CHICAGO

,

July 13, 2023

(press release)

–

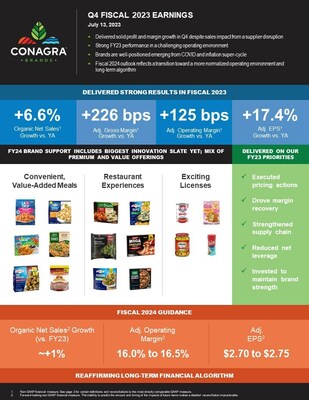

CHICAGO, July 13, 2023 /PRNewswire/ -- Today Conagra Brands, Inc. (NYSE: CAG) reported results for the fourth quarter and full year fiscal year 2023, which ended on May 28, 2023. All comparisons are against the prior-year fiscal period, unless otherwise noted. Highlights CEO Perspective Sean Connolly, president and chief executive officer of Conagra Brands, commented, "Our business delivered strong results in fiscal 2023, as we successfully delivered on our priorities to execute inflation-justified pricing, drive gross margin recovery, and reduce net leverage while investing to maintain the strength of our brands. These efforts, and the continued implementation of our playbook, have our brands well-positioned following the volatility of the past few years. Looking ahead, we anticipate transitioning toward a more normalized operating environment in fiscal 2024 - with easing inflationary pressures and improved supply chain operations - and remain committed to our long-term financial algorithm." Total Company Fourth Quarter Results In the quarter, reported and organic net sales increased 2.2% to $3.0 billion. The 2.2% increase was driven by a 9.9% improvement in price/mix, which was partially offset by a 7.7% decrease in volume. Price/mix was driven by the company's inflation-driven pricing actions and favorable brand mix. The volume decrease was primarily driven by the elasticity impact from inflation-driven pricing actions and shortages from supply chain disruptions. Gross profit increased 9.8% to $783 million in the quarter, and adjusted gross profit increased 11.0% to $803 million. Fourth quarter gross profit benefited from higher organic net sales and productivity, which more than offset the negative impacts of cost of goods sold inflation (including unfavorable commodity positions) and unfavorable operating leverage. Gross margin increased 183 basis points to 26.3% in the quarter, and adjusted gross margin increased 216 basis points to 27.0%. Selling, general, and administrative expense (SG&A), which includes advertising and promotional expense (A&P), increased 45.5% to $726 million in the quarter primarily due to $345 million of brand impairment charges. Adjusted SG&A, which excludes A&P, increased 24.3% to $301 million driven by incremental supply chain and technology investments along with increased incentive compensation compared to the prior year quarter. A&P for the quarter increased 49.7% to $69 million, driven primarily by increases in modern marketing and customer investments along with wrapping strategic reductions in the prior year period. Net interest expense was $108 million in the quarter. Compared to the prior-year period, net interest expense increased 12.2% or $12 million, primarily due to a higher weighted average interest rate on outstanding debt. The average diluted share count in the quarter was 480 million shares. In the quarter, net income attributable to Conagra Brands decreased 76.4% to $37 million, or $0.08 per diluted share. Adjusted net income attributable to Conagra Brands decreased 5.1% to $299 million, or $0.62 per diluted share. The decrease was driven primarily by the increase in SG&A. Adjusted EBITDA, which includes equity method investment earnings and pension and postretirement non-service income, increased 0.6% to $594 million in the quarter, primarily driven by the increase in adjusted gross profit, offset by higher SG&A and lower pension income. Total Company Fiscal 2023 Results For the full fiscal year, net sales increased 6.4% to $12.3 billion. The growth in net sales primarily reflects: For the full fiscal year, gross profit increased 15.0% to $3.3 billion and adjusted gross profit increased 16.1% to $3.3 billion as the benefits from higher organic net sales and productivity more than offset the negative impacts from cost of goods sold inflation (including unfavorable commodity positions), unfavorable operating leverage, and elevated supply chain operating costs. Gross margin increased 198 basis points to 26.6% and adjusted gross margin increased 226 basis points to 27.1%. For the full fiscal year, EPS decreased 22.8% to $1.42 and adjusted EPS increased 17.4% to $2.77, driven by an increase in adjusted operating profit. For the full fiscal year, the Company generated $995 million in net cash flows from operating activities and $633 million of free cash flow. Grocery & Snacks Segment Fourth Quarter Results Reported and organic net sales for the Grocery & Snacks segment increased 3.6% to $1.2 billion in the quarter. In the quarter, price/mix increased 9.1% and volume decreased 5.5%. Price/mix was driven by favorability in inflation-driven pricing. The volume decrease was primarily driven by the elasticity impact from inflation-driven pricing actions and shortages from supply chain disruptions. In the quarter, the company gained share in snacking categories including meat snacks and seeds, and some staples categories including canned pasta and Asian sauces and marinades. Operating profit for the segment decreased 4.5% to $156 million in the quarter. Adjusted operating profit decreased 8.1% to $235 million as the negative impacts of cost of goods sold inflation (including unfavorable commodity positions), unfavorable operating leverage, and increased A&P and SG&A more than offset the impacts from higher organic net sales and productivity. Refrigerated & Frozen Segment Fourth Quarter Results Reported and organic net sales for the Refrigerated & Frozen segment decreased 1.1% to $1.2 billion in the quarter. In the quarter, price mix increased 10.4% and volume decreased 11.5%. Price/mix was driven by favorability in inflation-driven pricing. The volume decrease was primarily driven by the elasticity impact from inflation-driven pricing actions and shortages from supply chain disruptions due to a third-party supplier shutdown. In the quarter, the company gained share in categories such as frozen sides, multi serve meals, and frozen breakfast sausage. Operating profit for the segment decreased to a $43 million loss in the quarter as a result of the brand impairment charges outlined above. Adjusted operating profit increased 17.7% to $218 million as higher organic net sales and productivity more than offset the negative impacts of cost of goods sold inflation (including unfavorable commodity positions), unfavorable operating leverage, and increased A&P and SG&A. International Segment Fourth Quarter Results Net sales for the International segment increased 8.6% to $251 million in the quarter reflecting: On an organic net sales basis, price/mix increased 13.8% and volume decreased 4.3%. Price/mix was driven by inflation-driven pricing. The volume decrease was primarily a result of the elasticity impact from inflation-driven pricing actions. Operating profit for the segment increased 265.0% to $21 million in the quarter. Adjusted operating profit increased 70.7% to $34 million as the benefits from higher organic net sales and productivity were partially offset by the negative impact of cost of goods sold inflation (including unfavorable commodity positions) and increased A&P and SG&A. Foodservice Segment Fourth Quarter Results Reported and organic net sales for the Foodservice segment increased 5.5% to $303 million in the quarter. In the quarter, price/mix increased 9.3% and volume decreased 3.8%. Price/mix was driven by inflation-driven pricing. The volume decline was primarily a result of the elasticity impact from inflation-driven pricing actions. Operating profit for the segment increased 46.7% to $32 million and adjusted operating profit decreased 2.3% to $28 million in the quarter as the benefits of higher organic net sales and productivity were more than offset by the negative impacts of cost of goods sold inflation (including unfavorable commodity positions) and unfavorable operating leverage. Other Fourth Quarter Items Corporate expenses increased 103.5% to $108 million in the quarter and adjusted corporate expense increased 50.7% to $82 million in the quarter driven by incremental supply chain and technology investments along with increased incentive compensation compared to the prior year quarter. Pension and post-retirement non-service income was $6 million in the quarter compared to $19 million of income in the prior-year period. In the quarter, equity method investment earnings increased 32.8% to $63 million, driven by continued favorable market conditions for the Ardent Mills joint venture, and the venture's effective management through recent volatility in the wheat markets. In the quarter, the effective tax rate was (102.0)% compared to 14.4% in the prior-year period due primarily to a valuation allowance adjustment. The adjusted effective tax rate was 24.3% compared to 22.3% in the prior-year period. In the quarter, the company paid a dividend of $0.33 per share. Dividend Update Subsequent to quarter-end, the Company's Board of Directors approved an increase of the annual dividend from $1.32 per share to $1.40 per share. The Company's new quarterly dividend payment of $0.35 per share of Conagra common stock will be paid on August 31, 2023 to stockholders of record as of the close of business on July 31, 2023. Outlook The company is providing the following guidance for fiscal 2024: The company also expects cost of goods sold inflation to continue into fiscal 2024. Guidance anticipates net inflation (input cost inflation including the impacts of hedging and other sourcing benefits) to be roughly 3%. The inability to predict the amount and timing of the impacts of foreign exchange, acquisitions, divestitures, and other items impacting comparability makes a detailed reconciliation of forward-looking non-GAAP financial measures impracticable. Please see the end of this release for more information. Items Affecting Comparability of EPS The following are included in the $0.08 EPS for the fourth quarter of fiscal 2023 (EPS amounts are rounded and after tax). Please see the reconciliation schedules at the end of this release for additional details. The following are included in the $0.33 EPS for the fourth quarter of fiscal 2022 (EPS amounts are rounded and after tax). Please see the reconciliation schedules at the end of this release for additional details. Please note that certain prior year amounts have been reclassified to conform with current year presentation. Discussion of Results Conagra Brands will host a webcast and conference call at 9:30 a.m. Eastern time today to discuss the results. The live audio webcast and presentation slides will be available on www.conagrabrands.com/investor-relations under Events & Presentations. The conference call may be accessed by dialing 1-877-883-0383 for participants in the U.S. and 1-412-902-6506 for all other participants and using passcode 0327346. Please dial in 10 to 15 minutes prior to the call start time. Following the company's remarks, the conference call will include a question-and-answer session with the investment community. A replay of the webcast will be available on www.conagrabrands.com/investor-relations under Events & Presentations until July 13, 2024. About Conagra Brands Conagra Brands, Inc. (NYSE: CAG), headquartered in Chicago, is one of North America's leading branded food companies. Guided by an entrepreneurial spirit, Conagra Brands combines a rich heritage of making great food with a sharpened focus on innovation. The company's portfolio is evolving to satisfy people's changing food preferences. Conagra's iconic brands, such as Birds Eye®, Duncan Hines®, Healthy Choice®, Marie Callender's®, Reddi-wip®, and Slim Jim®, as well as emerging brands, including Angie's® BOOMCHICKAPOP®, Duke's®, Earth Balance®, Gardein®, and Frontera®, offer choices for every occasion. For more information, visit www.conagrabrands.com. Note on Forward-Looking Statements This document contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. Readers of this document should understand that these statements are not guarantees of performance or results. Many factors could affect our actual financial results and cause them to vary materially from the expectations contained in the forward-looking statements, including those set forth in this document. These risks, uncertainties, and factors include, among other things: risks associated with general economic and industry conditions, including inflation, rising interest rates, decreased availability of capital, volatility in financial markets, declining consumer spending rates, recessions, decreased energy availability, increased energy costs (including fuel surcharges), supply chain challenges, labor shortages, and geopolitical conflicts (including the ongoing conflict between Russia and Ukraine); negative impacts caused by public health crises; risks related to our ability to deleverage on currently anticipated timelines, and to continue to access capital on acceptable terms or at all; risks related to the Company's competitive environment, cost structure, and related market conditions; risks related to our ability to execute operating and value creation plans and achieve returns on our investments and targeted operating efficiencies from cost-saving initiatives, and to benefit from trade optimization programs; risks related to the availability and prices of commodities and other supply chain resources, including raw materials, packaging, energy, and transportation, including any negative effects caused by changes in levels of inflation and interest rates, weather conditions, health pandemics or outbreaks of disease, actual or threatened hostilities or war, or other geopolitical uncertainty; risks related to the effectiveness of our hedging activities and ability to respond to volatility in commodities; disruptions or inefficiencies in our supply chain and/or operations; risks related to the ultimate impact of, including reputational harm caused by, any product recalls and product liability or labeling litigation, including litigation related to lead-based paint and pigment and cooking spray; risks related to our ability to respond to changing consumer preferences and the success of our innovation and marketing investments; risks associated with actions by our customers, including changes in distribution and purchasing terms; risks related to the seasonality of our business; risks associated with our co-manufacturing arrangements and other third-party service provider dependencies; risks associated with actions of governments and regulatory bodies that affect our businesses, including the ultimate impact of new or revised regulations or interpretations including to address climate change or implement changes to taxes and tariffs; risks related to the Company's ability to execute on its strategies or achieve expectations related to environmental, social, and governance matters, including as a result of evolving legal, regulatory, and other standards, processes, and assumptions, the pace of scientific and technological developments, increased costs, the availability of requisite financing, and changes in carbon pricing or carbon taxes; risks related to a material failure in or breach of our or our vendors' information technology systems and other cybersecurity incidents; risks related to our ability to identify, attract, hire, train, retain and develop qualified personnel; risk of increased pension, labor or people-related expenses; risks and uncertainties associated with intangible assets, including any future goodwill or intangible assets impairment charges; risk relating to our ability to protect our intellectual property rights; risks relating to acquisition, divestiture, joint venture or investment activities; the amount and timing of future dividends, which remain subject to Board approval and depend on market and other conditions; and other risks described in our reports filed from time to time with the Securities and Exchange Commission. We caution readers not to place undue reliance on any forward-looking statements included in this document, which speak only as of the date of this document. We undertake no responsibility to update these statements, except as required by law. Note on Non-GAAP Financial Measures This document includes certain non-GAAP financial measures, including adjusted EPS, organic net sales, adjusted gross profit, adjusted operating profit, adjusted SG&A, adjusted corporate expenses, adjusted gross margin, adjusted operating margin, adjusted effective tax rate, adjusted net income attributable to Conagra Brands, free cash flow, net debt, net leverage ratio, and adjusted EBITDA. Management considers GAAP financial measures as well as such non-GAAP financial information in its evaluation of the company's financial statements and believes these non-GAAP financial measures provide useful supplemental information to assess the company's operating performance and financial position. These measures should be viewed in addition to, and not in lieu of, the company's diluted earnings per share, operating performance and financial measures as calculated in accordance with GAAP. Organic net sales excludes, from reported net sales, the impacts of foreign exchange, divested businesses and acquisitions, as well as the impact of any 53rd week. All references to changes in volume and price/mix throughout this release are on an organic net sales basis. References to adjusted items throughout this release refer to measures computed in accordance with GAAP less the impact of items impacting comparability. Items impacting comparability are income or expenses (and related tax impacts) that management believes have had, or are likely to have, a significant impact on the earnings of the applicable business segment or on the total corporation for the period in which the item is recognized, and are not indicative of the company's core operating results. These items thus affect the comparability of underlying results from period to period. References to earnings before interest, taxes, depreciation, and amortization (EBITDA) refer to net income attributable to Conagra Brands before the impacts of discontinued operations, income tax expense (benefit), interest expense, depreciation, and amortization. References to adjusted EBITDA refer to EBITDA before the impacts of items impacting comparability. Hedge gains and losses are generally aggregated, and net amounts are reclassified from unallocated corporate expense to the operating segments when the underlying commodity or foreign currency being hedged is expensed in segment cost of goods sold. The net change in the derivative gains (losses) included in unallocated corporate expense during the period is reflected as a comparability item, Corporate hedging derivate gains (losses). Note on Forward-Looking Non-GAAP Financial Measures Our fiscal 2024 guidance includes certain non-GAAP financial measures (organic net sales growth, adjusted operating margin, adjusted EPS, net leverage ratio, and adjusted effective tax rate) that are presented on a forward-looking basis. Historically, the company has calculated these non-GAAP financial measures excluding the impact of certain items such as, but not limited to, foreign exchange, acquisitions, divestitures, restructuring expenses, the extinguishment of debt, hedging gains and losses, impairment charges, legacy legal contingencies, and unusual tax items. Reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures are not provided because the company is unable to provide such reconciliations without unreasonable effort, due to the uncertainty and inherent difficulty of predicting the timing and financial impact of such items. For the same reasons, the company is unable to address the probable significance of the unavailable information, which could be material to future results. Conagra Brands, Inc. Consolidated Statements of Earnings (in millions) (unaudited) FOURTH QUARTER Thirteen Weeks Thirteen Weeks May 28, 2023 May 29, 2022 Percent Change Net sales $ 2,973.3 $ 2,910.0 2.2 % Costs and expenses: Cost of goods sold 2,189.9 2,196.6 (0.3) % Selling, general and administrative expenses 726.4 499.3 45.5 % Pension and postretirement non-service income (6.0) (19.0) (68.3) % Interest expense, net 108.0 96.2 12.2 % Income (loss) before income taxes and equity method investment earnings (45.0) 136.9 N/A Income tax expense (benefit) (18.3) 26.7 N/A Equity method investment earnings 63.0 47.5 32.8 % Net income $ 36.3 $ 157.7 (76.9) % Less: Net loss attributable to noncontrolling interests (1.2) (1.2) 3.8 % Net income attributable to Conagra Brands, Inc. $ 37.5 $ 158.9 (76.4) % Earnings per share - basic Net income attributable to Conagra Brands, Inc. $ 0.08 $ 0.33 (75.8) % Weighted average shares outstanding 477.7 480.4 (0.6) % Earnings per share - diluted Net income attributable to Conagra Brands, Inc. $ 0.08 $ 0.33 (75.8) % Weighted average share and share equivalents outstanding 479.7 482.5 (0.6) % Conagra Brands, Inc. Consolidated Statements of Earnings (in millions) (unaudited) FISCAL YEAR 2023 Fifty-Two Weeks Fifty-Two Weeks May 28, 2023 May 29, 2022 Percent Change Net sales $ 12,277.0 $ 11,535.9 6.4 % Costs and expenses: Cost of goods sold 9,012.2 8,697.1 3.6 % Selling, general and administrative expenses 2,189.5 1,492.8 46.7 % Pension and postretirement non-service income (24.2) (67.3) (63.9) % Interest expense, net 409.6 379.9 7.8 % Income before income taxes and equity method investment earnings 689.9 1,033.4 (33.2) % Income tax expense 218.7 290.5 (24.7) % Equity method investment earnings 212.0 145.3 45.9 % Net income $ 683.2 $ 888.2 (23.1) % Less: Net loss attributable to noncontrolling interests (0.4) — (100.0) % Net income attributable to Conagra Brands, Inc. $ 683.6 $ 888.2 (23.0) % Earnings per share - basic Net income attributable to Conagra Brands, Inc. $ 1.43 $ 1.85 (22.7) % Weighted average shares outstanding 478.9 480.3 (0.3) % Earnings per share - diluted Net income attributable to Conagra Brands, Inc. $ 1.42 $ 1.84 (22.8) % Weighted average share and share equivalents outstanding 480.7 482.2 (0.3) % Conagra Brands, Inc. Consolidated Balance Sheets (in millions) (unaudited) May 28, 2023 May 29, 2022 ASSETS Current assets Cash and cash equivalents $ 93.9 $ 83.3 Receivables, less allowance for doubtful accounts of $3.8 and $3.9 965.4 867.4 Inventories 2,232.0 1,966.7 Prepaid expenses and other current assets 93.7 116.3 Total current assets 3,385.0 3,033.7 Property, plant and equipment, net 2,773.8 2,737.2 Goodwill 11,178.2 11,329.2 Brands, trademarks and other intangibles, net 3,205.9 3,857.8 Other assets 1,509.7 1,477.2 $ 22,052.6 $ 22,435.1 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Notes payable $ 641.4 $ 184.3 Current installments of long-term debt 1,516.0 707.3 Accounts payable 1,529.4 1,864.6 Accrued payroll 164.1 151.7 Other accrued liabilities 589.8 610.9 Total current liabilities 4,440.7 3,518.8 Senior long-term debt, excluding current installments 7,081.3 8,088.2 Other noncurrent liabilities 1,723.3 1,965.9 Total stockholders' equity 8,807.3 8,862.2 $ 22,052.6 $ 22,435.1 Conagra Brands, Inc. and Subsidiaries Consolidated Statements of Cash Flows (in millions) (unaudited) Fifty-Two Fifty-Two May 28, 2023 May 29, 2022 Cash flows from operating activities: Net income $ 683.2 $ 888.2 Adjustments to reconcile net income to net cash flows from operating activities: Depreciation and amortization 369.9 375.4 Asset impairment charges 771.1 284.8 Equity method investment earnings in excess of distributions (73.6) (66.3) Stock-settled share-based payments expense 79.2 26.1 Contributions to pension plans (12.5) (11.5) Pension benefit (13.9) (54.4) Other items 8.0 (46.6) Change in operating assets and liabilities excluding effects of business acquisitions and dispositions: Receivables (102.1) (69.5) Inventories (265.3) (232.8) Deferred income taxes and income taxes payable, net (188.5) (8.7) Prepaid expenses and other current assets 23.5 (10.1) Accounts payable (248.9) 223.6 Accrued payroll 12.5 (23.5) Other accrued liabilities (21.7) (71.9) Deferred employer payroll taxes (25.5) (25.5) Net cash flows from operating activities 995.4 1,177.3 Cash flows from investing activities: Additions to property, plant and equipment (362.2) (464.4) Sale of property, plant and equipment 3.2 20.2 Purchase of marketable securities (5.2) (4.5) Sale of marketable securities 5.2 10.4 Proceeds from divestitures — 0.1 Other items 4.1 3.3 Net cash flows from investing activities (354.9) (434.9) Cash flows from financing activities: Issuances of short-term borrowings, maturities greater than 90 days 286.8 392.6 Repayment of short-term borrowings, maturities greater than 90 days (330.0) (392.6) Net issuance (repayment) of other short-term borrowings, maturities less than or equal to 90 days 394.6 (523.1) Issuance of long-term debt 500.0 499.1 Repayment of long-term debt (712.4) (48.5) Debt issuance costs (4.1) (2.5) Repurchase of Conagra Brands, Inc. common shares (150.0) (50.0) Payment of intangible asset financing arrangement — (12.6) Cash dividends paid (623.8) (581.8) Exercise of stock options and issuance of other stock awards, including tax withholdings 2.3 (11.3) Other items 5.0 (7.3) Net cash flows from financing activities (631.6) (738.0) Effect of exchange rate changes on cash and cash equivalents and restricted cash 1.7 (1.3) Net change in cash and cash equivalents and restricted cash 10.6 3.1 Cash and cash equivalents and restricted cash at beginning of period 83.3 80.2 Cash and cash equivalents and restricted cash at end of period $ 93.9 $ 83.3 Conagra Brands, Inc. Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (in millions) Q4 FY23 Grocery & Refrigerated & International Foodservice Total Net Sales $ 1,200.0 $ 1,219.4 $ 250.6 $ 303.3 $ 2,973.3 Impact of foreign exchange — — 2.2 — 2.2 Organic Net Sales $ 1,200.0 $ 1,219.4 $ 252.8 $ 303.3 $ 2,975.5 Year-over-year change - Net Sales 3.6 % (1.1) % 8.6 % 5.5 % 2.2 % Impact of foreign exchange (pp) — — 0.9 — — Organic Net Sales 3.6 % (1.1) % 9.5 % 5.5 % 2.2 % Volume (Organic) (5.5) % (11.5) % (4.3) % (3.8) % (7.7) % Price/Mix 9.1 % 10.4 % 13.8 % 9.3 % 9.9 % Q4 FY22 Grocery & Refrigerated & International Foodservice Total Net Sales $ 1,158.8 $ 1,233.0 $ 230.8 $ 287.4 $ 2,910.0 Net sales from divested businesses — — — — — Organic Net Sales $ 1,158.8 $ 1,233.0 $ 230.8 $ 287.4 $ 2,910.0 FY23 Grocery & Refrigerated & International Foodservice Total Net Sales $ 4,981.9 $ 5,156.2 $ 1,002.5 $ 1,136.4 $ 12,277.0 Impact of foreign exchange — — 20.9 — 20.9 Organic Net Sales $ 4,981.9 $ 5,156.2 $ 1,023.4 $ 1,136.4 $ 12,297.9 Year-over-year change - Net Sales 6.1 % 6.1 % 3.3 % 12.7 % 6.4 % Impact of foreign exchange (pp) — — 2.1 — 0.2 Organic Net Sales 6.1 % 6.1 % 5.4 % 12.7 % 6.6 % Volume (Organic) (8.5) % (7.3) % (7.5) % (3.2) % (7.5) % Price/Mix 14.6 % 13.4 % 12.9 % 15.9 % 14.1 % FY22 Grocery & Refrigerated & International Foodservice Total Net Sales $ 4,697.4 $ 4,859.3 $ 970.8 $ 1,008.4 $ 11,535.9 Net sales from divested businesses — — — — — Organic Net Sales $ 4,697.4 $ 4,859.3 $ 970.8 $ 1,008.4 $ 11,535.9 Conagra Brands, Inc. Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (in millions) Q4 FY23 Grocery & Refrigerated & International Foodservice Corporate Total Operating Profit (Loss) $ 155.6 $ (42.6) $ 20.5 $ 31.5 $ (108.0) $ 57.0 Restructuring plans 0.1 1.8 — — 2.0 3.9 Brand impairment charges 78.9 252.6 13.7 — — 345.2 Acquisitions and divestitures — — — — 7.6 7.6 Legal matters — — — — 3.8 3.8 Fire related costs — 2.2 — (3.3) — (1.1) Third-party vendor cybersecurity incident — 4.2 — 0.2 — 4.4 Corporate hedging derivative losses (gains) — — — — 12.5 12.5 Adjusted Operating Profit $ 234.6 $ 218.2 $ 34.2 $ 28.4 $ (82.1) $ 433.3 Operating Profit Margin 13.0 % (3.5) % 8.2 % 10.4 % 1.9 % Adjusted Operating Profit Margin 19.6 % 17.9 % 13.6 % 9.4 % 14.6 % Year-over-year % change - Operating Profit (4.5) % N/A 265.0 % 46.7 % 103.5 % (73.4) % Year-over year % change - Adjusted Operating Profit (8.1) % 17.7 % 70.7 % (2.3) % 50.7 % (0.5) % Year-over-year bps change - Operating Profit (110) bps (975) bps 575 bps 292 bps (544) bps Year-over-year bps change - Adjusted Operating Profit (248) bps 286 bps 497 bps (75) bps (39) bps Q4 FY22 Grocery & Refrigerated & International Foodservice Corporate Total Operating Profit $ 162.9 $ 77.2 $ 5.6 $ 21.5 $ (53.1) $ 214.1 Restructuring plans 0.7 1.5 — — 7.9 10.1 Brand impairment charges 90.7 103.9 14.4 — — 209.0 Acquisitions and divestitures — — — — 0.2 0.2 Legal matters — — — — (5.0) (5.0) Consulting fees on tax matters — — — — 1.1 1.1 Fire related costs 0.9 2.8 — 7.6 — 11.3 Environmental matters — — — — (6.5) (6.5) Corporate hedging derivative losses (gains) — — — — 0.9 0.9 Adjusted Operating Profit $ 255.2 $ 185.4 $ 20.0 $ 29.1 $ (54.5) $ 435.2 Operating Profit Margin 14.1 % 6.3 % 2.4 % 7.5 % 7.4 % Adjusted Operating Profit Margin 22.0 % 15.0 % 8.7 % 10.1 % 15.0 % Conagra Brands, Inc. Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (in millions) FY23 Grocery & Refrigerated & International Foodservice Corporate Total Operating Profit $ 1,002.8 $ 255.0 $ 121.4 $ 85.0 $ (388.9) $ 1,075.3 Restructuring plans 0.6 5.1 (0.1) — 7.5 13.1 Impairment of businesses held for sale 0.5 5.7 — 20.5 — 26.7 Acquisitions and divestitures — — — — 8.4 8.4 Goodwill and brand impairment charges 78.9 638.3 13.7 — — 730.9 Legal matters — — — — 3.8 3.8 Fire related costs — 15.3 — (1.9) — 13.4 Third-party vendor cybersecurity incident — 4.2 — 0.2 — 4.4 Municipal water break costs 3.5 — — — — 3.5 Corporate hedging derivative losses (gains) — — — — 37.1 37.1 Adjusted Operating Profit $ 1,086.3 $ 923.6 $ 135.0 $ 103.8 $ (332.1) $ 1,916.6 Operating Profit Margin 20.1 % 4.9 % 12.1 % 7.5 % 8.8 % Adjusted Operating Profit Margin 21.8 % 17.9 % 13.5 % 9.1 % 15.6 % Year-over-year % change - Operating Profit 16.7 % (54.6) % 13.8 % 41.0 % 61.0 % (20.1) % Year-over year % change - Adjusted Operating Profit 10.1 % 29.6 % 11.3 % 24.9 % 34.4 % 15.7 % Year-over-year bps change - Operating Profit 183 bps (660) bps 112 bps 150 bps (291) bps Year-over-year bps change - Adjusted Operating Profit 80 bps 324 bps 97 bps 89 bps 125 bps FY22 Grocery & Refrigerated & International Foodservice Corporate Total Operating Profit $ 859.5 $ 561.1 $ 106.7 $ 60.3 $ (241.6) $ 1,346.0 Restructuring plans 9.4 14.5 0.2 0.3 24.6 49.0 Impairment of businesses held for sale 26.3 28.9 — 14.9 — 70.1 Brand impairment charges 90.7 103.9 14.4 — — 209.0 Acquisitions and divestitures — — — — 2.4 2.4 Proceeds received from the sale of a legacy investment — — — — (3.3) (3.3) Legal matters — — — — (19.6) (19.6) Consulting fees on tax matters — 1.7 — — 1.1 2.8 Fire related costs 0.9 2.8 — 7.6 — 11.3 Environmental matters — — — — (6.5) (6.5) Corporate hedging derivative losses (gains) — — — — (4.4) (4.4) Adjusted Operating Profit $ 986.8 $ 712.9 $ 121.3 $ 83.1 $ (247.3) $ 1,656.8 Operating Profit Margin 18.3 % 11.5 % 11.0 % 6.0 % 11.7 % Adjusted Operating Profit Margin 21.0 % 14.7 % 12.5 % 8.2 % 14.4 % Conagra Brands, Inc. Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (in millions) Q4 FY23 Gross profit Selling, general Operating profit1 Income (loss) Income tax Income tax rate Net income Diluted EPS from Reported $ 783.4 $ 726.4 $ 57.0 $ (45.0) $ (18.3) (102.0) % $ 37.5 $ 0.08 % of Net Sales 26.3 % 24.4 % 1.9 % Restructuring plans 0.6 3.3 3.9 3.9 0.9 3.0 0.01 Brand impairment charges3 — 345.2 345.2 345.2 78.6 265.4 0.55 Acquisitions and divestitures — 7.6 7.6 7.6 1.5 6.1 0.01 Corporate hedging derivative losses (gains) 12.5 — 12.5 12.5 3.1 9.4 0.02 Advertising and promotion expenses2 — 68.9 — — — — — Legal matters — 3.8 3.8 3.8 1.0 2.8 0.01 Fire related costs 2.2 (3.3) (1.1) (1.1) (0.3) (0.8) — Third-party vendor cybersecurity incident 4.4 — 4.4 4.4 1.1 3.3 0.01 Valuation allowance adjustment — — — — 28.1 (28.1) (0.06) Rounding — — — — — — (0.01) Adjusted $ 803.1 $ 300.9 $ 433.3 $ 331.3 $ 95.7 24.3 % $ 298.6 $ 0.62 % of Net Sales 27.0 % 10.1 % 14.6 % Year-over-year % of net sales change - reported 183 bps 727 bps (544) bps Year-over-year % of net sales change - adjusted 216 bps 180 bps (39) bps Year-over-year change - reported 9.8 % 45.5 % (73.4) % N/A N/A (76.4) % (75.8) % Year-over-year change - adjusted 11.0 % 24.3 % (0.5) % (7.5) % 5.6 % (5.1) % (4.6) % Q4 FY22 Gross profit Selling, general Operating profit1 Income before Income tax expense Income tax rate Net income Diluted EPS from Reported $ 713.4 $ 499.3 $ 214.1 $ 136.9 $ 26.7 14.4 % $ 158.9 $ 0.33 % of Net Sales 24.5 % 17.2 % 7.4 % Restructuring plans (0.1) 10.2 10.1 10.1 2.6 7.5 0.02 Acquisitions and divestitures — 0.2 0.2 0.2 — 0.2 — Corporate hedging losses (gains) 0.9 — 0.9 0.9 0.2 0.7 — Advertising and promotion expenses2 — 46.1 — — — — — Consulting fees on tax matters — 1.1 1.1 1.1 0.2 0.9 — Fire related costs 9.1 2.2 11.3 11.3 2.8 8.5 0.02 Brand impairment charges3 — 209.0 209.0 209.0 48.4 159.0 0.33 Legal matters — (5.0) (5.0) (5.0) (1.2) (3.8) (0.01) Environmental matters — (6.5) (6.5) (6.5) (1.5) (5.0) (0.01) Unusual tax items — — — — 12.5 (12.5) (0.03) Adjusted $ 723.3 $ 242.0 $ 435.2 $ 358.0 $ 90.7 22.3 % $ 314.4 $ 0.65 % of Net Sales 24.9 % 8.3 % 15.0 % 1 Operating profit is derived from taking Income from continuing operations before income taxes and equity method investment earnings, adding back Interest expense, net and removing Pension and postretirement non-service income. 2 Advertising and promotion expense (A&P) has been removed from adjusted selling, general and administrative expense because this metric is used in reporting to management, and management believes this adjusted measure provides useful supplemental information to assess the company's operating performance. Please note that A&P is not removed from adjusted profit measures. 3 Includes charges related to consolidated joint ventures. These charges are recorded at 100% for all line items before Net income attributable to Conagra Brands, Inc. Net income attributable to Conagra Brands, Inc. excludes Net income (loss) attributable to noncontrolling interests. Conagra Brands, Inc. Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (in millions) FY23 Gross profit Selling, general Operating profit1 Income before Income tax Income tax rate Net income Diluted EPS from Reported $ 3,264.8 $ 2,189.5 $ 1,075.3 $ 689.9 $ 218.7 24.2 % $ 683.6 $ 1.42 % of Net Sales 26.6 % 17.8 % 8.8 % Restructuring plans 1.4 11.7 13.1 13.1 3.2 9.9 0.02 Acquisitions and divestitures — 8.4 8.4 8.4 1.7 6.7 0.01 Corporate hedging derivative losses (gains) 37.1 — 37.1 37.1 9.2 27.9 0.06 Advertising and promotion expenses 2 — 290.1 — — — — — Fire related costs 16.0 (2.6) 13.4 13.4 3.3 10.1 0.02 Third-party vendor cybersecurity incident 4.4 — 4.4 4.4 1.1 3.3 0.01 Municipal water break costs 3.5 — 3.5 3.5 0.8 2.7 0.01 Impairment of businesses held for sale — 26.7 26.7 26.7 6.6 20.1 0.04 Goodwill and brand impairment charges3 — 730.9 730.9 730.9 137.5 592.2 1.23 Legal matters — 3.8 3.8 3.8 1.0 2.8 0.01 Valuation allowance adjustment — — — — 28.1 (28.1) (0.06) Adjusted $ 3,327.2 $ 1,120.5 $ 1,916.6 $ 1,531.2 $ 411.2 23.6 % $ 1,331.2 $ 2.77 % of Net Sales 27.1 % 9.1 % 15.6 % Year-over-year % of net sales change - reported 198 bps 489 bps (291) bps Year-over-year % of net sales change - adjusted 226 bps 77 bps 125 bps Year-over-year change - reported 15.0 % 46.7 % (20.1) % (33.2) % (24.7) % (23.0) % (22.8) % Year-over-year change - adjusted 16.1 % 16.3 % 15.7 % 13.9 % 18.2 % 16.8 % 17.4 % FY22 Gross profit Selling, general Operating profit1 Income before Income tax Income tax rate Net income Diluted EPS from Reported $ 2,838.8 $ 1,492.8 $ 1,346.0 $ 1,033.4 $ 290.5 24.6 % $ 888.2 $ 1.84 % of Net Sales 24.6 % 12.9 % 11.7 % Restructuring plans 21.8 27.2 49.0 49.0 12.1 36.9 0.08 Acquisitions and divestitures — 2.4 2.4 2.4 0.6 1.8 — Corporate hedging losses (gains) (4.4) — (4.4) (4.4) (1.1) (3.3) (0.01) Advertising and promotion expenses2 — 244.6 — — — — — Consulting fees on tax matters — 2.8 2.8 2.8 0.7 2.1 — Fire related costs 9.1 2.2 11.3 11.3 2.8 8.5 0.02 Impairment of businesses held for sale — 70.1 70.1 70.1 9.7 60.4 0.13 Proceeds received from the sale of a legacy investment — (3.3) (3.3) (3.3) (0.5) (2.8) (0.01) Brand impairment charges3 — 209.0 209.0 209.0 48.4 159.0 0.33 Legal matters — (19.6) (19.6) (19.6) (4.8) (14.8) (0.03) Environmental matters — (6.5) (6.5) (6.5) (1.5) (5.0) (0.01) Unusual tax items — — — — (8.9) 8.9 0.02 Adjusted $ 2,865.3 $ 963.9 $ 1,656.8 $ 1,344.2 $ 348.0 23.4 % $ 1,139.9 $ 2.36 % of Net Sales 24.8 % 8.4 % 14.4 % 1 Operating profit is derived from taking Income from continuing operations before income taxes and equity method investment earnings, adding back Interest expense, net and removing Pension and postretirement non-service income. 2 Advertising and promotion expense (A&P) has been removed from adjusted selling, general and administrative expense because this metric is used in reporting to management, and management believes this adjusted measure provides useful supplemental information to assess the company's operating performance. Please note that A&P is not removed from adjusted profit measures. 3 Includes charges related to consolidated joint ventures. These charges are recorded at 100% for all line items before Net income attributable to Conagra Brands, Inc. Net income attributable to Conagra Brands, Inc. excludes Net income (loss) attributable to noncontrolling interests. Conagra Brands, Inc. Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (in millions) FY23 FY22 % Change Net cash flows from operating activities $ 995.4 $ 1,177.3 (15.5) % Additions to property, plant and equipment (362.2) (464.4) (22.0) % Free cash flow $ 633.2 $ 712.9 (11.2) % May 28, 2023 May 29, 2022 Notes payable $ 641.4 $ 184.3 Current installments of long-term debt 1,516.0 707.3 Senior long-term debt, excluding current installments 7,081.3 8,088.2 Total Debt $ 9,238.7 $ 8,979.8 Less: Cash 93.9 83.3 Net Debt $ 9,144.8 $ 8,896.5 FY23 Net Debt1 $ 9,144.8 Net income attributable to Conagra Brands, Inc. $ 683.6 Add Back: Income tax expense 218.7 Income tax expense attributable to noncontrolling interests (0.5) Interest expense, net 409.6 Depreciation 313.1 Amortization 56.8 Earnings before interest, taxes, depreciation, and amortization (EBITDA) $ 1,681.3 Restructuring plans2 12.3 Acquisitions and divestitures 8.4 Corporate hedging derivative losses (gains) 37.1 Fire related costs 13.4 Municipal water break costs 3.5 Third-party vendor cybersecurity incident 4.4 Impairment of businesses held for sale 26.7 Legal matters 3.8 Goodwill and brand impairment charges3 729.3 Adjusted EBITDA $ 2,520.2 Net Debt to Adjusted EBITDA4 3.63 1 As of May 28, 2023 2 Excludes comparability items related to depreciation. 3 Excludes comparability items attributable to noncontrolling interests. 4 The Company defines its net debt leverage ratio as net debt divided by adjusted EBITDA for the trailing twelve month period. Conagra Brands, Inc. Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures (in millions) Q4 FY23 Q4 FY22 % Change Net income attributable to Conagra Brands, Inc. $ 37.5 $ 158.9 (76.4) % Add Back: Income tax expense (18.3) 26.7 Income tax expense attributable to noncontrolling interests (0.2) 0.4 Interest expense, net 108.0 96.2 Depreciation 79.4 75.0 Amortization 13.5 14.8 Earnings before interest, taxes, depreciation, and amortization $ 219.9 $ 372.0 (40.9) % Restructuring plans1 3.5 9.5 Acquisitions and divestitures 7.6 0.2 Corporate hedging derivative losses (gains) 12.5 0.9 Fire related costs (1.1) 11.3 Consulting fees on tax matters — 1.1 Third-party vendor cybersecurity incident 4.4 — Legal matters 3.8 (5.0) Environmental matters — (6.5) Brand impairment charges2 343.6 207.0 Adjusted Earnings before interest, taxes, depreciation, and amortization $ 594.2 $ 590.5 0.6 % FY23 FY22 % Change Net income attributable to Conagra Brands, Inc. $ 683.6 $ 888.2 (23.0) % Add Back: Income tax expense 218.7 290.5 Income tax expense attributable to noncontrolling interests (0.5) — Interest expense, net 409.6 379.9 Depreciation 313.1 316.1 Amortization 56.8 59.3 Earnings before interest, taxes, depreciation, and amortization $ 1,681.3 $ 1,934.0 (13.1) % Restructuring plans1 12.3 34.8 Acquisitions and divestitures 8.4 2.4 Corporate hedging derivative losses (gains) 37.1 (4.4) Fire related costs 13.4 11.3 Municipal water break costs 3.5 — Consulting fees on tax matters — 2.8 Third-party vendor cybersecurity incident 4.4 — Impairment of businesses held for sale 26.7 70.1 Proceeds from the sale of a legacy investment — (3.3) Legal matters 3.8 (19.6) Environmental matters — (6.5) Goodwill and brand impairment charges2 729.3 207.0 Adjusted Earnings before interest, taxes, depreciation, and amortization $ 2,520.2 $ 2,228.6 13.1 % 1 Excludes comparability items related to depreciation. 2 Excludes comparability items attributable to noncontrolling interests. For more information, please contact: SOURCE Conagra Brands, Inc.

Ended

Ended

Ended

Ended

Weeks Ended

Weeks Ended

Snacks

Frozen

Conagra Brands

Snacks

Frozen

Conagra Brands

Snacks

Frozen

Conagra Brands

Snacks

Frozen

Conagra Brands

Snacks

Frozen

Expense

Conagra Brands

Snacks

Frozen

Expense

Conagra Brands

Snacks

Frozen

Expense

Conagra Brands

Snacks

Frozen

Expense

Conagra Brands

and administrative

expenses

before income taxes

and equity method

investment earnings

expense (benefit)

attributable to

Conagra Brands, Inc.

income attributable to

Conagra Brands, Inc

common stockholders

and administrative

expenses

income taxes and

equity method

investment earnings

attributable to

Conagra Brands, Inc.

income attributable to

Conagra Brands, Inc

common stockholders

and administrative

expenses

income taxes and

equity method

investment earnings

expense

attributable to

Conagra Brands, Inc.

income attributable to

Conagra Brands, Inc

common stockholders

and administrative

expenses

income taxes and

equity method

investment earnings

expense

attributable to

Conagra Brands, Inc.

income attributable to

Conagra Brands, Inc

common stockholders

MEDIA: Mike Cummins

312-549-5257

Michael.Cummins@conagra.com

INVESTORS: Melissa Napier

312-549-5738

IR@conagra.com

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.