August 25, 2023 (press release) –

The United States has the world’s largest economy, and the third-largest population. Tissue producers across the whole of the North American region operate in a unique market. It is a very slow-growing and mature market despite Americans consuming tissue at the highest per-person rate in the world.

They also consume more tissue products away from home, such as when traveling, working, or entertaining. Average production for this area comes in at about 35% Commercial or AfH tissue, which again is the highest rate globally. This is why there was such a disruption in the tissue sector during the pandemic when everyone had to stay home.

The Impact of Mexico and Canada on the American Tissue Market

The United States has the most significant percentage of tissue capacity running with TAD or other structured technology for advanced tissue production. After all, the birthplace of TAD technology was in Green Bay, Wisconsin.

However, Canada and Mexico play significant roles in production and consumption due to the North American Free Trade Agreement (NAFTA). Because of this, tissue finished products and parent rolls have free access to be transported across the continent. Therefore, Mexico and Canada continue investing in domestic TAD or structured tissue technology.

For example, Kimberly-Clark’s minority interest in Kimberly-Clark de Mexico dates back decades. There is also a trend of Canadian investment in US tissue mills, with some interest from Mexican tissue companies. This is because Canadian tissue consumers have very similar consumption rates and product wants. Mexico’s consumers on the other hand have a wide range of purchasing power, but it is still possible to find very high-end tissue products designed for affluent markets in specific locations.

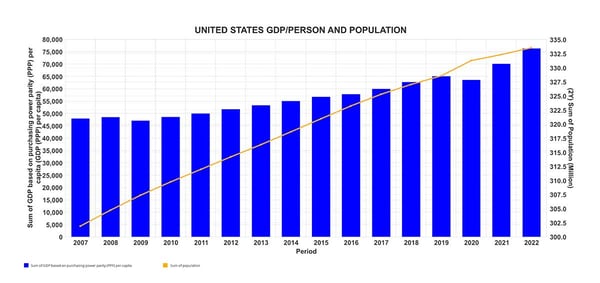

The United States population growth rate is estimated at 0.68% in 2023 by the World Factbook. The population trend and GDP per person are shown in Figure 1. GDP results sagged in 2020 due to the pandemic but recovered smartly in 2021-22.

Figure 1: United States GDP/Person and Population Trend

Source: FisherSolve

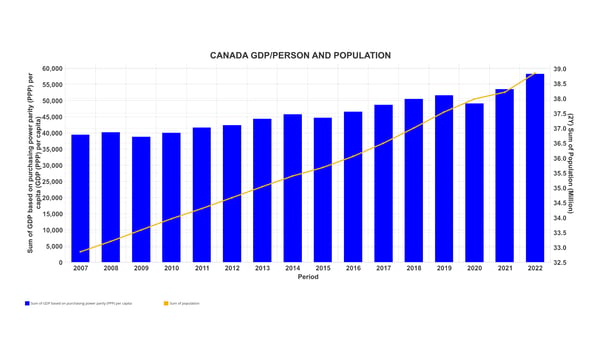

Canada’s income and population trends are very similar, as shown in Figure 2. The country’s population growth is estimated to be 0.73%, and generally slightly greater due to more immigration support.

Figure 2: Canada's GDP/Person and Population Trend

Source: FisherSolve

Source: FisherSolve

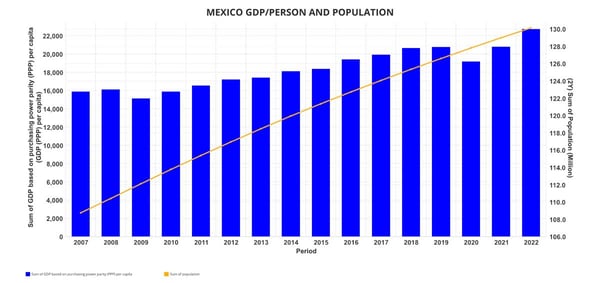

Mexico’s trends are shown in Figure 3. Their income is about 35-40% of Canada or the United States. Although Mexico has the world’s tenth-largest population, it is now growing slowly at about 0.61%.

Figure 3: Mexico's GDP/Person and Population Trend

Source: FisherSolve

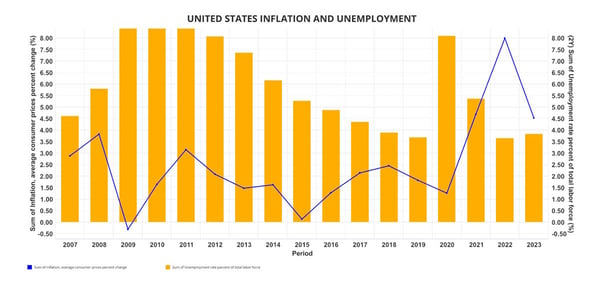

Unemployment and inflation are the other statistics that correlate to tissue demand. Americans enjoyed historically low unemployment and inflation after the Great Recession. However, the global inflation spike in 2022 has hit American consumers hard, as shown in Figure 4.

Figure 4: United States Inflation and Unemployment Trend

Source: FisherSolve

This is due in part to wartime energy price shocks and excess demand along with consumption shifts after emerging from the pandemic. Unemployment recovered to pre-pandemic levels and has resisted the Federal Reserve Bank’s efforts to slow business activity. Overall, consumer buying has returned to pre-pandemic behavior.

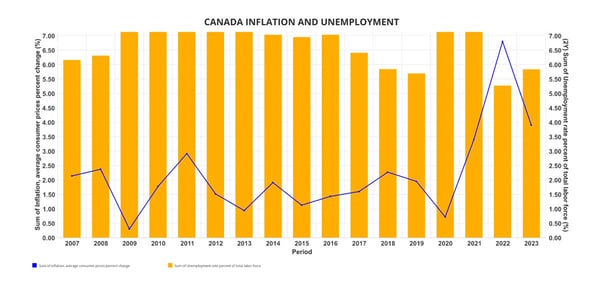

Figure 5: Canada's Inflation and Unemployment Trend

Source: FisherSolve

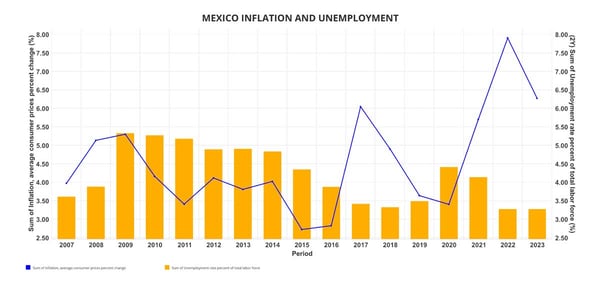

Canada’s inflation experience was very similar to the United States, as shown in Figure 5. Canada’s unemployment has been relatively steady and running about 1% higher than the US. Mexico’s economy tends to be less linked than the US and Canada, but the same trends can be seen in Figure 6.

Figure 6: Mexico's Inflation and Unemployment Trend

Source: FisherSolve

US Tissue Imports and Exports

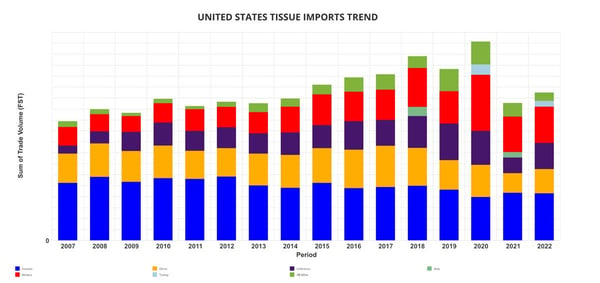

The United States imports about 700,000 tons of tissue yearly, as shown in Figure 7. The leading suppliers in order of input volume are Canada, China, Indonesia, Mexico, Italy, and Turkey. As we can see, there was a surge in imports in 2020, presumably due to the pandemic. This volume represents less than 10% of total US capacity.

Figure 7: United States Tissue Imports Trend

Source: FisherSolve

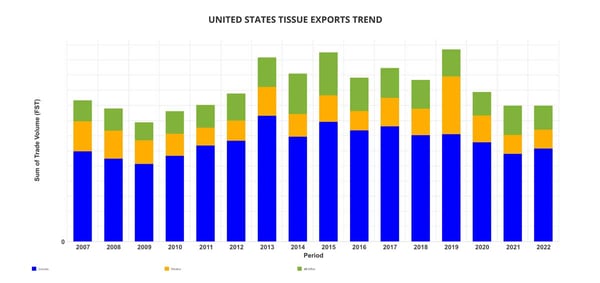

The United States exports about 60% of the tissue volume it imports, as shown in Figure 8. Mexico and Canada are the only significant customers for United States tissue exports.

Figure 8: United States Tissue Exports Trend

Source: FisherSolve

What Machines Do US Producers Use and Invest in?

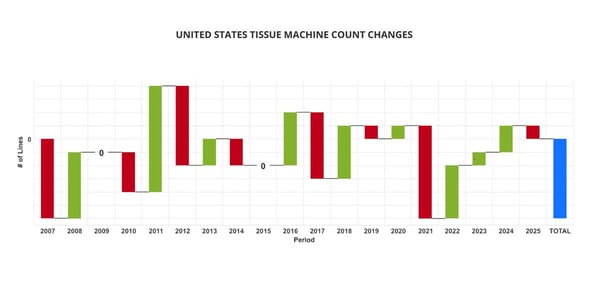

United States tissue producers have been actively removing and replacing old machines with new, significantly more productive assets in the last two decades. Figure 9 shows that a net gain of six new machines were installed since 2007. US tissue capacity grew at a compound annual CAGR of 0.83% over this study. This is much slower than the historical growth rate of 1-2% for this mature market.

Figure 9: United States Tissue Machine Count Changes

Source: FisherSolve

In comparison, Canada’s CAGR rate was 0.25% during this. However, new announcements will boost Canada’s production by 3.9% by 2025. Mexico experienced a 3.18% CAGR but does not have new machines planned before 2025.

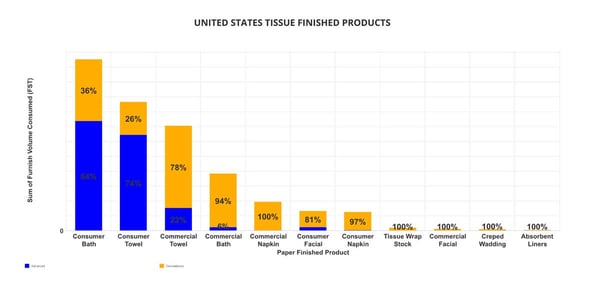

United States tissue producers have the world’s largest advanced process tissue machine fleet using TAD or structured technology. 44% of the total capacity is some form of advanced structured tissue. Figure 10 shows how tissue finished product formats deploy this advanced tissue capacity.

Figure 10: United States Finished Tissue Products by Technology

Source: FisherSolve

64% of consumer bath tissue is produced using advanced technology. The amount of advanced bath tissue production is due to Americans’ desire for exceptionally soft tissue at low strengths.

This is a less common factor driving advanced bath tissue production in Europe. The total volume of consumer towels is slightly less than bath tissue production but requires 74% advanced tissue capacity. Americans’ kitchen towel usage per capita is much higher than in Europe. Still, we see the trend in using advanced structured technology to achieve absorbency performance and reduce the total amount of towels required in most markets.

The United States’ production includes about 35% commercial tissue, much higher than Canada, Mexico, or European countries. Some of this volume is being exported to Canada and Mexico. There is a new trend toward commercial hand towels employing advanced technology, with 22% of production using structured or TAD processes. While there isn’t an advantage to using advanced tissue technology in napkins, there is just a small one for commercial bath and consumer facial tissue.

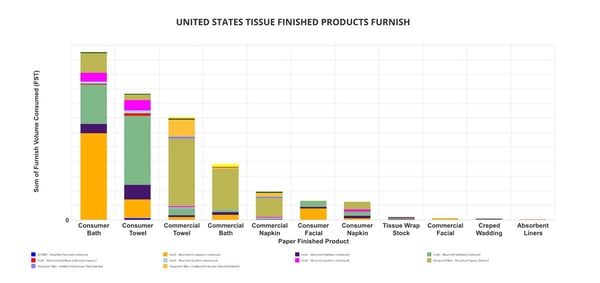

Figure 11 shows the furnish used in the same product categories. Eucalyptus fiber is used in more than half of consumer bath tissue production, with a small amount in consumer towels and a large percentage in consumer facial. Commercial grades tend to use high rates of recycled fiber.

Figure 11: United States Finished Tissue Products Furnish

Source: FisherSolve

How Competitive Is the US Tissue Market? Let's Look at Some Factors

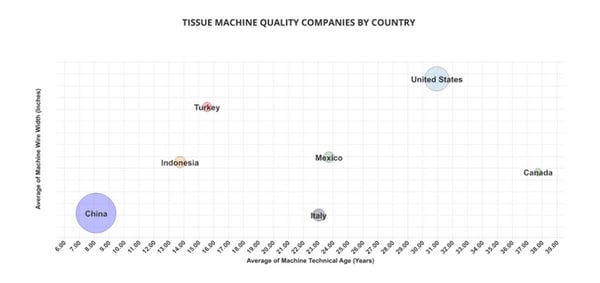

Figure 12 analyses the average tissue machine quality by country for the United States’ main trading partners. The X-axis represents the average technical age of the tissue machine fleets. It reflects when a machine was built and whether it has been updated to deliver current productivity and quality levels. The Y-axis shows the average machine wire width for each country. This is used to get an idea of how much production can be made by each machine.

Figure 12: Tissue Machine Quality by Country

Source: FisherSolve

The bubbles’ size represents each country’s relative total tissue capacity. China has the newest but narrowest fleet of tissue machines; Canada’s are relatively old and somewhat narrow; and US machines are also rather old but are the widest on average in this analysis. Presumably, this size increase has helped them remain competitive. Italy and Mexico have relatively middle-aged machines, but Mexico is significantly wider.

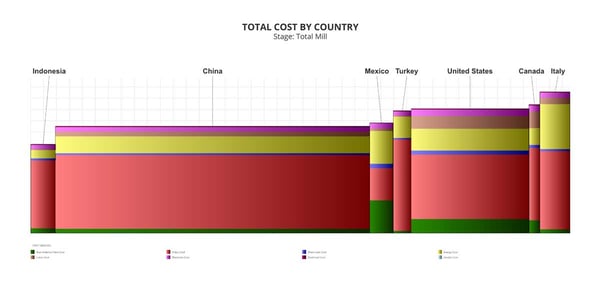

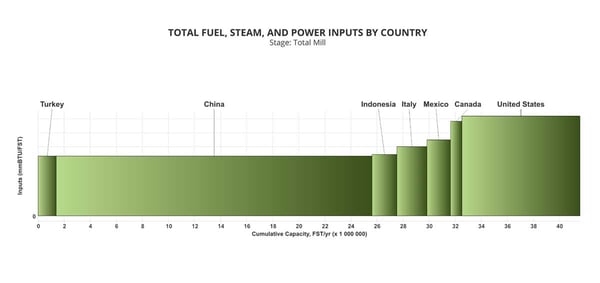

The same competitive set is shown in Figure 13 as a cash cost analysis. As we can see, Indonesia is the lowest cost producer, driven by low pulp costs. China and Mexico have very similar cost levels but for different reasons, as Mexico uses much more low-cost recycled fiber that China doesn’t use in tissue production. Turkey, the United States, and Canada have similar overall cost levels, but Italy suffers from high energy costs.

Figure 13: Trade Group Average Cash Cost/Ton

Source: FisherSolve

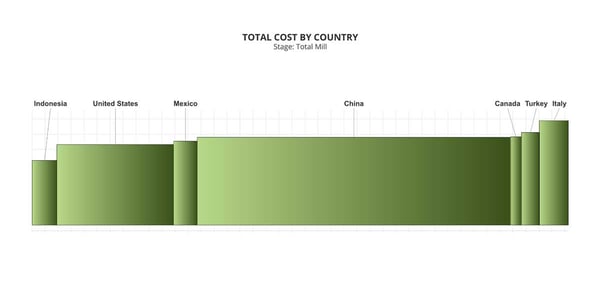

Analyzing average cash costs of tissue production in situations with large amounts of TAD or other structured tissue technology without considering the specific effects on cost and basis weight required for a product can be misleading. Figure 14 repeats the cost analysis using costs per case adjustments that reflect the ability of advanced tissue processes to produce higher product performance with less basis weight than conventional products. This results in a significant shift for the United States due to its large percentage of advanced technology employed. Mexico also sees a similar change.

Figure 14: Trade Group Average Cash Cost/Case

Source: FisherSolve

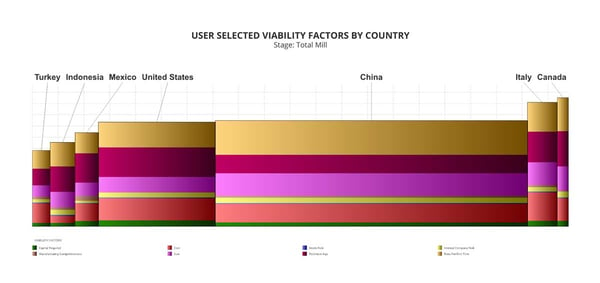

Figure 15 looks at the average tissue machine viability for each country. The viability analysis includes the costs already discussed. Still, it includes the capital required, the grade risk of each machine, internal company risk, manufacturing competitiveness, the overall size of the machine, technological age, and the tons per unit of width. The United States appears favorably in this analysis, but Canadian machines are showing their age.

Figure 15: Trade Group Average Tissue Viability

Source: FisherSolve

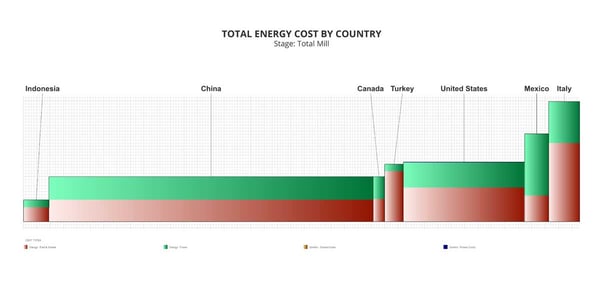

Any analysis of carbon emissions should start with the energy cost required to produce a ton of tissue. Figure 16 shows that Indonesia, China, and Canada have low energy costs. Turkey and the United States are competitive. Canada’s advantage is due to its hydropower. Mexico and Italy are high outliers in this group.

Figure 16: Trade Group Average Energy Cost per Ton

Source: FisherSolve

Figure 17 shows the same energy analysis but as energy units required per ton as opposed to the cost of the units. This reverses the results based on energy prices and puts the United States, Canada, and Mexico on the higher end of energy consumption. This is probably due to higher average softness requirements that means using extra drying before creping and a more significant percentage of advanced tissue technology that uses less pressing for water removal. North America enjoys relatively low energy costs making conservation efforts less rewarding on a cost basis.

Figure 17: Trade Group Average Energy Units/Ton

Source: FisherSolve

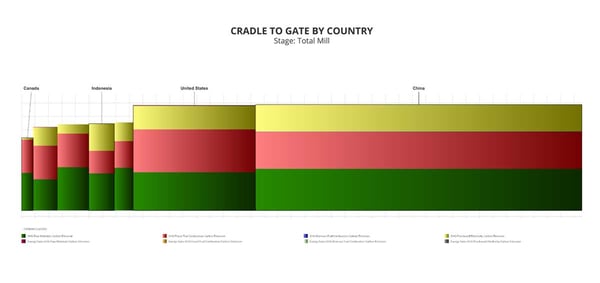

The carbon emissions per ton chart in Figure 18 shows a cradle-to-gate analysis that includes emissions from raw material production and transport, electric grid costs, and the fuel used on site. Canada leads in this area due to its low electric grid emissions driven by the large percentage of hydropower available. The United States and China are about the same. Carbon emission regulations are at greater risk to the United States as historically low-priced energy has not rewarded efficiency efforts.

Figure 18: Trade Group Average Carbon Emission by Ton (Cradle to Gate)

Source: FisherSolve

In Summary...

The United States tissue business is unique in customer consumption rates, percentage of TAD or other advanced technologies, and the exceptional drive for softness in consumer grades. American consumers tend to use more disposable kitchen towels at home than Europeans, which helps account for the increased consumer towel demand rates.

Canadians also tend to use more towels, which is why they experienced shortages during the pandemic. Mexico and Canada are top trading partners of the United States and have developed some of these same consumer behaviors. Canada and Mexico do not produce much commercial tissue, which would support the very high production rate in the United States. The march toward more advanced tissue process deployment (mostly TAD) continues in the United States with new capacity installations underway by Georgia Pacific in Wisconsin and Procter and Gamble in Utah.

Canada has ended a long drought of no new TAD machines with the newest Kruger machine installation in Quebec. Mexico doesn’t have any new machines announced but has added a significant amount of advanced process machines. There is no sign of an end to deploying advanced process technology in North America to meet high-performance consumer expectations.

The North American tissue market dynamics have attracted many new players, including European Essity and Sofidel and new American companies like First Quality Tissue. The dilution of producers’ market power in the United States compared to historical market concentration will continue to drive consolidation and closures of older assets that can’t meet quality or cost requirements.

Sustainability factors such as carbon emissions, fiber sourcing, and product design can be expected to play a more significant part. American tissue consumers could become more discerning about sustainability and drive winners and losers among the tissue producers. Could the growth of tissue consumption per capita and TAD in the United States finally peak and start to decrease with increased consumer concern about sustainability?

This is an area that producers and investors need to watch closely. All the data presented in this report represent averages of a considerable fleet of tissue producers in the United States. Analysis of competitive position requires specifics on tissue producers and individual machines. This article presents a static picture summary of the North American tissue industry today. Fiber prices, exchange rates and environmental regulations will change, providing some participants with advantages and others with new challenges. US tissue mills will continue to change hands and perhaps consolidate; neighboring countries may invest in tissue-making capacity, thus affecting America’s imports and exports.

GET OUR 2022 GLOBAL TISSUE INDUSTRY STUDY REPORT

Curious what else FisherSolve has to offer?

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistribute or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.