June 30, 2023

(press release)

–

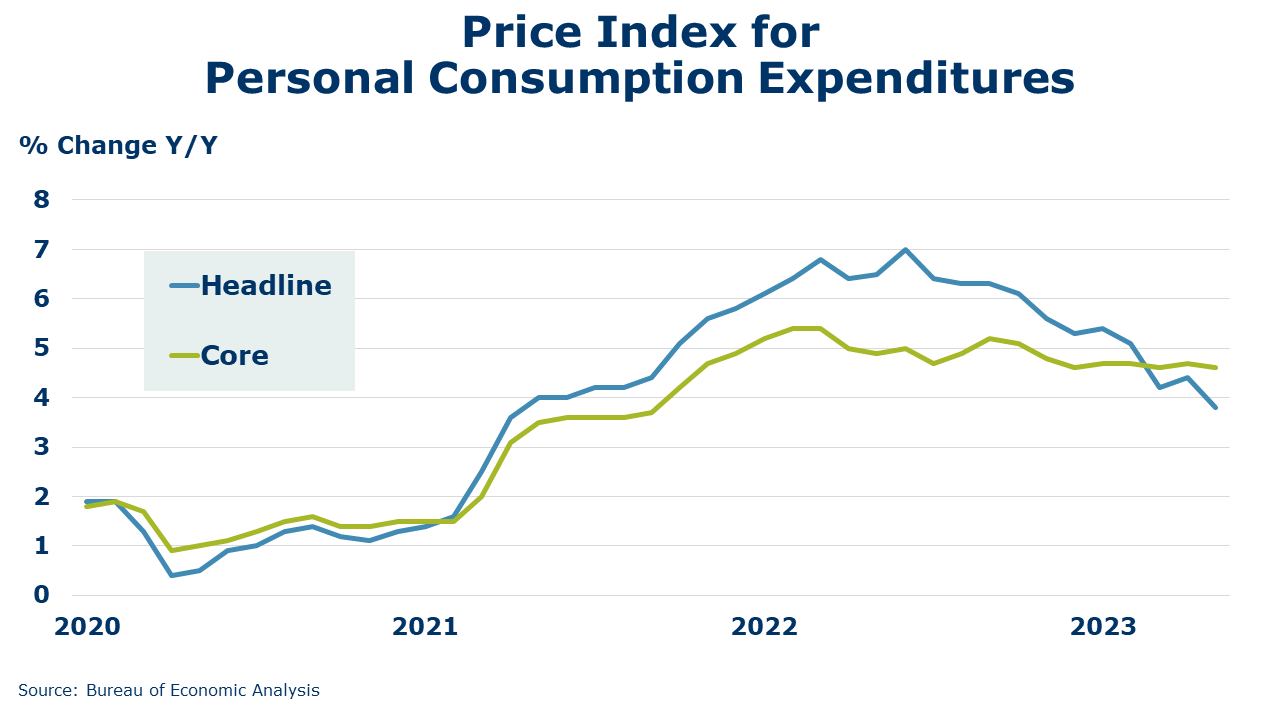

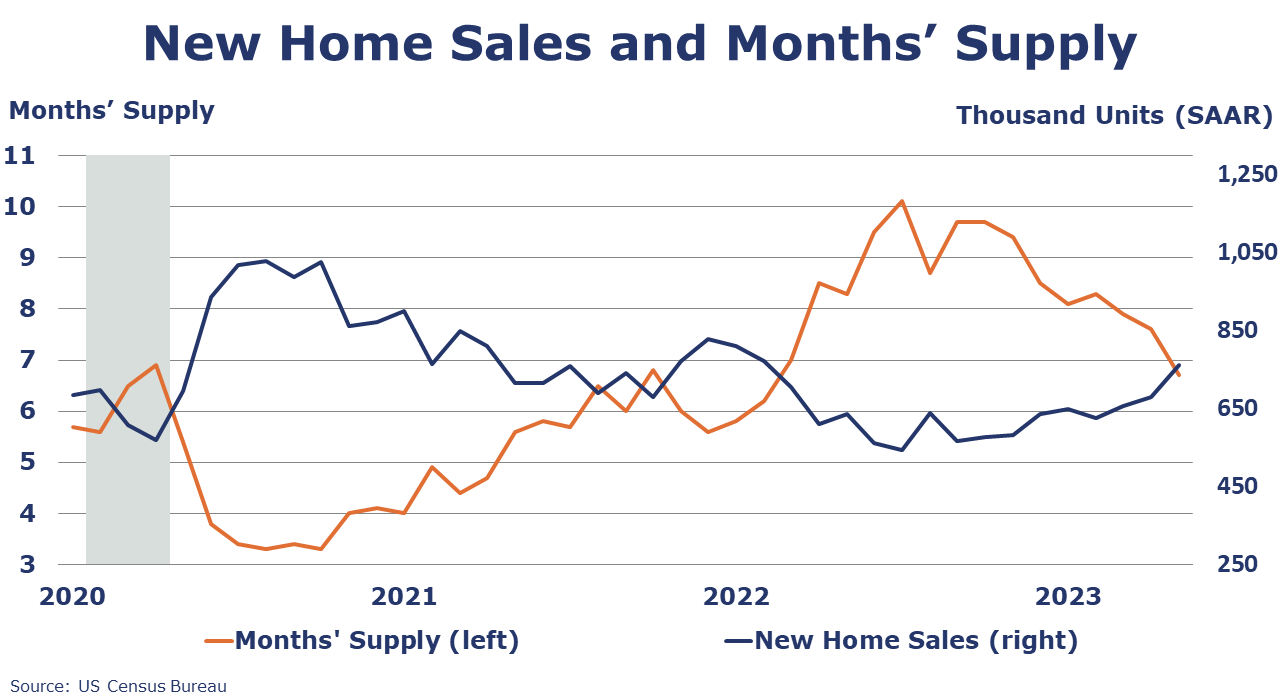

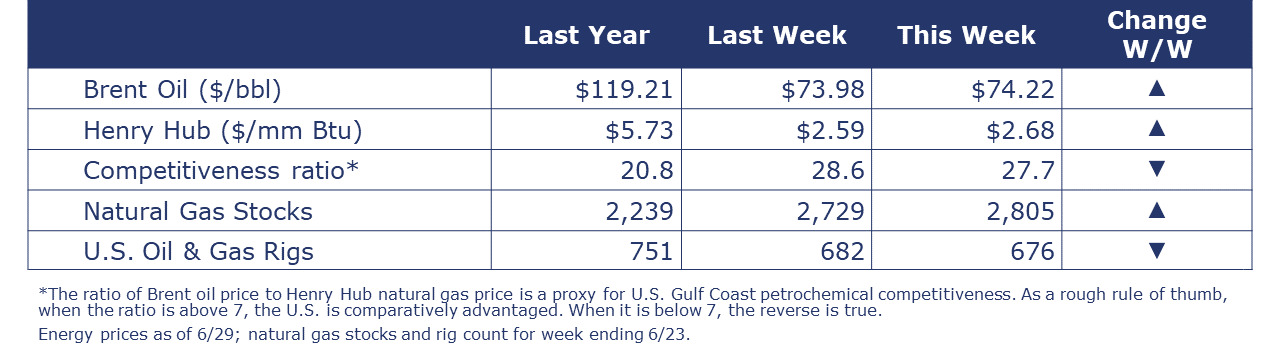

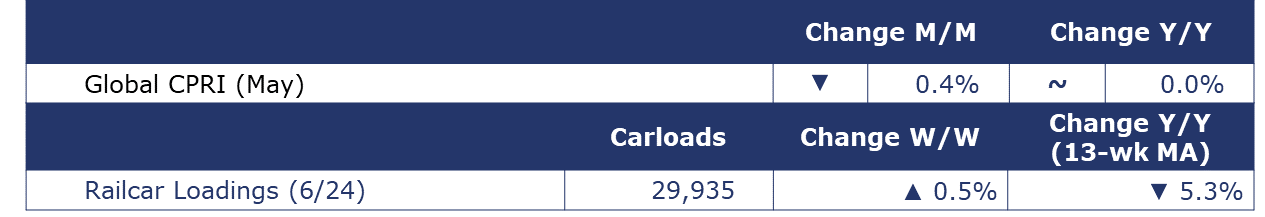

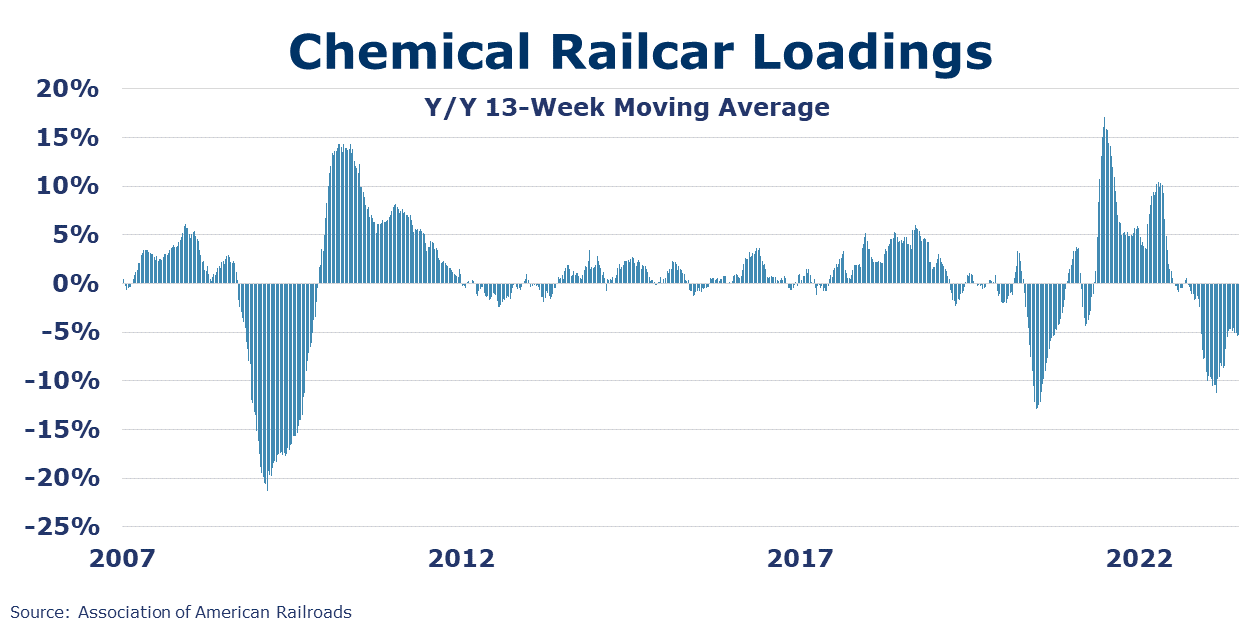

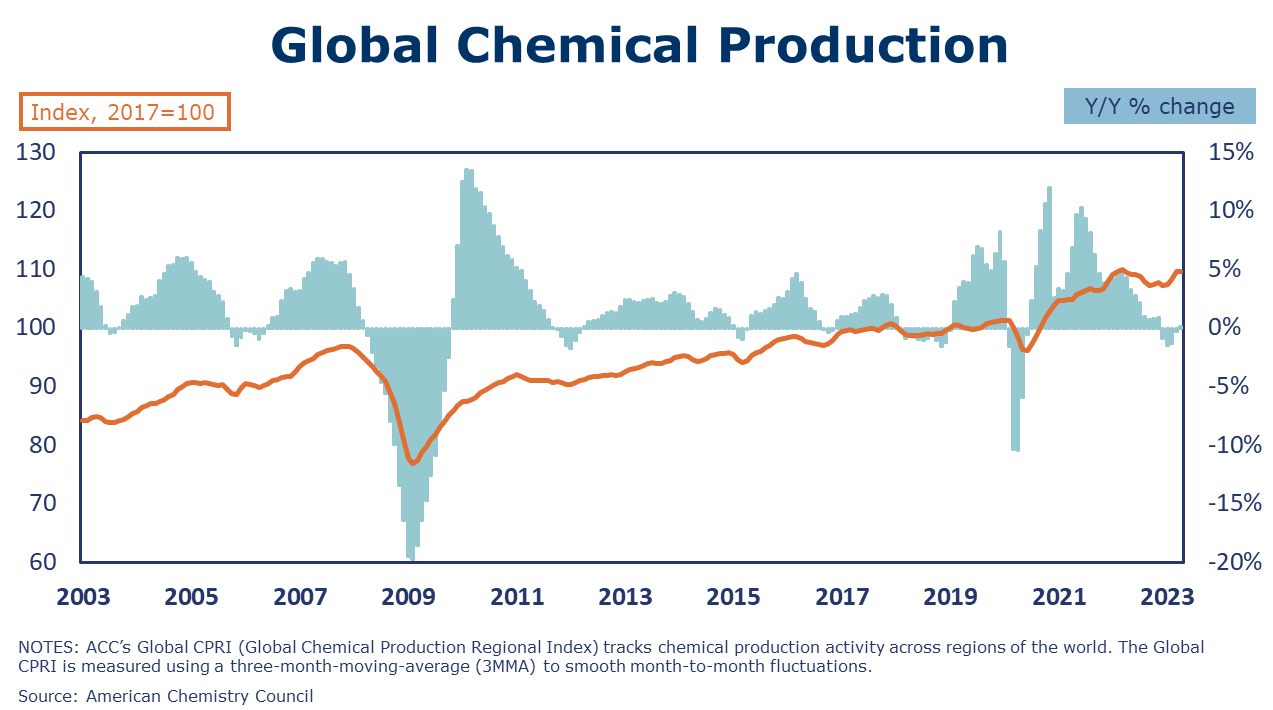

Running tab of macro indicators: 11 out of 20 The number of new jobless claims was down by 26,000 to 239,000 during the week ending June 24. Continuing claims fell by 19,000 to 1.7 million, and the insured unemployment rate for the week ending June 17 was unchanged at 1.2%. Consumer spending continued to expand last month, though at a slower pace. Personal consumption expenditures rose by 0.1% in May, following 0.6% gain in April. After factoring in inflation, consumer spending was flat. Higher spending on services offset lower spending on both durable and nondurable goods. Personal income rose 0.4%, buoyed by wage gains. Compared to a year ago, aggregate personal income was up 4.0% while consumer spending was up 2.1% Y/Y. The PCE price index edged higher and was up 3.8% Y/Y. Core PCE prices (excluding food and energy) rose another 0.3% and were 4.6% higher than a year earlier, a slightly slower pace than the 4.7% Y/Y gain in April. It is this core PCE price index that the Fed is targeting to bring down to 2%. New home sales rose for a third straight month, up by 12.2% in May. Sales activity rose in all regions, highest in the West and Northeast and lowest in the Midwest (4.1%). Inventories of new homes available for sale declined. As sales growth outpaced growth in inventories, the months’ supply declined from 7.6 in April to 6.7 in May, the lowest in a year. With extremely low inventories of existing homes, due to homeowners’ reluctance to give up low mortgage rates, there has been renewed activity in newly built homes. New home sales were up 20.0% Y/Y. The Conference Board Consumer Confidence Index® rose to 109.7 in June (from 102.5 in May). Consumers’ assessment of present economic and labor market conditions increased as did their expectations for the short-term outlook. Despite the uptick in June from 71.5 to 79.3, the expectations index remains below 80 (a level signaling recession) and has been there for 15 of the last 16 months. Considering their family’s current financial situation, 29% of consumers say it’s “good” while 18% say it’s “bad”. Looking ahead six months, 30% of consumers expect their family finances to be better while 14% expect their situation to be worse. Their outlook on the labor market improved but, expectations for short-term income prospects worsened. Expectations of a US recession are easing though they remain elevated with 69% of consumers saying a recession is “somewhat” or “very likely” to occur. Plans for major purchases such as autos and homes slowed in June as did plans for spending on travel and vacations. A large gain in transportation equipment boosted headline durable goods orders, which rose 1.7% in May. Core business goods orders were up 0.7% in May, an increase for the second consecutive month. Headline orders were up 3.5% Y/Y while core business orders were ahead 2.7% Y/Y. The third estimate of real GDP showed an annual growth rate of 2.0% in the first quarter of 2023, higher than the second estimate released last month. The updated estimates primarily reflected upward revisions to exports and consumer spending that were partly offset by downward revisions to nonresidential fixed investment and federal government spending. Imports, which are a subtraction in the calculation of GDP, were revised down. Compared to the fourth quarter, the deceleration in real GDP in the first quarter primarily reflected a downturn in private inventory investment and a slowdown in nonresidential fixed investment that were partly offset by an acceleration in consumer spending, an upturn in exports, and a smaller decrease in residential fixed investment. Imports turned up. Oil prices bounced around a little this week as fears of more rate hikes competed with a larger-than-expected draw on commercial oil inventories. U.S. natural gas prices were slightly higher compared to last week thanks to ongoing extreme heat in Texas. The combined oil and gas rig count fell for an eighth consecutive week, down by six to 676. Indicators for the business of chemistry bring to mind a red banner. Our latest assessment of the situation and outlook for chemicals and the economy was just released – check it out here: https://www.americanchemistry.com/chemistry-in-america/news-trends/blog-post/2023/acc-mid-year-situation-outlook-june-2023 According to data released by the Association of American Railroads, chemical railcar loadings up to 29,935 for the week ending June 24. Loadings were down 5.3% Y/Y (13-week MA), down 4.7% YTD/YTD and have been on the rise for 8 of the last 13 weeks. Among the comments from chemical manufacturing highlighted in the Texas Manufacturing Outlook survey for June: The ACC Global Chemical Production Regional Index (Global CPRI) inched down by 0.4% in May, following flat growth in April. North America and Asia led the decline in chemical production. The decline in May reflects slowing chemical production in several major producing countries, including the United States, China, Taiwan, India, Korea, United Kingdom, France, and Germany. Global output is down in all segments, with agricultural chemicals showing the sharpest decline. Compared to a year ago, global chemical production was flat. The banner colors represent observations about the current conditions in the overall economy and the business chemistry. For the overall economy we keep a running tab of 20 indicators. The banner color for the macroeconomic section is determined as follows: Green – 13 or more positives For the chemical industry there are fewer indicators available. As a result, we rely upon judgment whether production in the industry (defined as chemicals excluding pharmaceuticals) has increased or decreased three consecutive months. ACC members can access additional data, economic analyses, presentations, outlooks, and weekly economic updates through ACCexchange. In addition to this weekly report, ACC offers numerous other economic data that cover worldwide production, trade, shipments, inventories, price indices, energy, employment, investment, R&D, EH&S, financial performance measures, macroeconomic data, plus much more. To order, visit http://store.americanchemistry.com/. Every effort has been made in the preparation of this weekly report to provide the best available information and analysis. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material. Contact us at ACC_EconomicsDepartment@americanchemistry.com.MACROECONOMY & END-USE MARKETS

ENERGY

CHEMICALS

Note On the Color Codes

Yellow – between 8 and 12 positives

Red – 7 or fewer positivesFor More Information

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.