July 26, 2022

(press release)

–

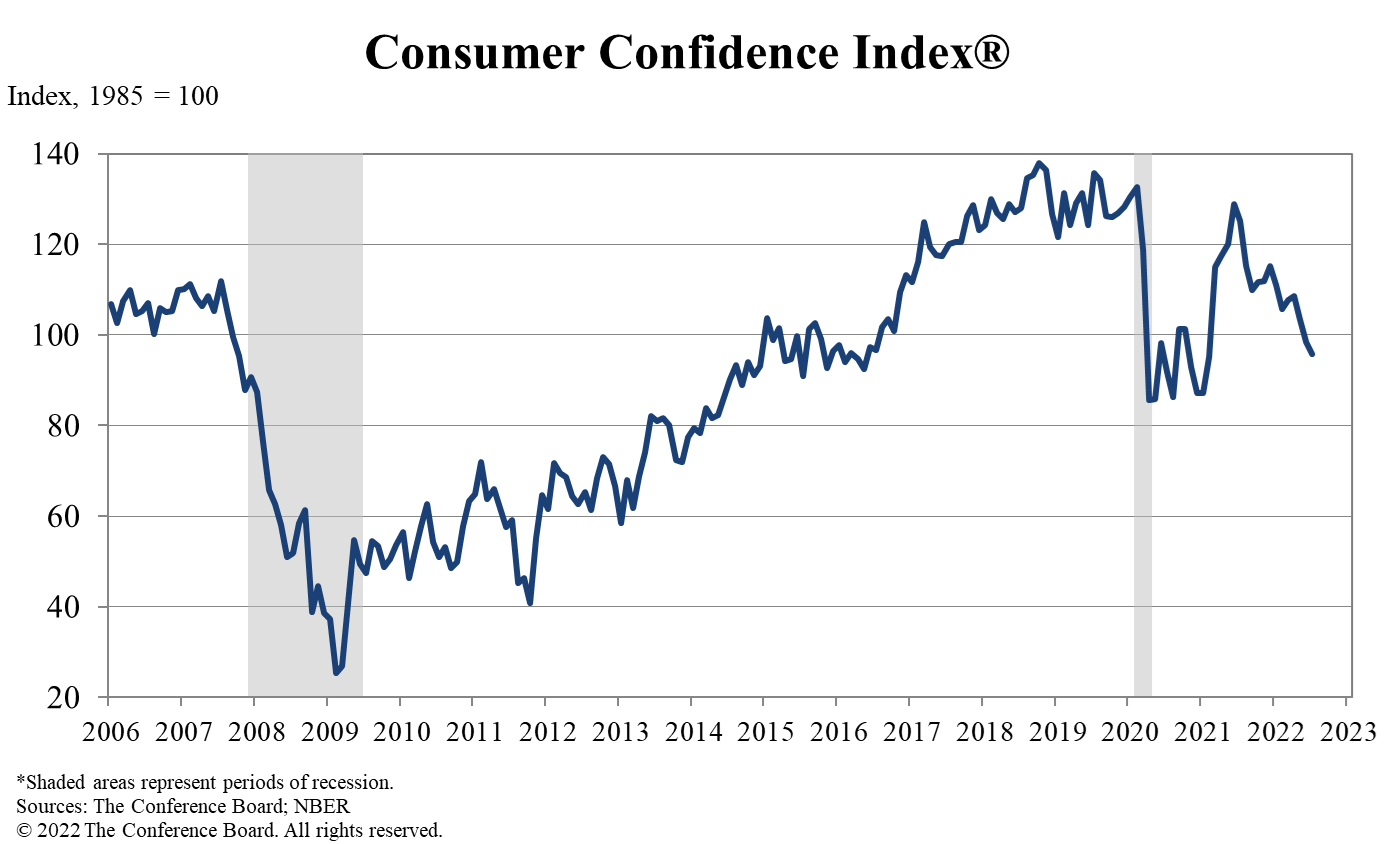

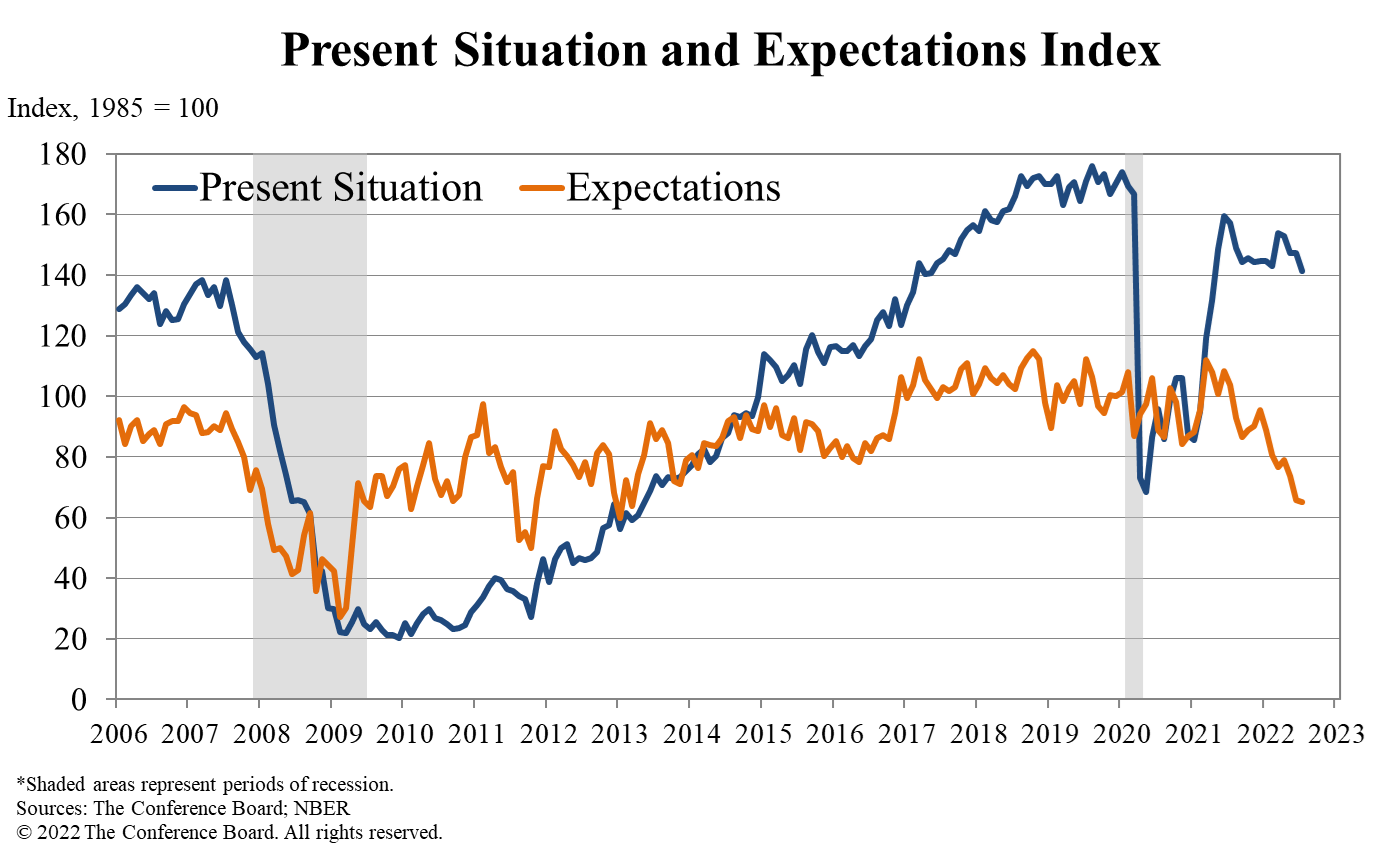

Index Fell for Third Straight Month, as Consumers’ View of Present Situation Weakened The Conference Board Consumer Confidence Index® decreased in July, following a larger decline in June. The Index now stands at 95.7 (1985=100), down 2.7 points from 98.4 in June. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell to 141.3 from 147.2 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—ticked down to 65.3 from 65.8. “Consumer confidence fell for a third consecutive month in July,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The decrease was driven primarily by a decline in the Present Situation Index—a sign growth has slowed at the start of Q3. The Expectations Index held relatively steady, but remained well below a reading of 80, suggesting recession risks persist. Concerns about inflation—rising gas and food prices, in particular—continued to weigh on consumers.” “As the Fed raises interest rates to rein in inflation, purchasing intentions for cars, homes, and major appliances all pulled back further in July. Looking ahead, inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months.” Present Situation Consumers’ appraisal of current business conditions was less favorable in July. 17.0% of consumers said business conditions were “good,” down from 19.5%. 50.1% of consumers said jobs were “plentiful,” down from 51.5%. Expectations Six Months Hence Consumers were mixed about the short-term business conditions outlook in July. Consumers were also mixed about the short-term labor market outlook. Consumers were more pessimistic about their short-term financial prospects. The monthly Consumer Confidence Survey®, based on an online sample, is conducted for The Conference Board by Toluna, a technology company that delivers real-time consumer insights and market research through its innovative technology, expertise, and panel of over 36 million consumers. The cutoff date for the preliminary results was July 21. Source: July 2022 Consumer Confidence Survey® The Conference Board The Conference Board publishes the Consumer Confidence Index® at 10 a.m. ET on the last Tuesday of every month. Subscription information and the technical notes to this series are available on The Conference Board website: https://www.conference-board.org/data/consumerdata.cfm. About The Conference Board The Conference Board is the member-driven think tank that delivers trusted insights for what’s ahead. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org • Learn more about our mission and becoming a member The next release is Tuesday, August 30 at 10 AM ET. For further information contact: Jonathan Liu at +1 212 339 0257 JLiu@tcb.org COPYRIGHT TERMS OF USE All material on Our Sites are protected by United States and international copyright laws. You must abide by all copyright notices and restrictions contained in Our Sites. You may not reproduce, distribute (in any form including over any local area or other network or service), display, perform, create derivative works of, sell, license, extract for use in a database, or otherwise use any materials (including computer programs and other code) on Our Sites ("Site Material"), except that you may download Site Material in the form of one machine readable copy that you will use only for personal, noncommercial purposes, and only if you do not alter Site Material or remove any trademark, copyright or other notice displayed on the Site Material. If you are a subscriber to any of the services offered on Our Sites, you may be permitted to use Site Material, according to the terms of your subscription agreement. Trademarks "THE CONFERENCE BOARD," the TORCH LOGO, "CONSUMER CONFIDENCE SURVEY", "CONSUMER CONFIDENCE INDEX", and other logos, indicia and trademarks featured on Our Sites are trademarks owned by The Conference Board, Inc. in the United States and other countries ("Our Trademarks"). You may not use Our Trademarks in connection with any product or service that does not belong to us nor in any manner that is likely to cause confusion among users about whether The Conference Board is the source, sponsor, or endorser of the product or service, nor in any manner that disparages or discredits us.

24.0% of consumers said business conditions were “bad,” up from 22.8%.

Consumers’ assessment of the labor market was less optimistic.

12.3% of consumers said jobs were “hard to get,” up from 11.6%.

Joseph DiBlasi at +781.308.7935 JDiBlasi@tcb.org

© The Conference Board 2022. All data contained in this table are protected by United States and international copyright laws. The data displayed are provided for informational purposes only and may only be accessed, reviewed, and/or used in accordance with, and the permission of, The Conference Board consistent with a subscriber or license agreement and the Terms of Use displayed on our website at www.conference-board.org. The data and analysis contained herein may not be used, redistributed, published, or posted by any means without express written permission from The Conference Board.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.