CHICAGO

,

January 26, 2022

(press release)

–

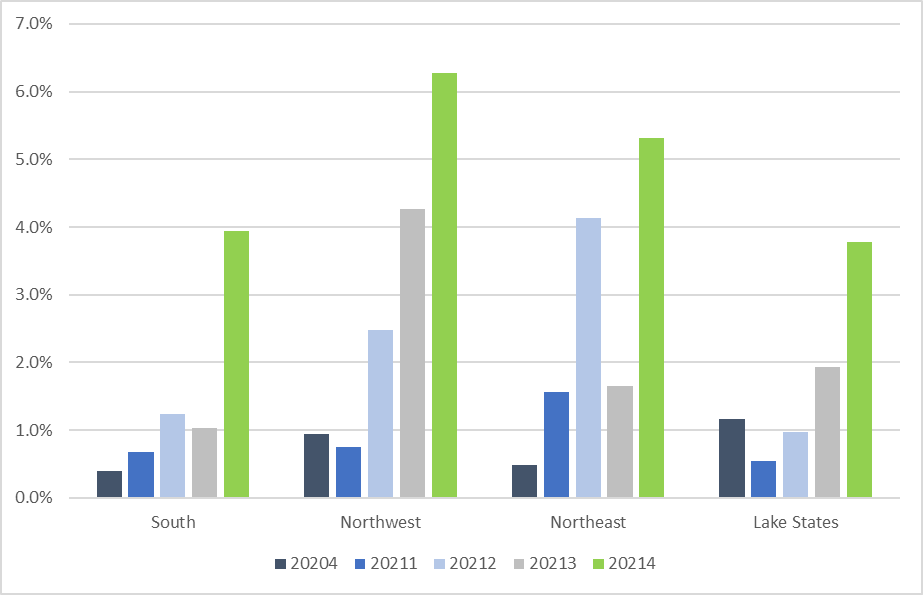

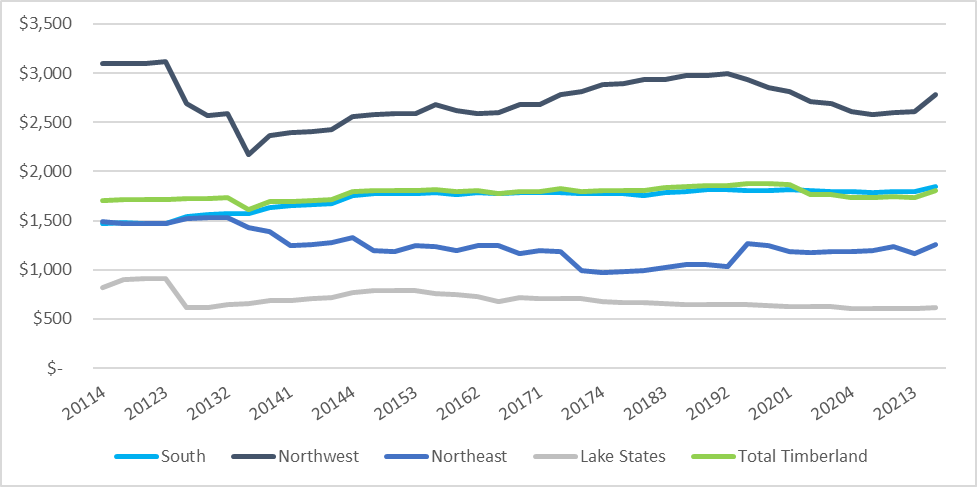

The National Council of Real Estate Investment Fiduciaries (NCREIF) has released fourth quarter 2021 results of the NCREIF Timberland Index. The index returned 4.56% for the quarter, up from 1.89% last quarter and 0.58% in the fourth quarter of 2020. The EBITDDA return, at 0.82%, was down 10 basis points from the third quarter, while the appreciation return in the fourth quarter increased 276 basis points quarter-over-quarter, up to 2.76%. The 4.56% fourth quarter return represents the strongest single quarter return for the total index since the fourth quarter of 2014. The Total Timberland Index had a 9.17% rolling one-year return, comprised of a 3.45% EBITDDA and 5.58% appreciation return. Timberland Quarterly Total Return Trends by Region Returns for the quarter were once again positive across each region. The Northwest region had the highest return of the fourth quarter at 6.28%, comprised of .87% EBITDDA and 5.41% appreciation returns. The South region returned 3.95% for the quarter, driven by solid appreciation return of 3.17%. The Northeast and Lake States regions returned, respectively, 5.31% and 3.79% for the quarter, buoyed by both strong appreciation returns of 4.75% and 2.37% as well as positive EBITDA returns of .56% and 1.42%. Fourth quarter results reflect the continued recovery of log markets across the U.S., as prices in some areas reached marks not seen since before the 2007-2009 recession. Timberland Market Value per Acre in USD by Region Timberland market value per acre was $1,811 for the fourth quarter, up 4.56% from its previous quarter mark. All regions experienced per acre market value increases. The South, Northwest, Northeast and Lake States regions ended the quarter with market values per acre of $1,849, $2,784, $1.257 and $617, respectively, representing strong increases of 2.88%, 6.72%, 8.29% and 1.71% from third quarter values. This was due largely price increases across the regions due to increased demand. The NCREIF Timberland Index consists of 454 investment-grade timber properties with a market value of $24 billion. This includes 309 properties in the South, 88 in the Northwest, 38 in the Northeast, and 17 in the Lake States. This data enhances the ability of institutional investors to evaluate the risk and performance of timberland investments across the United States.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.