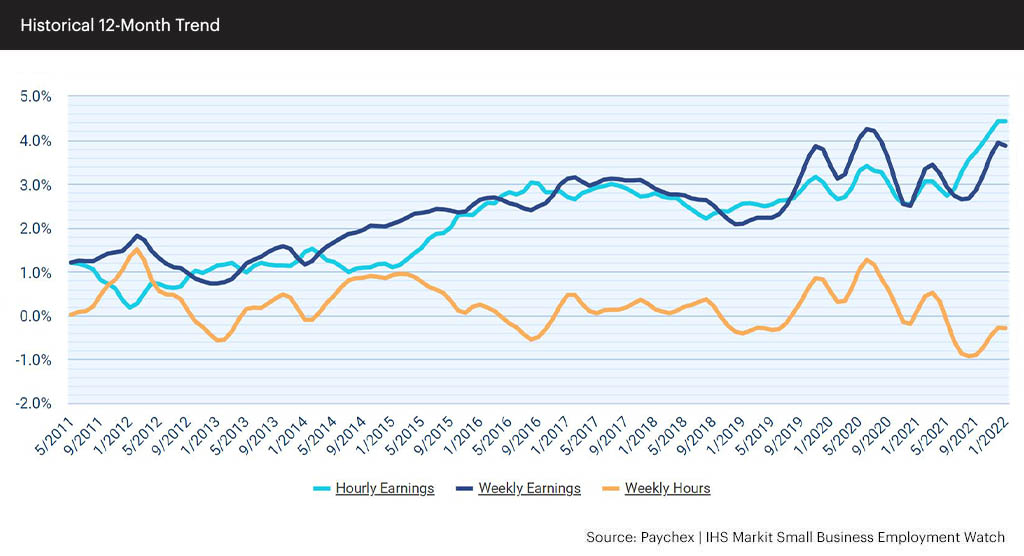

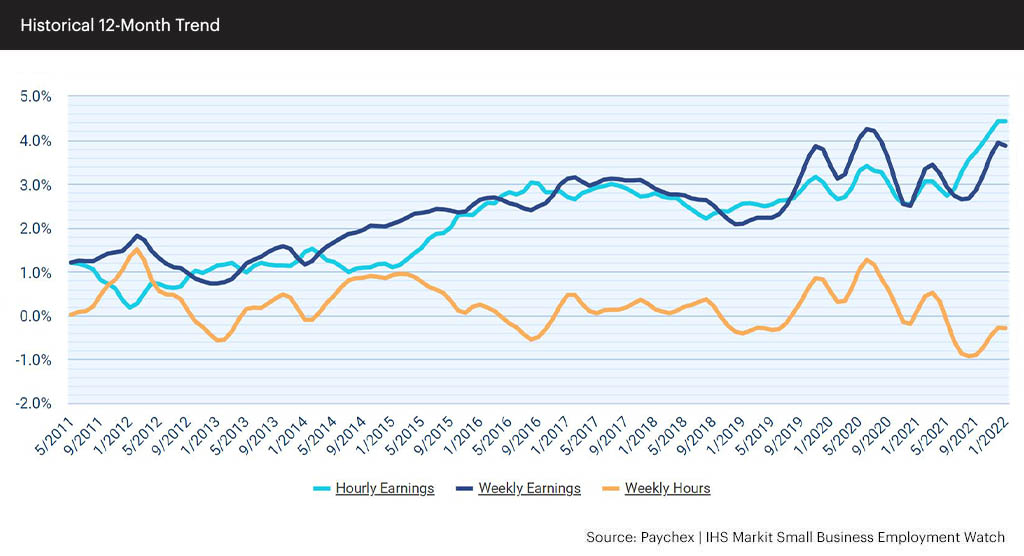

National Wage Report

- Up 4.43 percent year-over-year, hourly earnings growth remained at its peak level in January.

- Weekly earnings moderated slightly to 3.87 percent in January from 3.94 percent to end 2021.

- Annual weekly hours worked growth was essentially flat from December to January (-0.29 percent), though one-month annualized growth has been positive for the past four months.

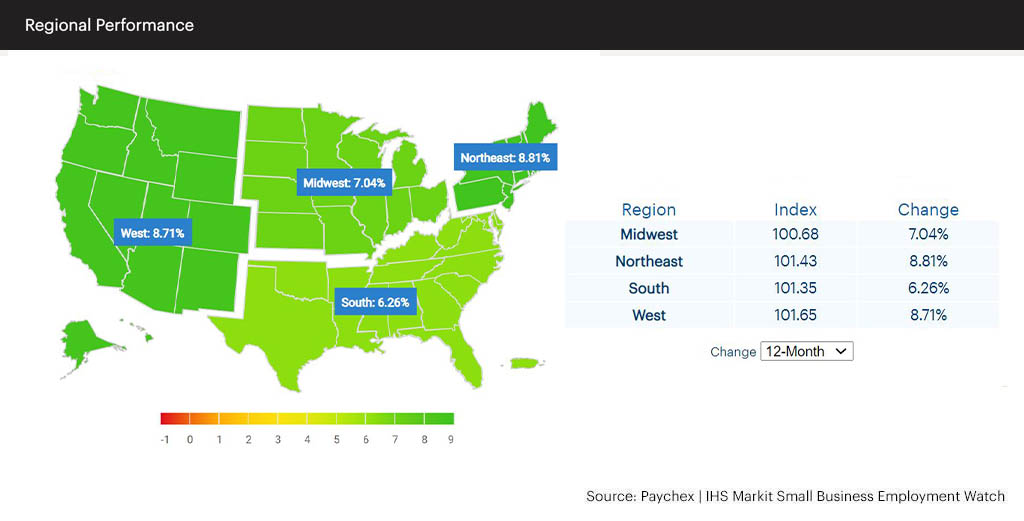

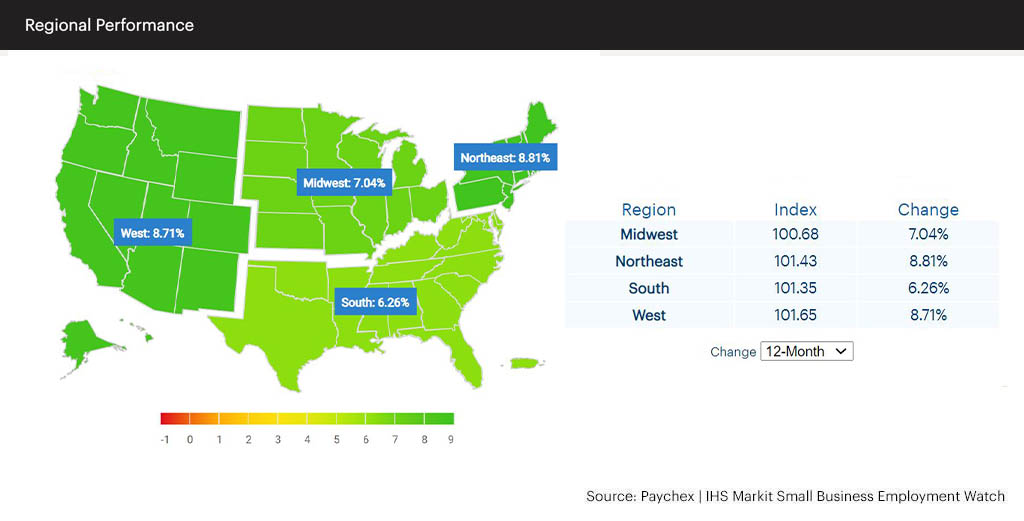

Regional Jobs Index

- The gains were broad-based as all regions advanced in January.

- The West leads all regions at 101.65, improving for the eleventh consecutive month.

- At 101.43, the Northeast leads one-month, three-month, and 12-month changes rates among regions.

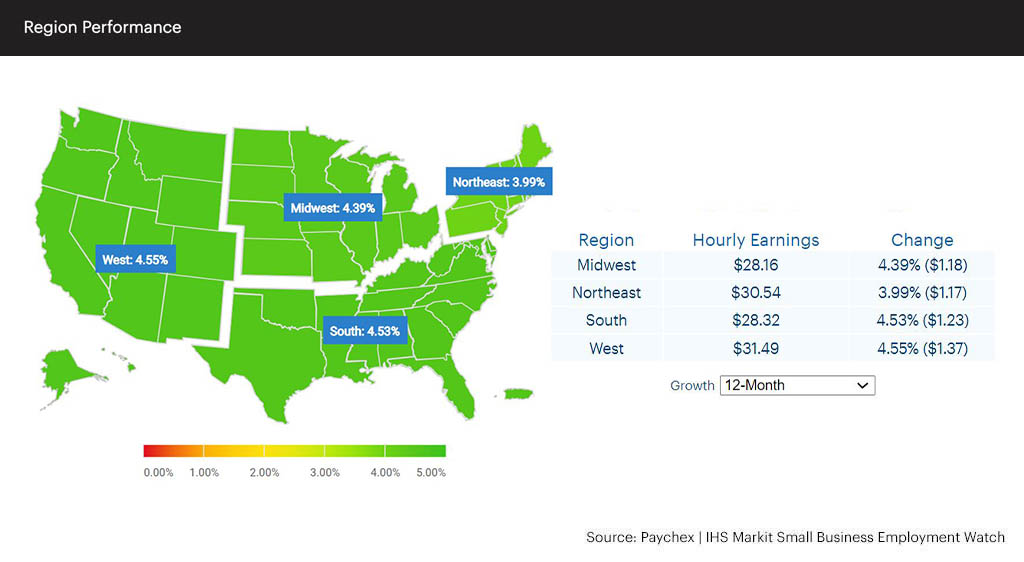

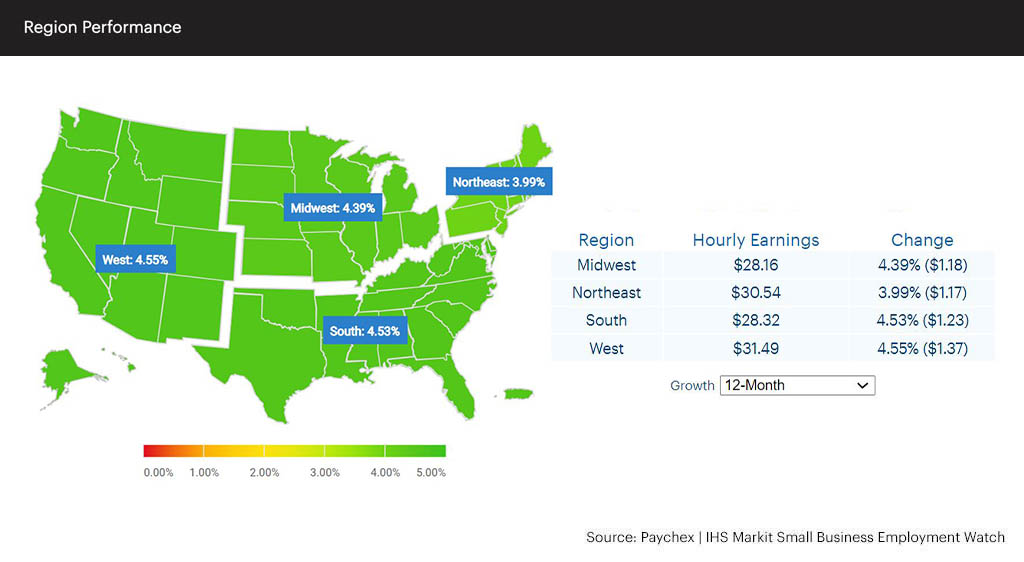

Regional Wage Report

- At 4.55 percent, hourly earnings growth remains strongest in the West region for the seventh consecutive month.

- The Northeast is the only region with hourly earnings growth below four percent. While all other regions have one-month annualized growth above four percent, growth in the Northeast is just 2.44 percent.

- All regions have fewer weekly hours worked year-over-year.

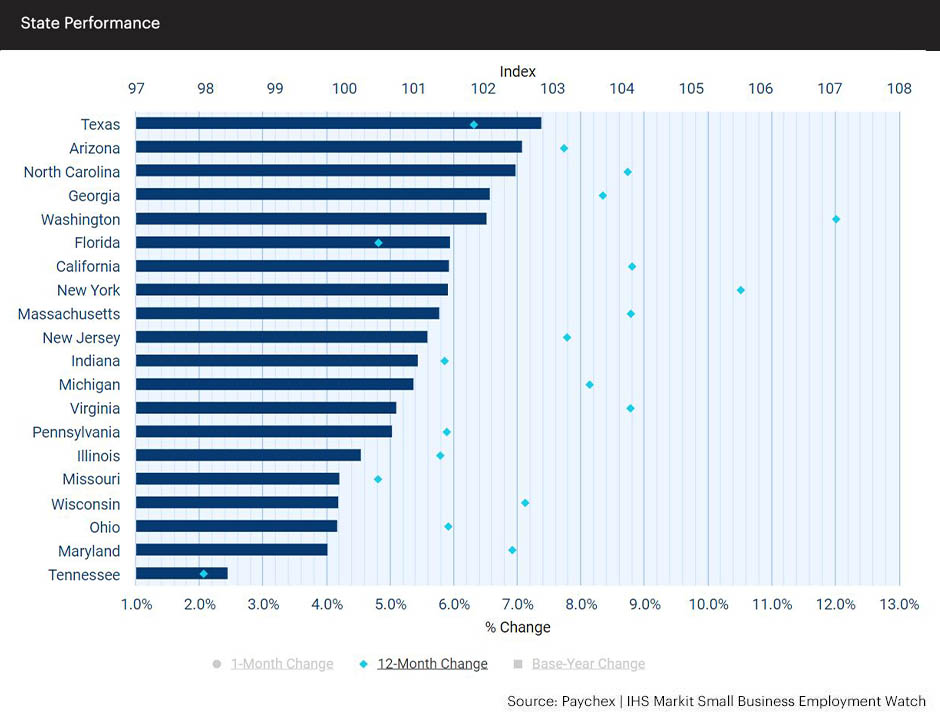

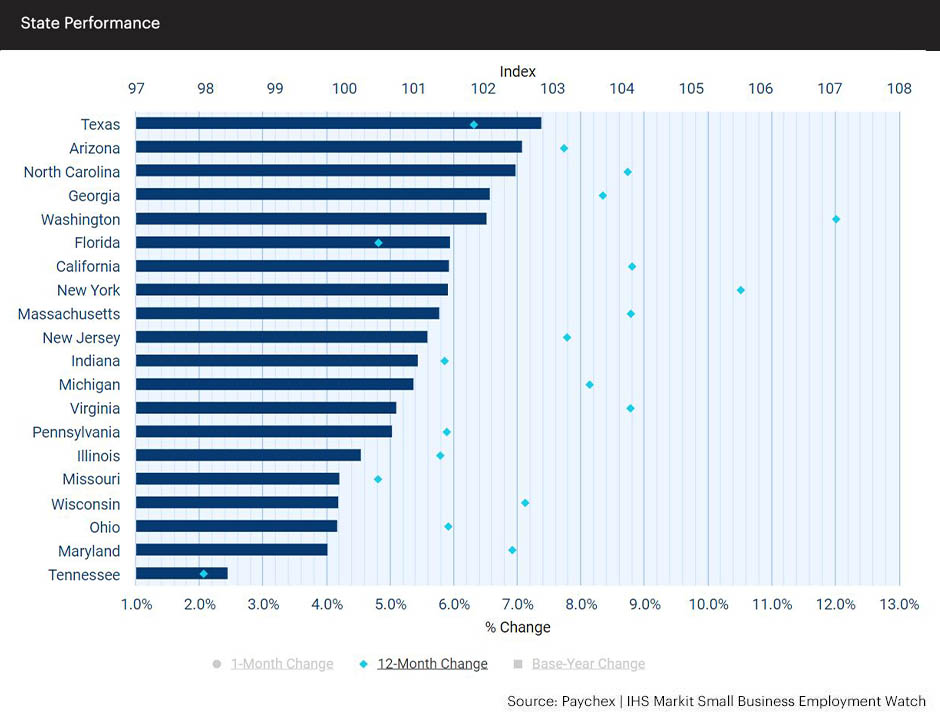

State Jobs Index

- Texas, Arizona, North Carolina, Georgia, and Washington lead, all with index levels greater than 102.

- At 101.51 and up 10.51 percent from last year, New York improved its ranking among states for the fifth consecutive month.

- Tennessee and Missouri had the strongest one-month gains in January (1.15 percent), although both states have an index below 100.

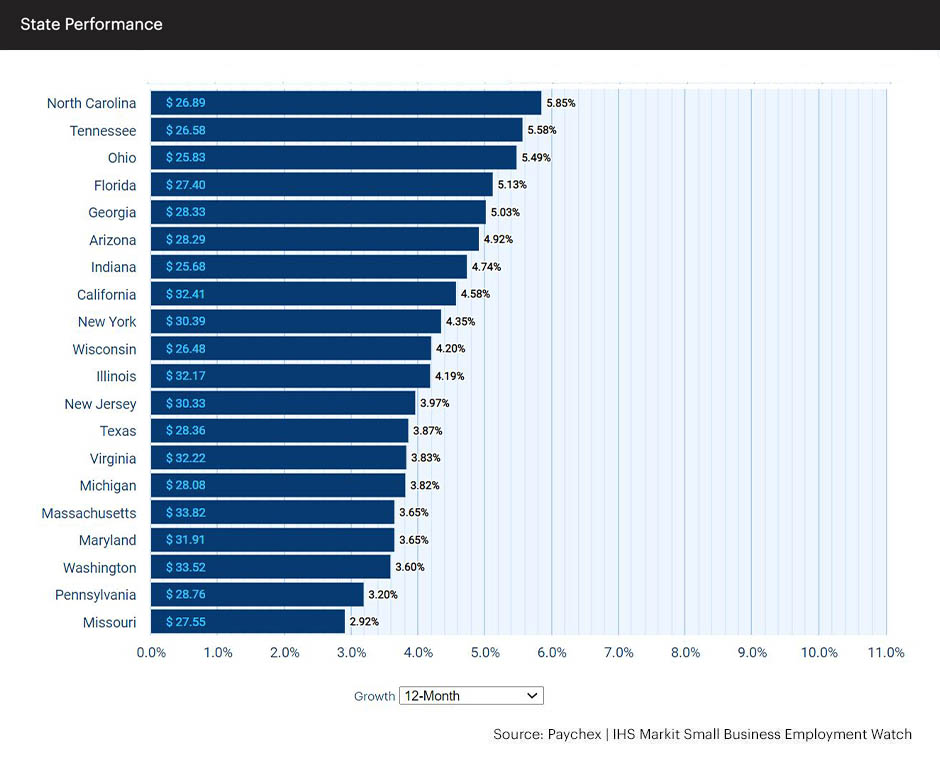

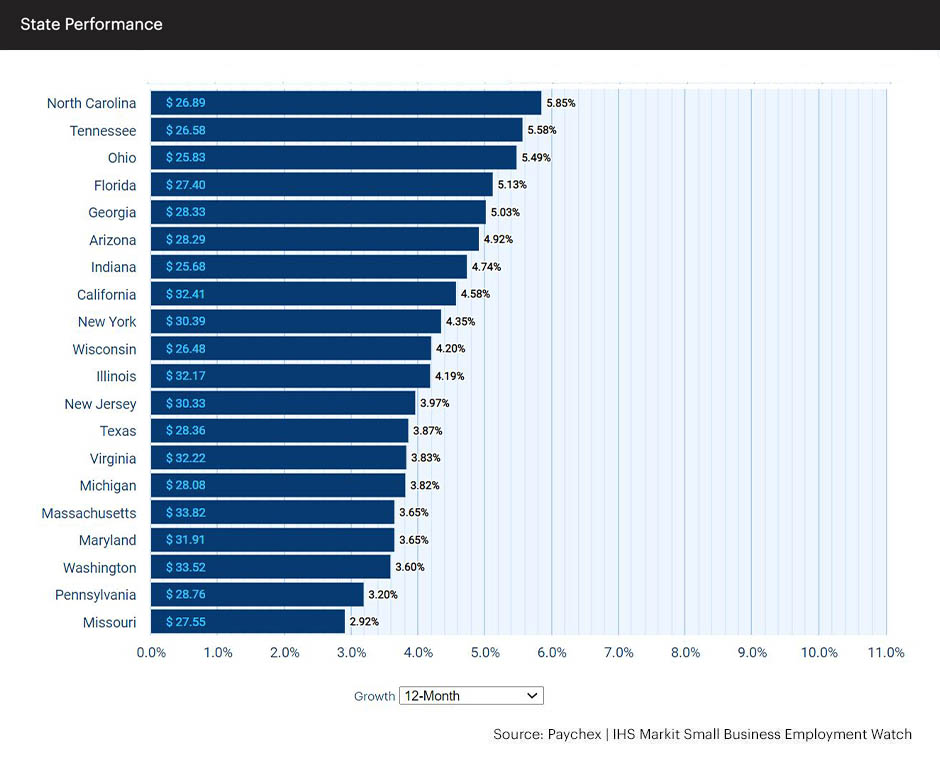

State Wage Report

- Four states registered hourly earnings growth above five percent, North Carolina, Tennessee, Ohio, Florida, and Georgia.

- Missouri (2.92 percent) is the only state with hourly earnings growth below three percent.

- Texas, Pennsylvania, and Arizona are the only three states with positive weekly hours worked growth year-over-year.

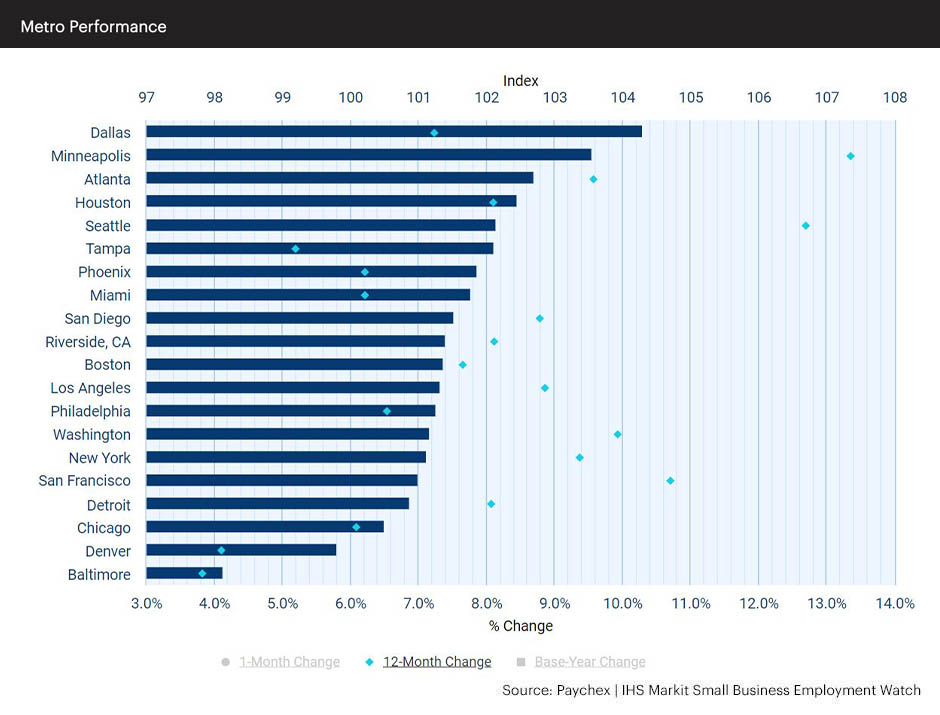

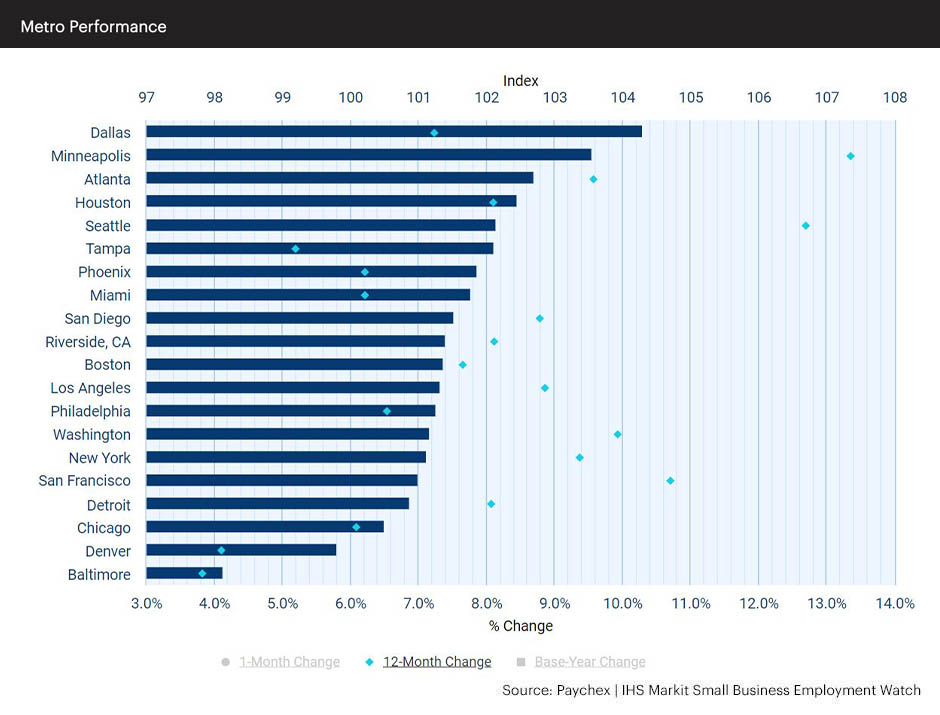

Metropolitan Jobs Index

- Dallas (104.30) and Minneapolis (103.56) lead all metros by a wide margin and were relatively unchanged in January.

- Denver gained 2.64 percent in January, increasing its index to 99.81. However, Denver and Baltimore remain the only metros with index levels below 100.

- Following four consecutive slowdowns to end 2021, Tampa gained 1.09 percent in January, its second best one-month gain since 2017.

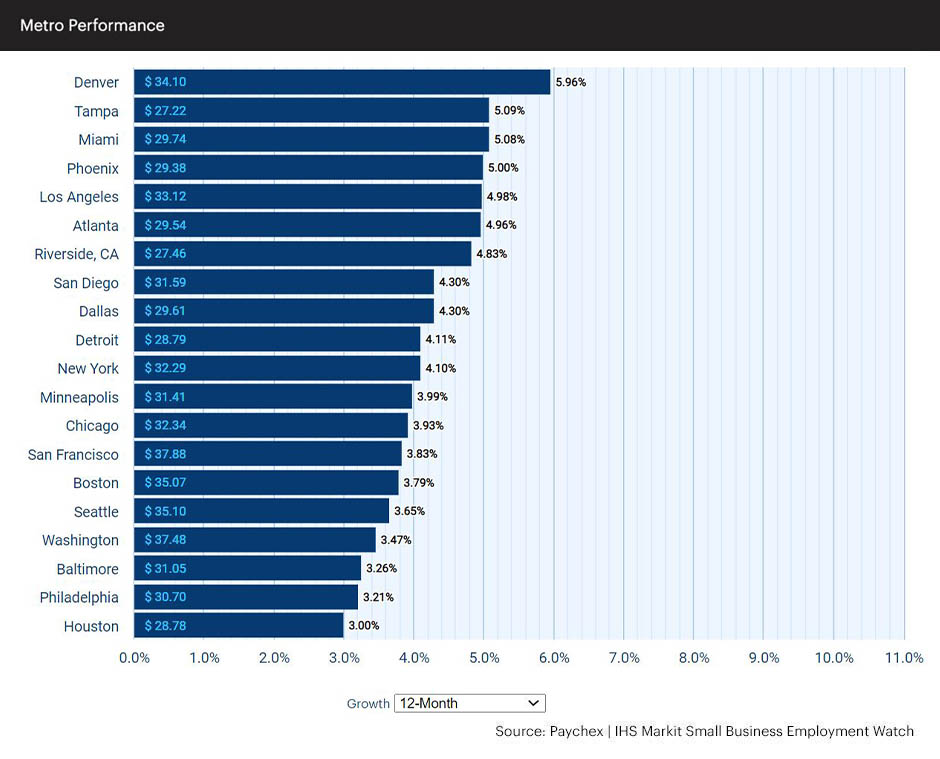

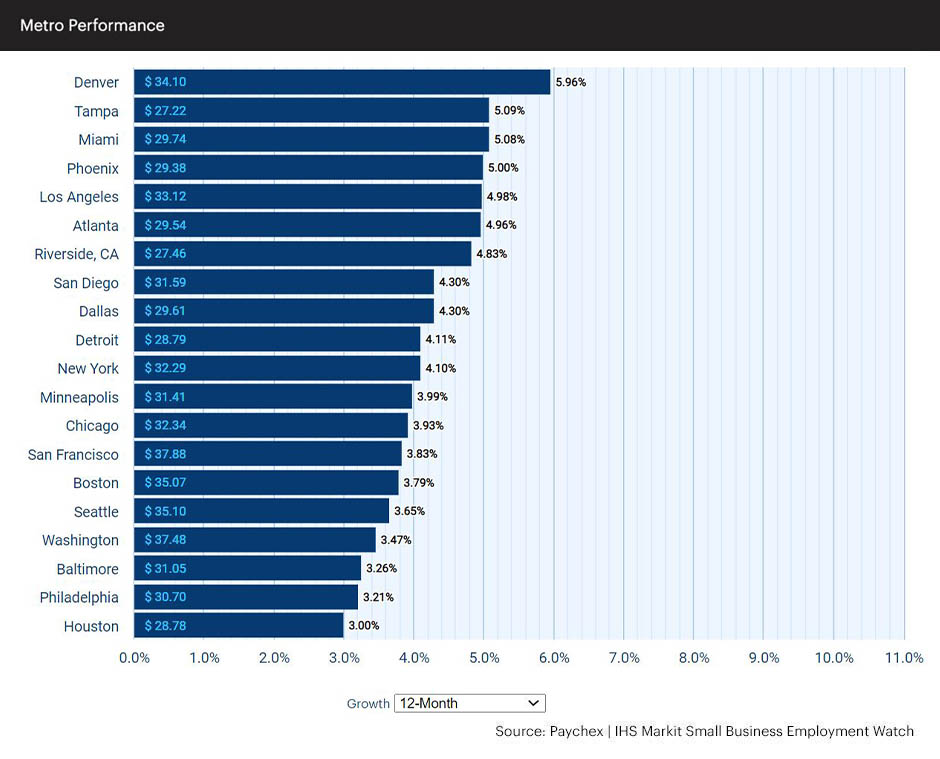

Metropolitan Wage Report

- Denver, Tampa, Miami, and Phoenix lead metros in hourly earnings growth, all above five percent. All metros have hourly earnings growth at or above three percent in January.

- Houston ranks last among metros in hourly earnings growth (3.00 percent), but first among metros in weekly hours worked growth (0.71 percent).

- San Francisco, Detroit, and Seattle all have weekly earnings growth below three percent, largely due to a decrease in weekly hours worked.

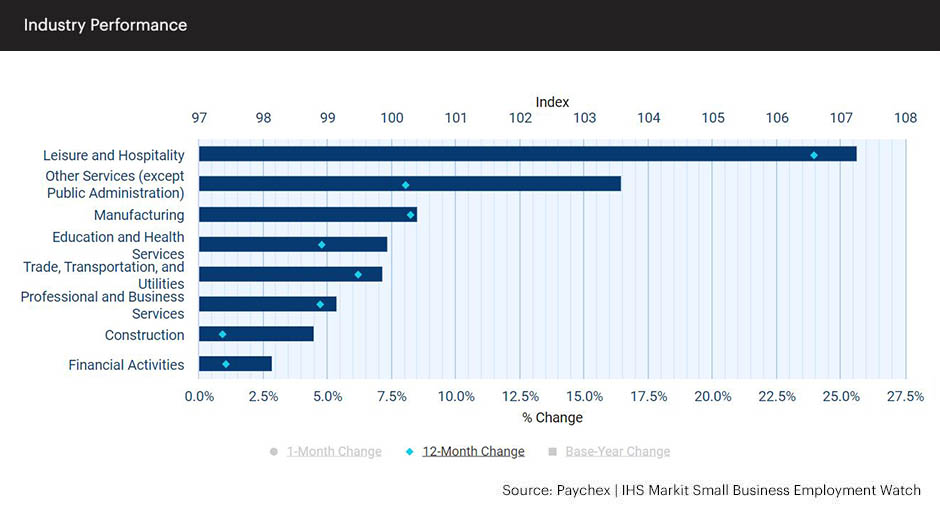

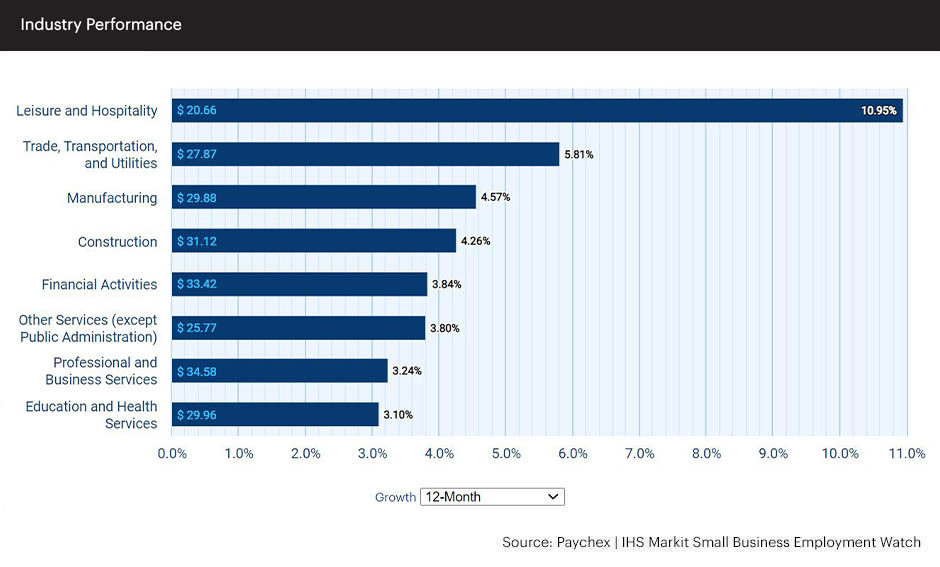

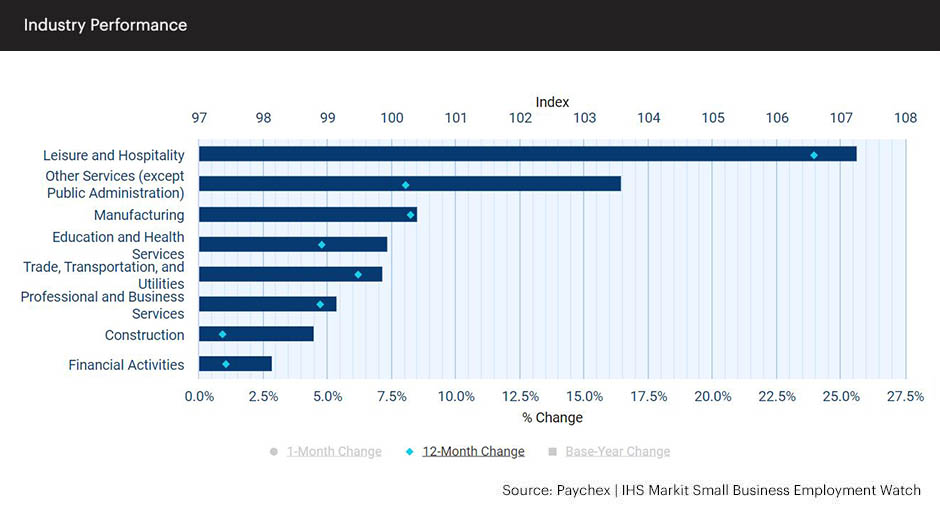

Industry Jobs Index

- Leisure and hospitality (107.25) accelerated further ahead of other sectors, gaining 1.49 percent in January and 23.94 percent since last January.

- The national index reported a new record high in January (101.33), though only leisure and hospitality, other services, and manufacturing have index levels above 100.

- Construction remains relatively flat and among the lowest sectors for jobs growth, trending below 99 for the ninth consecutive month.

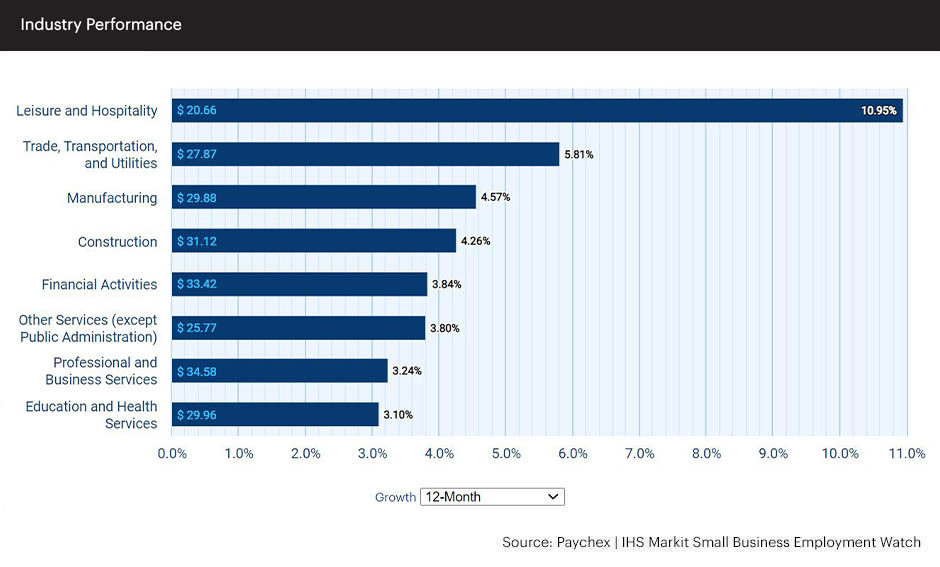

Industry Wage Report

- Leisure and hospitality leads all sectors with hourly earnings growth of 10.95 percent, nearly double the next highest ranked sector, trade, transportation, and utilities (5.81 percent).

- Likely due to the COVID-19 omicron variant, one-month annualized weekly hours worked growth dropped nearly eight percent in leisure and hospitality in January. For reference, education and health services (-0.31 percent) is the only other sector with negative one-month annualized weekly hours worked growth in January.

- At 3.10 percent, education and health services rank last among sectors in hourly earnings growth.

Note: Analysis is provided for seven major industry sectors. Definitions of each industry sector can be found here. The other services (except public administration) industry category includes religious, civic, and social organizations, as well as personal services, including automotive and household repair, salons, drycleaners, and other businesses.

More Information

For more information about the Paychex | IHS Markit Small Business Employment Watch, visit the website and sign up to receive monthly Employment Watch alerts.

*Information regarding the professions included in the industry data can be found at the Bureau of Labor Statistics website.

About the Paychex | IHS Markit Small Business Employment Watch

The Paychex | IHS Markit Small Business Employment Watch is released each month by Paychex, Inc., a leading provider of payroll, human resource, insurance, and benefits outsourcing solutions for small-to medium-sized businesses, and IHS Markit, a world leader in critical information, analytics, and expertise. Focused exclusively on small business, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful tool delivers real-time insights into the small business trends driving the U.S. economy.

Media Contacts

Lisa Fleming

Paychex, Inc.

585-387-6402

lfleming@paychex.com

Kate Smith

IHS Markit

781-301-9311

katherine.smith@ihsmarkit.com

Maggie Pryslak

Mower

585-576-1083

mpryslak@mower.com

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.