OTTAWA

,

March 25, 2024

(press release)

–

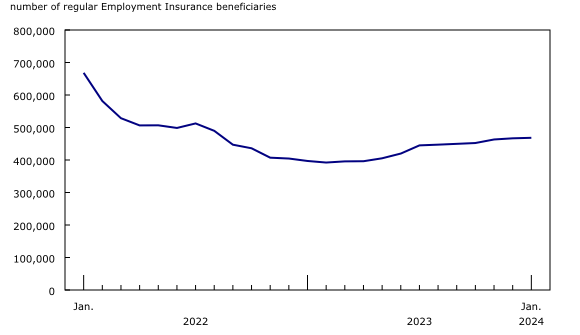

The number of Canadians receiving regular Employment Insurance (EI) benefits was little changed in January (+0.3%; +1,600) and stood at 468,000. From January 2023 to January 2024, the total number of regular EI beneficiaries increased by 71,000 (+18.0%), partly offsetting the year-over-year decline of 271,000 (-40.6%) from January 2022 to January 2023. Data from the Labour Force Survey (LFS) show that the unemployment rate declined 0.1 percentage points to 5.7% in January 2024, the first decline since December 2022. The unemployment rate had been on an upward trend through most of 2023, rising from 5.1% in April to 5.8% in December. In general, variations in the number of EI beneficiaries can reflect changes in the circumstances of different groups, including those becoming beneficiaries, those going back to work, those exhausting their regular benefits, and those no longer receiving benefits for other reasons. In January 2024, there were 800 (+1.7%) more youth (aged 15 to 24 years) receiving regular EI benefits, the second increase in three months. The increase in January was split evenly between young women (+400; +2.9%) and young men (+400; +1.2%). Compared with January 2023, the number of regular EI recipients increased by 7,300 (+29.3%) among young men and by 1,900 (+17.1%) among young women in January 2024. The LFS data show that over the same 12-month period, the youth unemployment rate rose 1.1 percentage points to 10.8%, indicating more difficult labour market conditions for youth. In January, the number of regular EI recipients among women aged 55 years and older fell by 500 (-1.0%), while it was little changed for older men. Over the 12 months ending in January, more older men (+9,400; +13.3%) and older women (+4,100; +9.6%) received regular EI benefits. While the number of core-aged (25 to 54 years old) men and women receiving regular EI benefits was little changed in January, it increased on a year-over-year basis for core-aged men (+32,000; +21.2%) and core-aged women (+16,000; +17.1%). According to the LFS, the unemployment rate increased on a year-over-year basis among core-aged men (+0.8 percentage points to 5.1%) and core-aged women (+0.9 percentage points to 5.0%). The number of regular EI beneficiaries in January rose in Alberta and Saskatchewan, while it declined in Newfoundland and Labrador and in Nova Scotia. There was little change in the other provinces. In Alberta, the number of people receiving regular EI benefits in January rose by 1,800 (+3.4%), the fourth consecutive monthly increase. Core-aged men (+900; +4.0%) and women (+400; +3.0%) posted an increase, along with men aged 55 years and older (+400; +5.3%). Data from the LFS show that after falling to a recent low of 5.5% in September 2023, the unemployment rate in the province trended up to 6.2% in January 2024. The Calgary (+600; +3.8%) and Edmonton (+600; +3.5%) census metropolitan areas both recorded increases in the number of regular EI recipients in the month. There were also more EI recipients in Saskatchewan in January (+300; +1.8%), the second increase in three months. In contrast, the number of beneficiaries fell in Newfoundland and Labrador (-400; -1.3%) in January, following little change over the final three months of 2023. The number of EI recipients receiving regular benefits also fell in Nova Scotia (-300; -1.5%), following little change in four of the previous five months. Industry Intelligence Editor's Note: This press release omits select charts and/or marketing language for editorial clarity. Click here to view the full report.Chart 1

The number of regular Employment Insurance beneficiaries up slightly since July 2023More young women and men receive regular Employment Insurance benefits in January

More regular Employment Insurance recipients in Alberta and Saskatchewan and fewer in Newfoundland and Labrador and Nova Scotia

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.