OTTAWA

,

February 22, 2022

(press release)

–

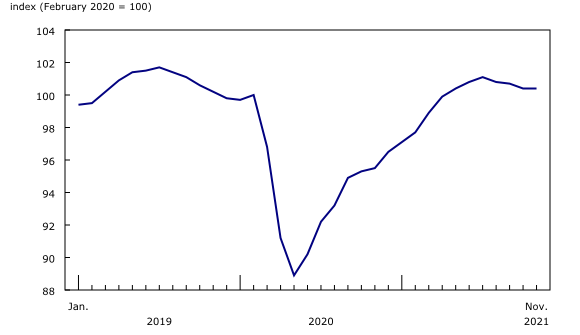

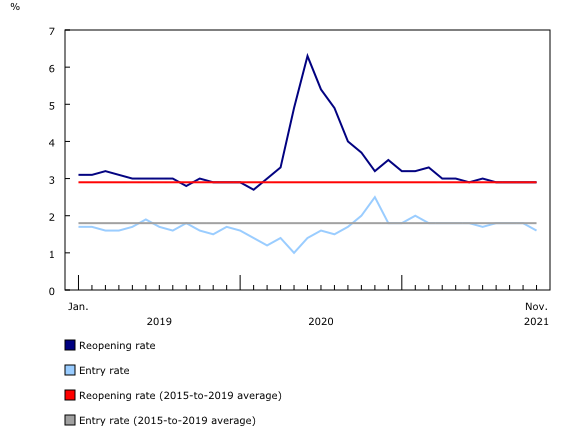

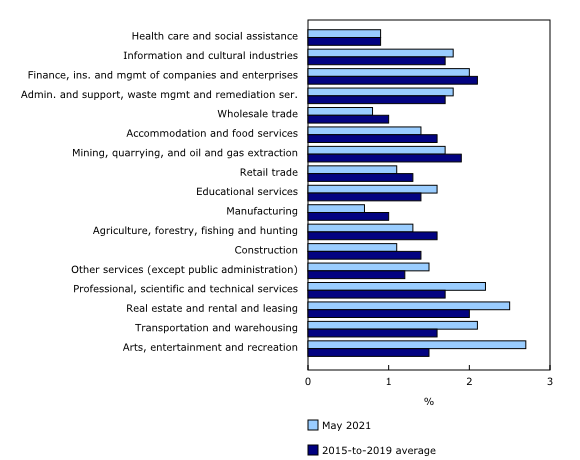

The business opening rate (business openings as a percentage of active businesses) decreased slightly from October to November 2021 (4.6% to 4.5%). However, the rate of business closures also decreased from October to November (4.4% to 4.3%). Overall, the number of active businesses was relatively unchanged, and November marked the seventh consecutive month in which the number of active businesses was above February 2020 levels. From October to November 2021, the reopening rate held steady at 2.9%, equal to its historical average from 2015 to 2019. Whereas the entry rate (new businesses as a percentage of active businesses) fell from 1.8% to 1.6%, lower than its historical average of 1.8%. The decrease in the entry rate was driven by Ontario, where the entry rate fell from 1.8% to 1.5%. Some sectors habitually have lower entry rates than others, and the entry rate for a sector should be compared with its historical entry rate rather than the entry rates for other sectors. For example, in November 2021 the entry rate in the wholesale trade sector was 0.6%, but this was close to the 2015-to-2019 historical average of 0.9%. In November 2021, the sectors with entry rates furthest from their historical averages were educational services (0.7% vs. 1.6%), accommodation and food services (1.0% vs. 1.7%), and arts, entertainment and recreation (1.0% vs. 1.6%). Exit rate of businesses falls below its average in May 2021 While the exit rate recovered at the national level, several sectors continued to have exit rates above their historical average. The largest difference was in the arts, entertainment, and recreation sector, which had an exit rate of 2.7% in May 2021 compared with its historical average of 1.5%. Other sectors with a large difference between the May 2021 rate and the historical rate were transportation and warehousing (2.1% vs. 1.6%), real estate and rental and leasing (2.5% vs. 2.0%), and professional, scientific and technical services (2.2% vs. 1.7%). Chart 1: Change in the number of active businesses, business sector, January 2019 to November 2021, seasonally adjusted series Chart 2: Monthly reopenings and entrants as a percentage of active businesses, business sector, Canada, January 2019 to November 2021, seasonally adjusted series Chart 3: Monthly entrants as a percentage of active businesses, by industry, Canada, November 2021, seasonally adjusted series Chart 4: Monthly temporary closures and exits as a percentage of active businesses, business sector, Canada, January 2019 to May 2021, seasonally adjusted series Chart 5: Monthly exits as a percentage of active businesses, by industry, Canada, May 2021, seasonally adjusted series Note to readers Openings are defined as businesses with employment in the current month and no employment in the previous month, while closures are defined as businesses that had employment in the previous month, but no employment in the current month. Continuing businesses are those that have employees in both months, and the active population in any given month is the number of opening and continuing businesses in that month. Reopening businesses are defined as opening businesses that were also active in a previous month (that is, they closed in a given month and had positive employment in a subsequent month). In contrast, entrants are opening businesses that were not active in a previous month. The definition of exits is based on the Longitudinal Employment Analysis Program (LEAP) annual exits. Because the LEAP definition can require up to 24 months of data to be counted as an exit, projections of exits using predicted growth rates are implemented using a regression model of exits on closures of more than six months. As a result, there are no published exits in the last six months. A temporary business closure is the difference between closures and exits. For more information on temporary business closures and exits, see "Defining and measuring business exits using monthly data series on business openings and closures." A business is defined as an enterprise operating in a particular geography and industry. The vast majority of businesses operate in one industry and one location or geography. For these businesses, in the monthly estimates of openings and closures, they will be counted once at the national/provincial level. For example, a retailer in Windsor, Ontario, will be counted as an active business in the Ontario estimates and once in the national estimates. Some businesses can have multiple operations, and these can be in different industries and geographies. For such businesses, in the monthly estimates of openings and closures, they can be counted more than once because they are active in multiple industries or geographies. For example, if a retailer has operations in both Alberta and Ontario, it will be counted as an active business in both provinces, but only once at the national level because it represents only one active firm. Similarly, a firm with retail and wholesale operations will be counted in both industries when individual industries are examined. However, when the business sector is examined, the firm counts only once because at that level it represents one firm active in the business sector. Contact information

The series on temporary business closures and exits (or "permanent closures") is now updated to May 2021. From April to May, the temporary closure rate rose from 2.6% to 2.8%, close to its 2015-to-2019 average of 2.9%. The exit rate fell from 2.0% to 1.5%, lower than its historical average of 1.7%. The exit rate has not been below its historical average since September 2020.

Every new month of data leads to a revision of the previously released data due to such factors as the seasonal adjustment process and a new version of the Generic Survey Universe File (or vintage of the Business Register). As such, the estimates may vary compared with a previous release.

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.