OTTAWA

,

July 21, 2023

(press release)

–

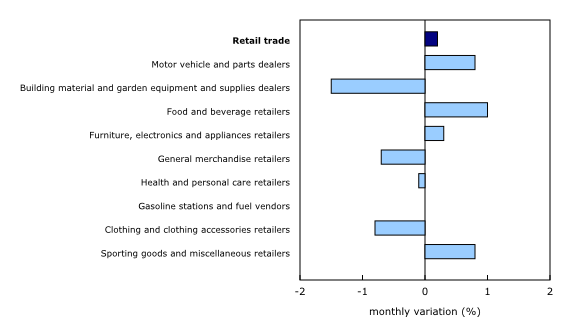

Retail sales increased 0.2% to $66.0 billion in May. Sales increased in five of nine subsectors and were led by increases at motor vehicle and parts dealers (+0.8%) and food and beverage retailers (+1.0%). Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were unchanged in May. In volume terms, retail sales increased 0.1%. Chart 1: Retail sales increase in May Sales at motor vehicle and parts dealers rise Core retail sales unchanged from April Offsetting these gains were lower sales at general merchandise retailers (-0.7%), building materials and garden equipment and supplies dealers (-1.5%) and clothing, clothing accessories, shoes, jewellery, luggage and leather goods retailers (-0.8%). Chart 2: Sales increase in five of nine subsectors in May Sales up in six provinces In British Columbia (+2.7%), retail sales were up for the third consecutive month. In the Vancouver census metropolitan area (CMA), retail sales increased 2.1%. The gain in Alberta (+2.0%) was primarily attributable to higher sales at motor vehicle and parts dealers. In Ontario (-0.6%) and Quebec (-0.9%), retail sales were down for the second time in three months. In the Toronto CMA, retail sales were up 0.9%, while in the Montréal CMA, retail sales were down 0.4%. Retail e-commerce sales in Canada Advance retail indicator Note to readers All data in this release are seasonally adjusted and expressed in current dollars, unless otherwise noted. Seasonally adjusted data are data that have been modified to eliminate the effect of seasonal and calendar influences to allow for more meaningful comparisons of economic conditions from period to period. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions. The percentage change for the advance estimate of retail sales is calculated using seasonally adjusted data and is expressed in current dollars. This early indicator is a special unofficial estimate being provided in the context of the COVID-19 pandemic to offer Canadians timely information on the retail sector. The data sources and methodology used are the same as those outlined on the Monthly Retail Trade Survey information page. Trend-cycle estimates are included in selected charts as a complement to the seasonally adjusted series. These data represent a smoothed version of the seasonally adjusted time series and provide information on longer-term movements, including changes in direction underlying the series. For information on trend-cycle data, see Trend-cycle estimates – Frequently asked questions. Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be extensive and could even lead to a reversal of movement, especially for the reference months near the end of the series or during periods of economic disruption. Seasonally adjusted estimates for cannabis store retailers are presented in unadjusted form, as no seasonal pattern has been established by official statistics yet. Establishing such a pattern requires several months of observed data. In the interim, the seasonally adjusted estimates for cannabis store retailers will be identical to the unadjusted figures. Some common e-commerce transactions, such as travel and accommodation bookings, ticket purchases and financial transactions, are not included in Canadian retail sales figures. Total retail sales expressed in volume terms are calculated by deflating current-dollar values using consumer price indexes. Find more statistics on retail trade. Next release Contact information Industry Intelligence Editor's Note: This press release omits select charts and/or marketing language for editorial clarity. Click here to view the full report.

Sales at motor vehicle and parts dealers (+0.8%) were up in May on the strength of higher sales at new car dealers (+0.7%) and other motor vehicle dealers (+5.5%). Gains at automotive parts, accessories and tire stores (+0.9%) were more than offset by lower sales at used car dealers (-1.2%).

Core retail sales were unchanged in May. Higher receipts were reported at food and beverage retailers (+1.0%) and, to a lesser extent, sporting goods, hobby, musical instrument, book and miscellaneous retailers (+0.8%).

Retail sales increased in six provinces in May, led by higher sales in British Columbia (+2.7%) and, to a lesser extent, Alberta (+2.0%).

On a seasonally adjusted basis, retail e-commerce sales were up 2.1% to $3.7 billion in May, accounting for 5.6% of total retail trade compared with 5.5% in April.

Statistics Canada is providing an advance estimate of retail sales, which suggests that sales were unchanged in June. Owing to its early nature, this figure will be revised. This unofficial estimate was calculated based on responses received from 47.7% of companies surveyed. The average final response rate for the survey over the previous 12 months was 89.1%.

Volume estimates and indices in table 20-10-0067 have been revised back to 2017, reflecting a change in the base year from 2012 to 2017 in addition to regular annual revisions of the indices back to January 2022 from updated respondent data.

Data on retail trade for June will be released on August 23.

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.