March 8, 2024

(press release)

–

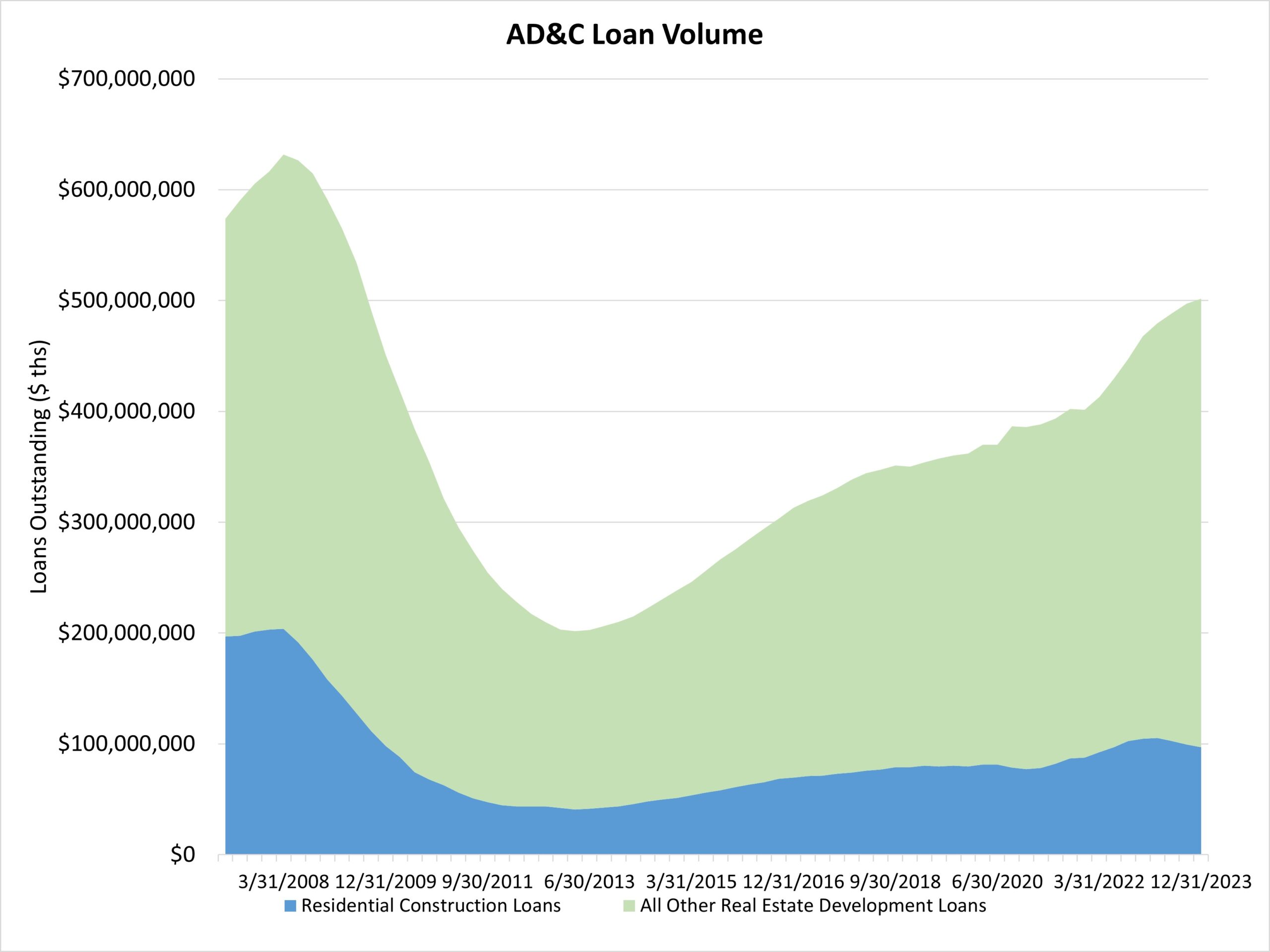

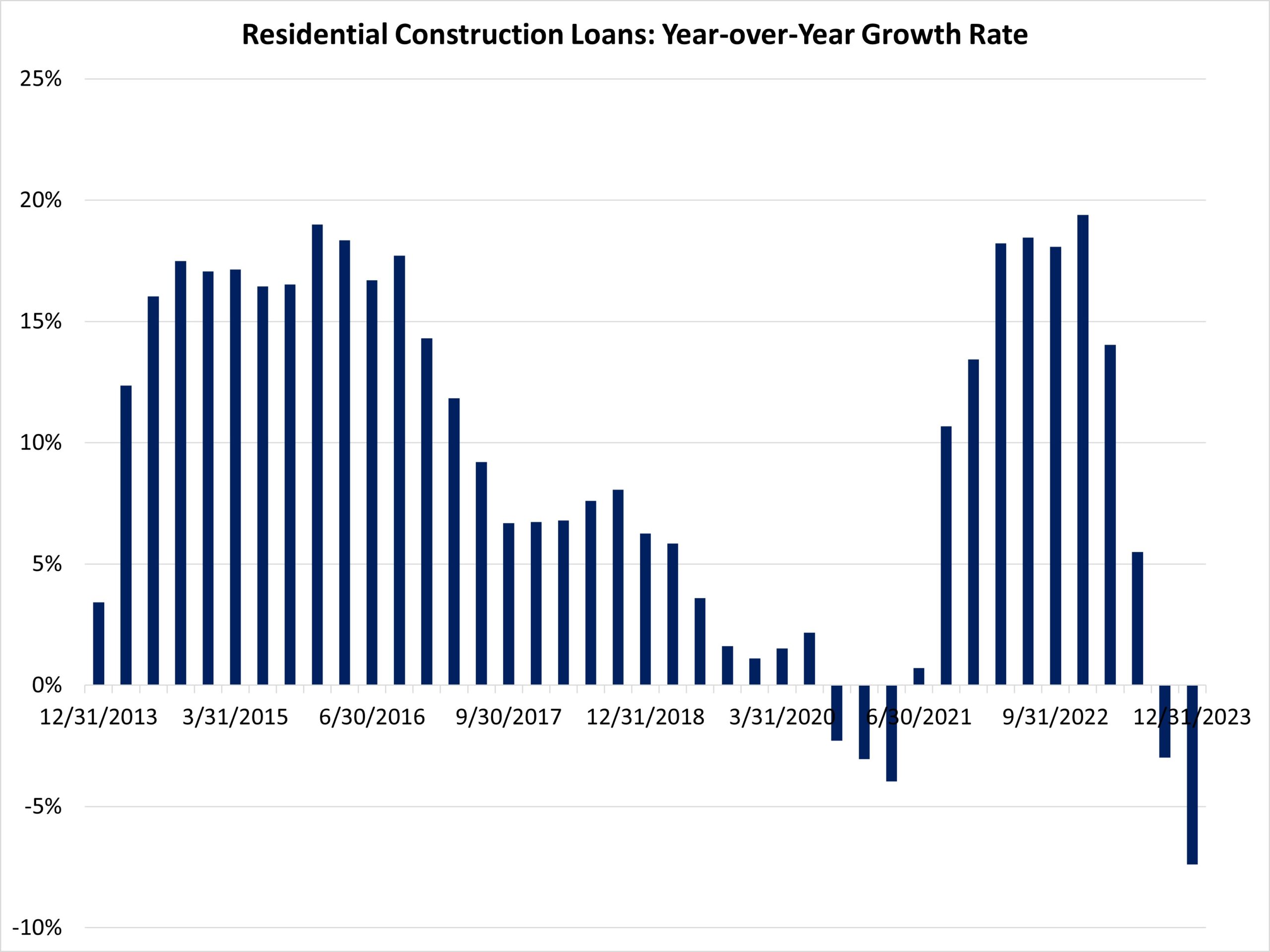

The volume of total outstanding acquisition, development and construction (AD&C) loans posted a decline during the fourth quarter of 2023 as interest rates increased and financial conditions tightened. However, AD&C loan conditions will improve in 2024 as the Fed begins easing monetary policy. The volume of 1-4 unit residential construction loans made by FDIC-insured institutions declined 2.5% during the fourth quarter. The volume of loans declined by $2.5 billion for the quarter. This loan volume retreat places the total stock of home building construction loans at $97 billion, off a post-Great Recession high set during the first quarter of 2023. On a year-over-year basis, the stock of residential construction loans is down 7.4%. This contraction for construction financing is a key reason home builder sentiment has moved lower at the end of 2023, even as building activity accelerated. Nonetheless, since the first quarter of 2013, the stock of outstanding home building construction loans is up 138%, an increase of more than $56 billion. It is worth noting the FDIC data represent only the stock of loans, not changes in the underlying flows, so it is an imperfect data source. Lending remains much reduced from years past. The current amount of existing residential AD&C loans now stands 52% lower than the peak level of residential construction lending of $204 billion reached during the first quarter of 2008. Alternative sources of financing, including equity partners, have supplemented this capital market in recent years. The FDIC data reveal that the total decline from peak lending for home building construction loans continues to exceed that of other AD&C loans (nonresidential, land development, and multifamily). Such forms of AD&C lending are off a smaller 7% from peak lending. For the third quarter, these loans posted a 1.7% increase.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.