MACROECONOMY & END-USE MARKETS

Running tab of macro indicators: 9 out of 20

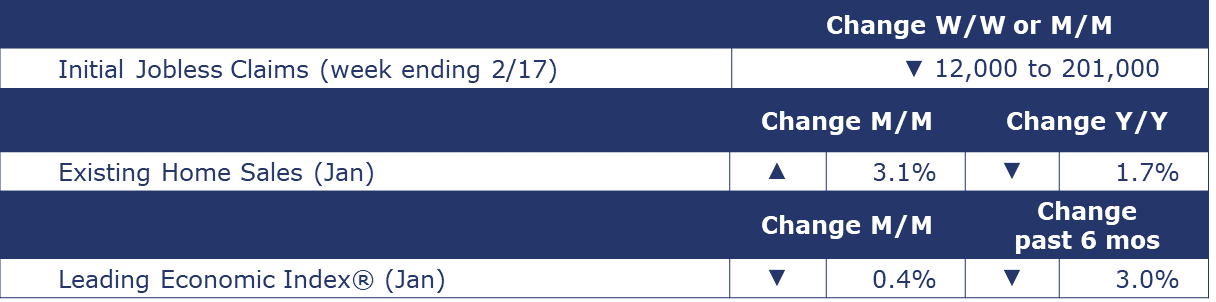

The number of new jobless claims fell by 12,000 to 201,000 during the week ending February 17. Continuing claims fell by 27,000 to 1.86 million, and the insured unemployment rate for the week ending February 10 was down 0.1% to 1.2%.

The Conference Board’s Leading Economic Index® continued to edge down in January, by another 0.4%. It was the 23rd consecutive monthly decline. The index declined 3.0% over the most recent 6 months and by 4.1% over the previous 6 months. This marked moderation has led to the Conference Board reversing their long running call for an impending U.S. recession. The Conference Board noted, “While the declining LEI continues to signal headwinds to economic activity, for the first time in the past two years, six out of its ten components were positive contributors over the past six-month period (ending in January 2024). As a result, the leading index currently does not signal recession ahead. While no longer forecasting a recession in 2024, we do expect real GDP growth to slow to near zero percent over Q2 and Q3.”

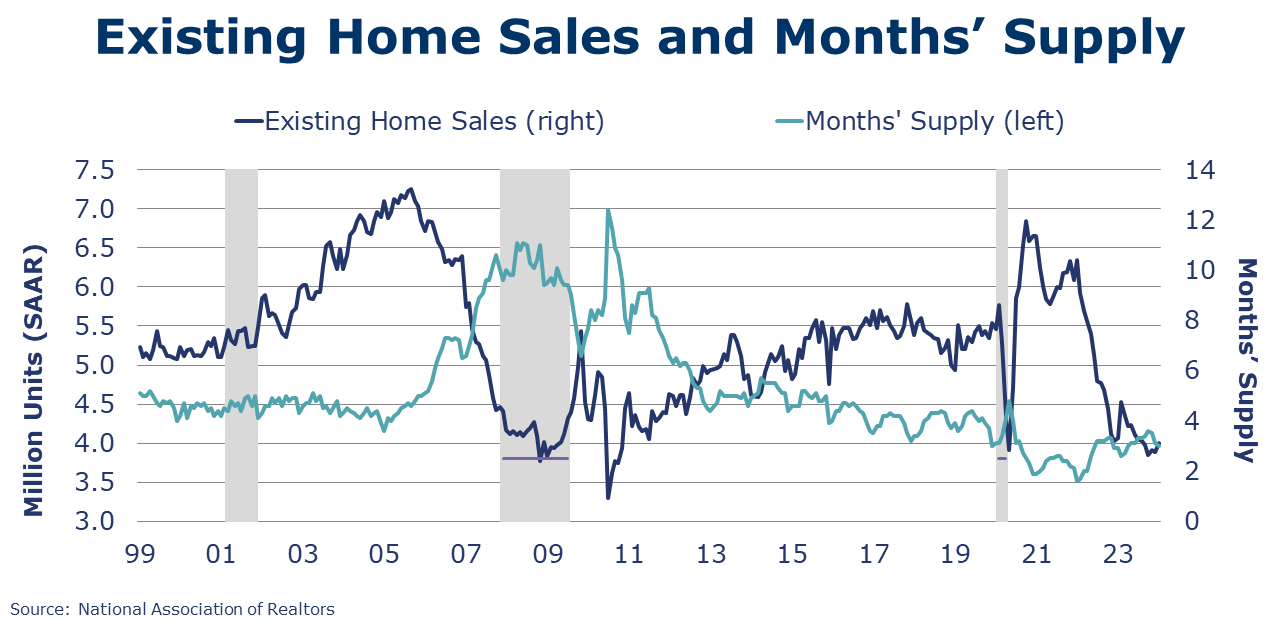

The National Association of REALTORS® reported existing home sales rose 3.1% in January to a SAAR of 4.00 million, a level down 1.7% Y/Y. Inventories rose 2.0% resulting in a 3.0-month supply. The median home sale price was up 5.1% Y/Y.

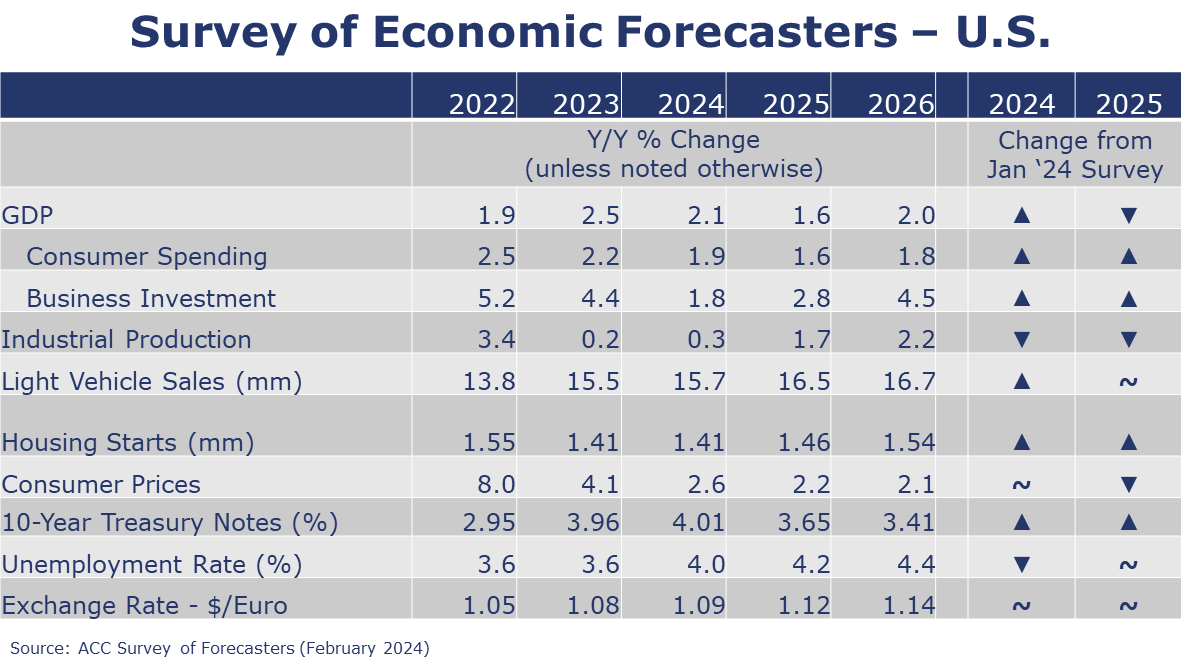

SURVEY OF ECONOMIC FORECASTERS

- Higher interest rates continue to dampen demand across the economy and the new year is getting off to a rocky start after a winter storm in January disrupted economic activity.

- U.S. GDP is expected to grow by 2.1% in 2024 and by 1.6% in 2025.

- Consumer spending growth is expected to downshift to a 1.9% Y/Y pace in 2024 (from 2.2% in 2023) and slow further to a 1.6% gain in 2025.

- Higher borrowing costs and heightened uncertainty have cooled growth in business investment which is expected to decelerate to a 1.8% pace in 2024 before increasing to a 2.8% gain in 2025 as interest rates decline.

- Following a 0.2% gain in 2023, we look for industrial production to edge only slightly higher (by 0.3%) in 2024 before strengthening to a 1.7% pace in 2025.

- Vehicle inventories started the year well ahead of where they were at the beginning of 2023, but higher borrowing costs have tempered demand. Sales of autos and light trucks are expected to grow to 15.7 million in 2024 (still below trend) before rising to a 16.5 million pace in 2025.

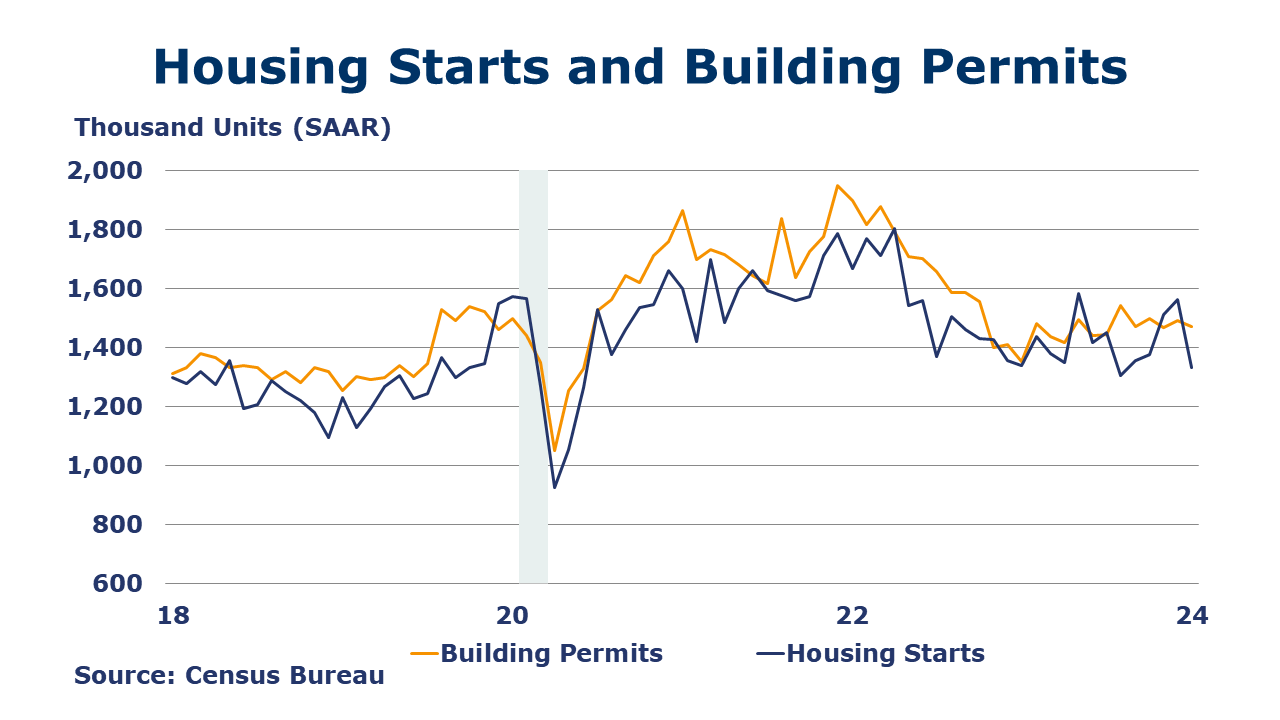

- Struggling with high prices, labor costs, and mortgage rates, new homebuilding has found some support from historically low inventories of existing homes. Housing starts are expected to remain flat at 1.41 million in 2024 before rising to a 1.46 million pace in 2025 as mortgage rates come down.

- The unemployment rate is expected to move higher from near 50-year lows to average 4.0% in 2024 and 4.2% in 2025.

- Recent data shows that inflation is slowing, though it remains above the Fed’s target and the Fed has indicated that they are taking a cautious approach to rate cuts. Growth in consumer prices is expected to decelerate to a 2.6% pace in 2024 and 2.2% in 2025.

- Expectations for interest rates (10-year Treasury) were slightly higher for 2024 but easing in 2025 as rate cuts are expected to start in mid-2024.

ENERGY

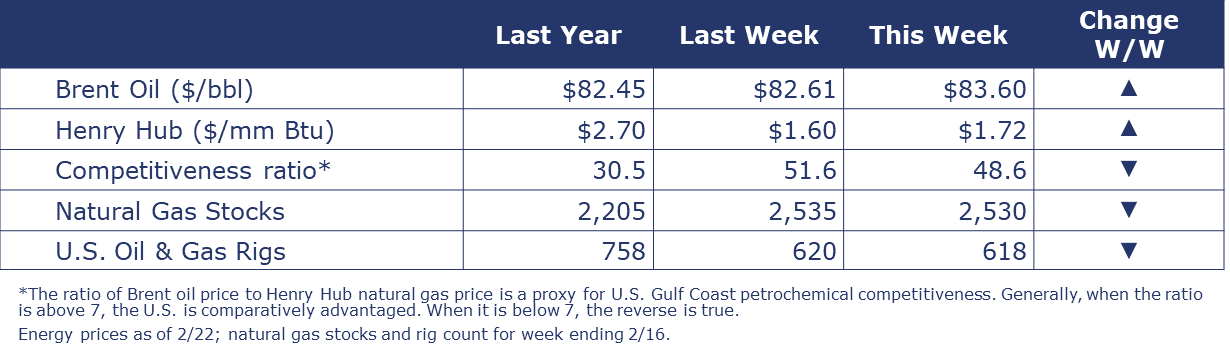

Oil prices were slightly higher than a week ago as ongoing tensions in the Middle East offset concerns about demand growth. U.S. natural gas prices were higher than a week ago, but remained near three-year lows as March approaches and inventories remain well above average. The combined oil and gas rig count fell by two to 618.

CHEMICALS

Indicators for the business of chemistry bring to mind a yellow banner.

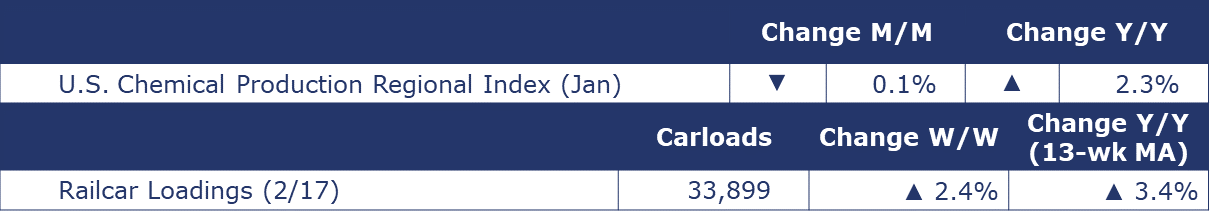

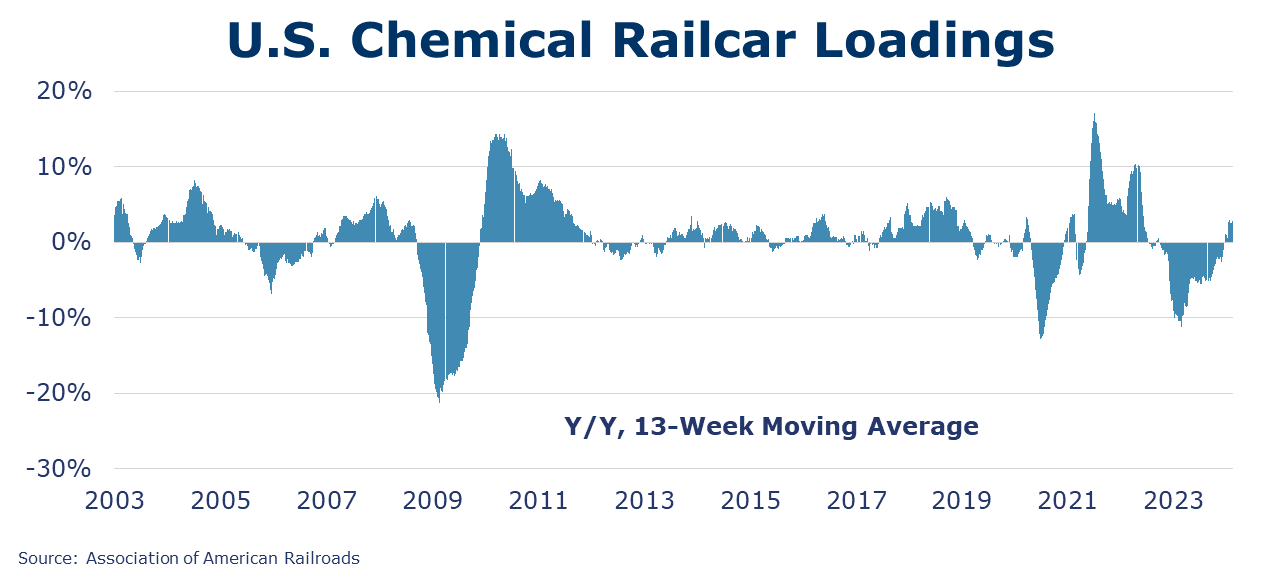

According to data released by the Association of American Railroads, chemical railcar loadings were up to 33,899 for the week ending February 17. Loadings were up 3.4% Y/Y (13-week MA), up (3.6%) YTD/YTD and have been on the rise for 7 of the last 13 weeks.

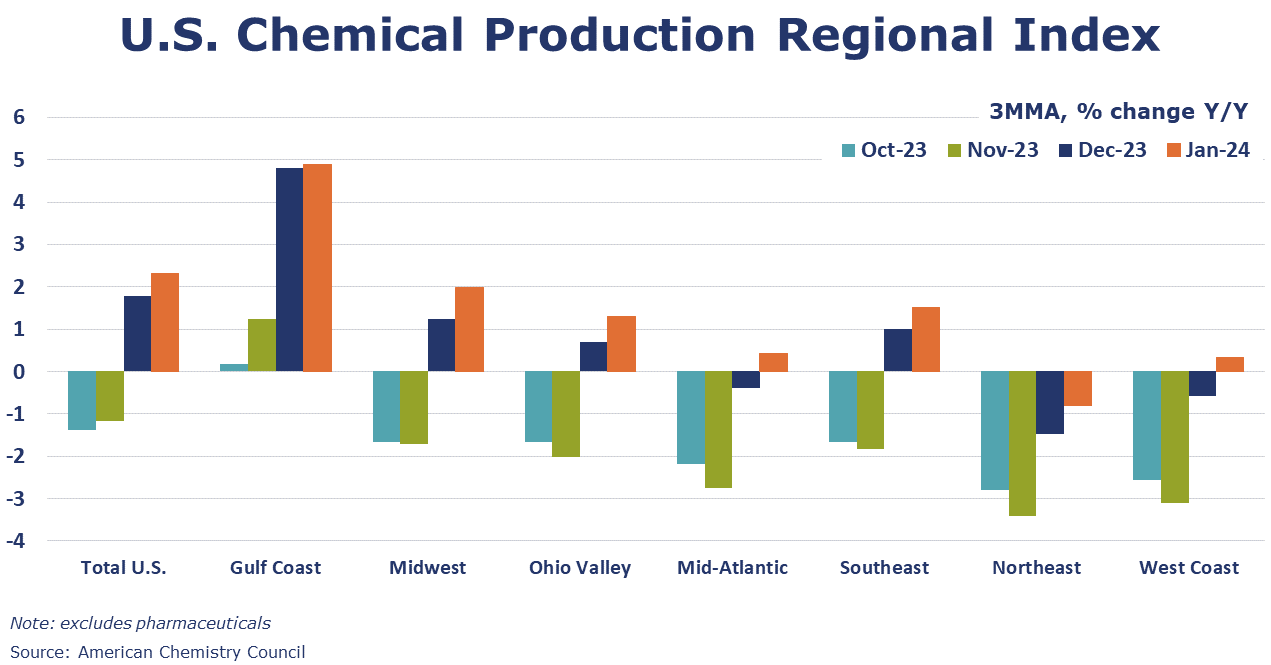

The U.S. Chemical Production Regional Index (CPRI) eased in January (lower by 0.1%). Output declined in the Gulf Coast and Southeast regions, reflecting in part, the freeze event that disrupted production. Output in the Mid-Atlantic and West Coast regions was slightly higher, while output was flat in the Midwest, Ohio Valley, and Northeast regions. Compared to last January, output was 2.3% higher, with Y/Y gains in all regions (except the Northeast).

Note On the Color Codes

Banner colors reflect an assessment of the current conditions in the overall economy and the business chemistry of chemistry. For the overall economy we keep a running tab of 20 indicators. The banner color for the macroeconomic section is determined as follows:

Green – 13 or more positives

Yellow – between 8 and 12 positives

Red – 7 or fewer positives

There are fewer indicators available for the chemical industry. Our assessment on banner color largely relies upon how chemical industry production has changed over the most recent three months.

For More Information

ACC members can access additional data, economic analyses, presentations, outlooks, and weekly economic updates through ACCexchange.

In addition to this weekly report, ACC offers numerous other economic data that cover worldwide production, trade, shipments, inventories, price indices, energy, employment, investment, R&D, EH&S, financial performance measures, macroeconomic data, plus much more. To order, visit http://store.americanchemistry.com/.

Every effort has been made in the preparation of this weekly report to provide the best available information and analysis. However, neither the American Chemistry Council, nor any of its employees, agents or other assigns makes any warranty, expressed or implied, or assumes any liability or responsibility for any use, or the results of such use, of any information or data disclosed in this material.

Contact us at ACC_EconomicsDepartment@americanchemistry.com.