OTTAWA

,

February 16, 2022

(press release)

–

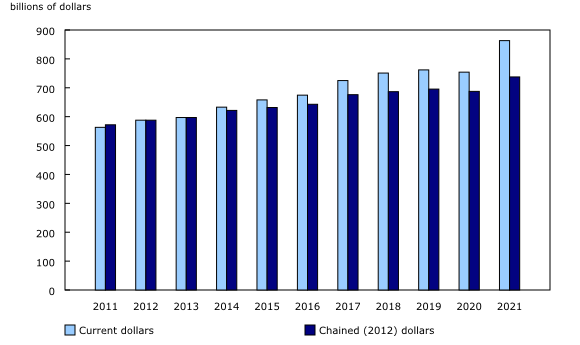

Wholesale sector extends growth streak Constant dollar sales grew 1.0% in December. Chart 1: Wholesale sales rise in December Motor vehicle sales continue to rise Sales of machinery, equipment and supplies grew 1.6% to $15.6 billion in December, the fourth consecutive monthly increase, and the highest level ever recorded in the subsector. Higher sales of computer and communications equipment; and farm, lawn and garden machinery and equipment were behind the gain. Sales of computer and communications equipment rose 3.4% to $4.8 billion, the fourth increase in the past five months, while sales of farm, lawn and garden machinery and equipment rose for the third time in the past four months. Declines in sales of food, beverages and tobacco (-2.5%) and in sales of miscellaneous goods (-2.3%) were largely offset by the increases in other subsectors. Sales of food, beverage and tobacco products fell for the second consecutive month, reflecting weaker sales in three of four industries. Given that the food industry dominates this subsector, the 2.7% decline in food sales generated almost all of the drop in the subsector. Miscellaneous goods sales fell in two of five industries that make up the subsector, with the agricultural supplies industry and chemical and allied products industry making up most of the decline. Sales rise in nine provinces Wholesale sales increased 1.3% in Ontario, the sixth consecutive month of growth, to $38.9 billion. Sales were 10.9% higher than in December 2020. Five subsectors increased, comprising 72% of sales. Machinery, equipment and supplies merchant wholesalers saw the largest increase in sales, climbing 5.4% to $8.2 billion. Most of the growth in the subsector was driven by sales of construction, forestry, mining, and industrial machinery, equipment and supplies, the second largest industry in the sector. Motor vehicle and motor vehicle parts and accessories merchant wholesalers added 2.6% in monthly sales, totalling $8.0 billion. Miscellaneous merchant wholesaler receipts slid 3.6% to $5.0 billion, partly reversing strong growth in November. Aside from the paper, paper product and disposable plastic product industry, all components of the subsector saw lower sales, with other miscellaneous merchant wholesalers seeing the largest reduction. Wholesalers in British Columbia took in 2.3% more sales, growing to $7.5 billion in December 2021—9.1% higher than December 2020. The five subsectors that increased in December 2021 made up 64% of sector sales. Building material and supplies sales gained the most, adding 11.0% for a total of $2.3 billion. Sales of lumber, millwork, hardware and other building supplies comprised the bulk of the growth. Lower sales of food, beverage and tobacco partially offset this increase, falling 10.4% to $1.4 billion. Alberta wholesalers reported a 5.6% drop in sales to $7.7 billion in December. Monthly sales were 17.2% higher than in December 2020. Sales of machinery, equipment and supplies wholesalers decreased the most (-5.9%), to $2.4 billion in sales. Sales of construction, forestry, mining, and industrial machinery, equipment and supplies wholesalers reported the largest monthly decline. Personal and household goods merchant wholesalers' sales were up 22.7%, to $0.4 billion. Increased sales of pharmaceuticals and pharmacy supplies explain a large part of the difference. Home furnishings wholesalers also realized higher sales. Inventory levels continue to grow The motor vehicle and motor vehicle parts and accessories subsector contributed nearly one-third of the increase in inventories, up 8.7% to $12.8 billion in December. This was the highest reported inventory level since February 2020. The increase was largely driven by the motor vehicle industry as production gradually resumed, following the disruptions due to the ongoing semiconductor chip shortages and plant shutdowns. Inventories of personal and household goods grew 4.4% to $18.7 billion in December. The pharmaceuticals and pharmacy supplies wholesalers primarily accounted for this increase, as inventories rose 9.6% to a record high $8.9 billion. Building material and supplies also reached record high inventory levels in December, up 3.7% to $20.6 billion. The lone subsector with decreased inventories in December was food, beverage and tobacco, which shrank 1.0% to $11.3 billion. The food merchant industry, which held 88% of inventories, fell 1.3% to $9.9 billion. Notwithstanding the decrease in the subsector, inventory levels were still among the highest on record, having only been surpassed in October and November of 2021. The inventory-to-sales ratio increased from 1.37 in November to 1.41 in December. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their levels. Annual review of wholesale sales in 2021 All seven subsectors report higher sales in 2021 Chart 2: Wholesale sales by subsector, dollar change from 2020 Wholesale sales of building material and supplies grew 32.5% in 2021 to $144.1 billion. Lumber, millwork, hardware and other building supplies merchant wholesalers contributed 55%, or $79.1 billion, of sales in the subsector, adding 36.1% compared with its 2020 sales. This industry reported robust growth in sales in the first half of 2021, before contracting 22.8% in the third quarter, and returning to growth in the final quarter of 2021. Sales reflected both a change in the volume of goods sold to support housing starts and changes in prices paid for lumber. The value of single dwelling building permits rose 41.5% in 2021, to $40.7 million. The number of permits increased 6.0% to 323,228. The price of lumber and other sawmill products averaged 50.0% higher in 2021 than 2020. At its highest point in May 2021, prices were more than double the 2020 average, and they never dropped below a low point in September 2021 which was 14.6% higher than the 2020 average. Machinery, equipment and supplies merchant wholesalers sold goods worth 12.8% more than 2020 for a total of $180.4 billion in 2021. All component industries increased their annual sales, with the construction, forestry, mining, and industrial machinery, equipment and supplies industry increasing the most. Sales in this industry grew 16.0% to $56.9 billion. Computer and communications equipment and supplies merchant wholesalers' sales increased 10.3% to $58.0 billion, growing in the first and fourth quarters of 2021, but decreasing in the middle of the year, in part due to the semiconductor shortage. Sales volumes increased 7.3% to $737.5 billion in 2021. Chart 3: Wholesale sales, 2011 to 2021 Supply chain disruptions Workers at the Port of Montréal, the second largest port in Canada, went on strike over stalled contract negotiations in May. A total of 15% of Monthly Wholesale Trade Survey respondents reported the strike affected their business, to the tune of an estimated $230 million in lost national sales, on top of delays and increased costs for those who rerouted their goods. The supply of goods through Canada's largest port, the Port of Vancouver, was also disrupted in November when floods washed out stretches of highways and railroads used to move goods inland. The estimated negative impact on national wholesale sales in November was $300 million. Many wholesalers used alternate shipping routes or modes of transportation to move goods until regular ground transportation was restored, incurring higher costs. International disruptions abroad also had implications for Canadian wholesalers. In March, a large container ship, the Ever Given, blocked the Suez Canal for six days, causing a large backlog of ships waiting to pass through the canal. Public health measures in China led to reduced service or closures in globally significant ports in August, May and December. Moreover, reduced activity in foreign factories producing goods for export and reduced ground transportation capacity introduced delays and uncertainty that affected the ability of Canadian wholesalers to access goods from global producers. Shipping in 2021 was further complicated by the lack of available shipping containers, with many containers languishing in ports, while container shipping prices skyrocketed. Moreover, the efficiency of global shipping suffered because many containers were returned unfilled. Tight supplies were aggravated by the stockpiling of inventories as a hedge against uncertainty in the supply of goods. At the beginning of the pandemic, some manufacturers cancelled orders of semiconductor chips, a category of components found in digital goods from gaming consoles, to washing machines, and cars. The vast majority of advanced semiconductor chips are produced by a small number of companies in Asia. In addition, some semiconductor producers also reduced their output as a result of health measures. When demand for goods that require semiconductor chips recovered from the plunging levels of April 2020, many semiconductor manufacturers were unprepared to fill the orders. When the pandemic began, some manufacturers cancelled planned orders of semiconductor chips. Chip foundries reconfigured to sell different products, and switching back takes a significant amount of time. As a result, delays and shortages persisted in 2021. Because semiconductor chips are so pervasive, it is difficult to isolate the impact of the shortage on each wholesale subsector. However, the impact on motor vehicle and motor vehicle parts and accessories wholesalers through much of the year was noteworthy. The shortage disrupted seasonal patterns in the subsector as motor vehicle manufacturers across North America opened and closed production lines based on semiconductor availability, which varied between companies and even between models offered by the same company. The value of inventories in the subsector was lower every month of 2021 than the same month in 2020, except for November and December. Motor vehicle and motor vehicle parts and accessories sales contracted in the first half of 2021, remained steady in the third quarter, and increased sharply in the last quarter. Overall, motor vehicle and motor vehicle parts and accessories merchant wholesalers reported a 12.6% increase, for $128.1 billion in annual sales. Vaccines Sales rise in all provinces Chart 4: Wholesale sales by province, dollar change from 2020 The largest increase came in Ontario, up 11.9% to $435.8 billion. Sector sales contracted modestly (-0.8%) in the second quarter, but increased in every other quarter of the year. Sales in all seven subsectors grew, with building material and supplies merchant wholesalers and machinery, equipment and supplies merchant wholesalers adding the most to their annual sales. Sales of building material and supplies increased 29.1% to $59.1 billion. Sales increased in the first half of 2021, retrenched in the third quarter, and grew again in the final quarter. Machinery, equipment and supplies merchant wholesalers reported receipts 12.8% higher in 2021, mainly due to growth in the first quarter of the year. Quebec wholesalers reported 18.4% more sales, for a total of $168.5 billion for 2021. Quarterly sales contracted in the third quarter, but grew in every other quarter despite monthly sales falling in five months of the year. Annual sales in six out of seven subsectors increased, while the subsectors with higher annual sales comprised 79% of sales in Quebec. Building material and supplies merchant wholesalers reported the largest change, a 35.3% increase for an annual total of $29.1 billion. The subsector reported sales 22.1% higher in the first quarter, and increases greater than 10% in the second and fourth quarters, while sales contracted 17.5% in the third quarter when national sales in the subsector also shrank. Personal and household goods wholesalers added 19.5% to annual sales, finishing the year with $37.1 billion. Quarterly sales grew in the first half of the year, and a moderate retrenchment of sales in the third quarter was more than offset by renewed growth in the fourth quarter. The food, beverage, and tobacco subsector reported sales 1.8% lower in 2021 than in 2020. Note to readers Seasonally adjusted data are data that have been modified to eliminate the effect of seasonal and calendar influences to allow for more meaningful comparisons of economic conditions from period to period. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions. Trend-cycle estimates are included in selected charts as a complement to the seasonally adjusted series. These data represent a smoothed version of the Seasonally adjusted time series and provide information on longer-term movements, including changes in direction underlying the series. For information on trend-cycle data, see Trend-cycle estimates – Frequently asked questions. Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be large and could even lead to a reversal of movement, especially for reference months near the end of the series or during periods of economic disruptions. Total wholesale sales expressed in volume are calculated by deflating current dollar values using relevant price indexes. The wholesale sales series in chained (2012) dollars is a chained Fisher volume index, with 2012 as the reference year. For more information, see Deflation of wholesale sales. The Monthly Wholesale Trade Survey covers all industries within the wholesale trade sector, as defined by the North American Industry Classification System (NAICS), with the exception of oilseed and grain merchant wholesalers (NAICS 41112), petroleum and petroleum products merchant wholesalers (NAICS 412) and business-to-business electronic markets, and agents and brokers (NAICS 419). Real-time data tables Next release Products Contact information Industry Intelligence Editor's Note: This press release omits select charts and/or marketing language for editorial clarity. Click here to view the full report.

Wholesale sales rose 0.6% in December to $76.2 billion, the fifth consecutive monthly increase. Sales increased in five of seven subsectors, representing two-thirds of total wholesale sales. The month was marked by strong movement in four subsectors in particular. Gains in the automobile and automobile parts and accessories subsector, and in the machinery, equipment and supplies subsector were largely offset by lower sales in the food, beverage and tobacco subsector and in the miscellaneous subsector.

Sales of motor vehicles and motor vehicle parts and accessories grew 3.3% in December to $11.8 billion. Sales in December were 1.6% below the pre-pandemic level of $12.0 billion in February 2020. The increase reflects, in part, a 4.7% increase in motor vehicles and parts, and a 5.1% increase in imports. Notwithstanding the high level of sales, Canadian manufacturers of motor vehicles were still unable to run their facilities at full capacity due to the ongoing shortage of semiconductors. Many manufacturers had to close for all or part of multiple days over and above the normal Christmas shutdowns as a result of semiconductor shortages.

Sales increased in nine provinces and two territories comprising 90% of national sales in December. Wholesalers in Alberta and Yukon reported lower sales.

The value of wholesale inventories rose 2.9% in December to $107.2 billion. Inventories rose every month in 2021 except April. Higher inventories were reported in six of the seven subsectors, representing 89% of total inventories.

Annual sales in the Canadian wholesale sector grew 14.5% to $863.3 billion in 2021. Notably, sales were 13.3% higher than in 2019, the last full year before the pandemic began in Canada. Sales increased in nine months of the year, and every quarter except for the third.

Disruptions to global supply chains had a significant impact on the sector in 2021.

Although Canada received some doses of vaccines against COVID-19 in December 2020, most of the doses were delivered in 2021. The Government of Canada committed around $9 billion in its 2021 budget to procuring vaccines and therapeutics, and to international support, with the majority of that amount dedicated to purchasing vaccines for use in Canada. Pharmaceuticals and pharmacy supplies merchant wholesalers—the wholesale industry group that contains vaccines, gloves, and syringes, among other pharmacy supplies and prescription drugs—reported an 8.3%, or $5.1 billion, year-over-year increase in sales, for a total of $66.0 billion in 2021.

Wholesalers in every province and two territories recorded higher sales in 2021.

All data in this release are seasonally adjusted and expressed in current dollars, unless otherwise noted.

Real-time data tables 20-10-0019-01, 20-10-0020-01 and 20-10-0005-01 will be updated soon.

Wholesale trade data for January 2022 will be released on March 16, 2022.

The product "Monthly Wholesale Trade Survey: Interactive Tool" (Catalogue number71-607-X) is available online. This product is based on the data published in the tables of the Monthly Wholesale Trade Survey: 20-10-0074-01, 20-10-0076-01 and 20-10-0003-01.

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca). To enquire about the concepts, methods or data quality of this release, contact Jeff Paul (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca), Mining, Manufacturing, and Wholesale Trade Division.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.