OTTAWA

,

August 15, 2022

(press release)

–

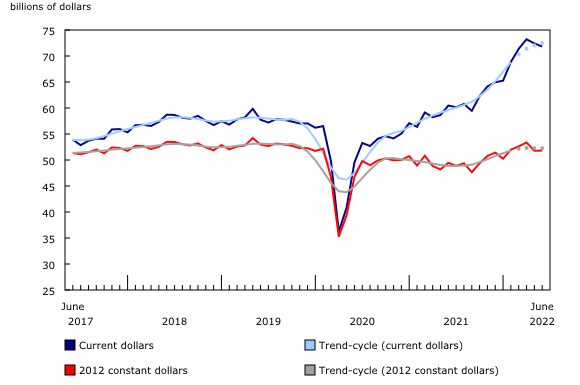

Following a 1.1% decline in May, manufacturing sales fell 0.8% to $71.8 billion in June, on lower sales in 8 of 21 industries, led by the petroleum and coal product (-7.8%), wood product (-7.2%) and aerospace product and parts (-16.8%) industries. Meanwhile, sales of motor vehicles (+13.8%) and chemical products (+6.0%) increased the most. Chart 1: Manufacturing sales On a quarterly basis, sales rose 5.8% in the second quarter, the eighth consecutive quarterly gain and the third largest gain in dollars on record. The petroleum and coal industry (+21.9%) contributed the most to the increase, while the wood product industry (-6.3%) posted the largest quarterly decline. Sales in constant dollars edged up 0.1% in June, while the Industrial Product Price Index declined 1.1% in that month. On a quarterly basis, constant dollars sales increased 1.3% in the second quarter. Petroleum and coal sales decline the most Wood product sales fell 7.2% to $3.9 billion in June, the third consecutive monthly decline, mainly on lower sales of sawmills and wood preservation products (-19.1%). Consequently, sales of wood on a quarterly basis fell 6.3%. Prices of softwood lumber declined 28.0% in June, the largest monthly decline since July 2021 (-32.9%), while exports of forestry products and building and packaging materials fell 6.6%. Lower construction activities in the United States resulted in declines in demand for Canadian wood products, while the total value of building permits in Canada decreased 1.5% in June. Other industries that contributed to the monthly decline were the aerospace product and parts (-16.8%), food (-1.8%), and beverage and tobacco product (-6.0%) industries. Motor vehicles post the largest increase Sales in New Brunswick decline the most In New Brunswick, following seven consecutive monthly increases, manufacturing sales fell 9.6% to $2.2 billion in June, primarily on lower sales of non-durables (-10.9%). On a quarterly basis, total sales in New Brunswick were up 9.2% in the second quarter. In Quebec, sales declined 1.0% to $18.0 billion in June, mainly driven by lower production in the aerospace product and parts industry (-21.4%) and lower sales in the petroleum and coal and beverage and tobacco product industries. Year over year, total sales for Quebec rose 14.3% in June. In Manitoba, sales marked the highest level on record, rising 9.0% to $2.2 billion in June, mainly on higher sales in the chemical (+75.6%) and transportation equipment (+20.8%) product industries. Higher sales of pharmaceutical and medicine products (+47.2%) accounted for most of the observed gains in the chemical industry in June. In Ontario, sales increased 0.5% to $30.8 billion in June, primarily attributable to higher sales of the motor vehicle industry (+13.1%) and non-metallic minerals (+10.7%). On a quarterly basis, total sales for Ontario were up 5.9% in the second quarter. Windsor sales decline the most, while Toronto sales post the largest increase Manufacturing sales in Windsor decreased 22.9% to $1.2 billion in June, mainly on lower sales of motor vehicle and motor vehicle parts. The Windsor motor vehicle industry has faced repeated shutdowns due to a global shortage of microchips since 2021. The declines were partially offset by higher sales in the machinery and fabricated metal industries. In Saskatoon, sales fell 8.5% to $477.0 million in June, following a 2.6% decline in May, mainly driven by lower food sales. The declines in June were partially offset by an increase in sales of computer and electronic products. Year over year, total sales in Saskatoon rose 12.6%. Sales in Toronto rose 2.8% to $11.8 billion in June, mainly on higher sales of the motor vehicle industry (+27.1%) and to a lesser extent, chemicals (+2.8%). Compared with the same month a year earlier, total sales in Toronto were 20.6% higher. Record-high inventory levels continue Chart 2: Inventory levels rise The inventory-to-sales ratio increased from 1.57 in May to 1.62 in June. This ratio measures the time, in months, that would be required to exhaust inventories if sales were to remain at their current level. Chart 3: The inventory-to-sales ratio increases Unfilled orders rise Chart 4: Unfilled orders rise The total value of new orders increased 2.7% to $73.6 billion in June, largely due to higher new orders of aerospace product and parts, motor vehicles, and chemical products. Capacity utilization rate increases Chart 5: The capacity utilization rate increases The capacity utilization rates rose in 10 of 21 industries in June and was noticeable in the transportation equipment (+7.2 percentage points), computer and electronic (+4.1 percentage points), and fabricated metal (+2.9 percentage points) product industries. The gains were partially offset by a lower capacity utilization rate in the petroleum and coal (-3.0 percentage points) and wood (-1.3 percentage points) product industries. Note to readers Seasonally adjusted data are data that have been modified to eliminate the effect of seasonal and calendar influences to allow for more meaningful comparisons of economic conditions from period to period. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions. Trend-cycle estimates are included in selected charts as a complement to the seasonally adjusted series. These data represent a smoothed version of the seasonally adjusted time series and provide information on longer-term movements, including changes in direction underlying the series. For information on trend-cycle data, see Trend-cycle estimates – Frequently asked questions. Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be large and could even lead to a reversal of movement, especially for reference months near the end of the series or during periods of economic disruption. Non-durable goods industries include food; beverage and tobacco products; textile mills; textile product mills; clothing; leather and allied products; paper; printing and related support activities; petroleum and coal products; chemicals; and plastics and rubber products. Durable goods industries include wood products; non-metallic mineral products; primary metals; fabricated metal products; machinery, computer and electronic products; electrical equipment; appliances and components; transportation equipment; furniture and related products; and miscellaneous manufacturing. Production-based industries For the aerospace and shipbuilding industries, the value of production is used instead of the value of sales of goods manufactured. The value of production is calculated by adjusting monthly sales of goods manufactured by the monthly change in inventories of goods in process and finished products manufactured. The value of production is used because of the extended period of time that it normally takes to manufacture products in these industries. Unfilled orders are a stock of orders that will contribute to future sales, assuming that the orders are not cancelled. New orders are those received, whether sold in the current month or not. New orders are measured as the sum of sales for the current month plus the change in unfilled orders from the previous month to the current month. Manufacturers reporting sales, inventories and unfilled orders in US dollars Some Canadian manufacturers report sales, inventories and unfilled orders in US dollars. These data are then converted to Canadian dollars as part of the data production cycle. For sales, based on the assumption that they occur throughout the month, the average monthly exchange rate for the reference month established by the Bank of Canada is used for the conversion. The monthly average exchange rate is available in table 33-10-0163-01. Inventories and unfilled orders are reported at the end of the reference period. For most respondents, the daily average exchange rate on the last working day of the month is used for the conversion of these variables. However, some manufacturers choose to report their data as of a day other than the last working day of the month. In these instances, the daily average exchange rate on the day selected by the respondent is used. Note that because of exchange rate fluctuations, the daily average exchange rate on the day selected by the respondent can differ from both the exchange rate on the last working day of the month and the monthly average exchange rate. Daily average exchange rate data are available in table 33-10-0036-01. Revision policy Each month, the Monthly Survey of Manufacturing releases preliminary data for the reference month and revised data for the previous three months. Revisions are made to reflect new information provided by respondents and updates to administrative data. Once a year, a revision project is undertaken to revise multiple years of data. Real-time data tables Real-time data tables 16-10-0118-01, 16-10-0119-01, 16-10-0014-01 and 16-10-0015-01 will be updated on August 22, 2022. Next release Data from the Monthly Survey of Manufacturing for July will be released on September 14, 2022. Contact information Industry Intelligence Editor's Note: This press release omits select charts and/or marketing language for editorial clarity. Click here to view the full report.

Sales in the petroleum and coal industry decreased 7.8% to $10.7 billion in June, following five consecutive monthly gains. Despite the monthly decline, quarter over quarter, sales of petroleum and coal products rose 21.9% in the second quarter. Concerns over the global economic slowdown led to lower demands for energy products and contributed to the lower sales in the petroleum and coal product industry in June. Petroleum sales on a constant dollar basis fell 11.3% in June. Prices of refined petroleum energy products (including liquid fuels) increased 1.9% in June, while exports of refined petroleum energy products were down 3.0%.

Following a 32.6% decline in May, sales of motor vehicles increased 13.8% to $3.7 billion in June on higher production in most of the motor vehicle assembly plants in Ontario despite the ongoing semiconductor chip shortages. On a quarterly basis, motor vehicle sales rose 10.0% in the second quarter, while year over year, sales were up 27.4%. Despite the higher month-over-month sales in June, exports of motor vehicles and parts declined 2.3%.

Manufacturing sales declined in 8 provinces in June, led by New Brunswick, Quebec, and Alberta. Meanwhile, Manitoba and Ontario posted increases.

Manufacturing sales fell in 8 of the 15 selected census metropolitan areas in June, led by Windsor and Saskatoon. Sales in Toronto increased the most in June.

Total inventory levels increased 2.1% to $116.4 billion in June, mainly on higher inventories in the machinery (+4.3%), transportation equipment (+2.5%) and chemical (+3.5%) product industries. Meanwhile, the miscellaneous industry (-3.5%) posted the largest decline in inventory levels in June. Raw materials, representing the largest component of inventories, have been trending upward for 20 consecutive months due to higher prices. Year over year, total inventories rose 27.7%.

The total value of unfilled orders rose 1.7% to $105.0 billion in June. The increases were mainly attributable to higher unfilled orders in the motor vehicle (+87.5%), aerospace product and parts (+1.4%), and computer and electronic (+3.7%) product industries. Total unfilled orders were up 19.1% on a year-over-year basis in June.

The capacity utilization rate (not seasonally adjusted) for the total manufacturing sector increased from 78.8% in May to 79.3% in June due to higher production.

Monthly data in this release are seasonally adjusted and are expressed in current dollars, unless otherwise specified.

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.