The global wood market has seen its share of shifts in recent years. Factors like the pandemic supply chain disruption, Russia’s wood export ban, and worsening wildfires have impacted market flow.

Case-in-point: Canada’s shrinking market share of the softwood lumber market. As Canadian production capacity dips, European lumber could fill the gap for ever-insatiable US wood demand.

ResourceWise has already covered this story and Europe's potential to close the gap Canada has left open. As wildfire season continues, we continue to learn additional insights into how this situation may play out in the market.

Related: Canadian Lumber Market Shrinking, Could Europe Fill the Gap?

It should come as no surprise that wildfires are one of the primary culprits to a decreasing lumber supply. How will this year’s burn season contribute to this change? And what could this mean in broader global pricing for softwood lumber and other wood products?

Canada’s Wildfire Season Directly Affects Canada’s Lumber Output

Canada experienced the worst wildfire season on record this year. Millions of hectares were burnt throughout the summer months. This left immense amounts of smoke that traveled across the eastern United States.

In fact, Canadian wildfire smoke was detected as far away as Norway. Accordingly, to call this a globally significant event is not an exaggeration.

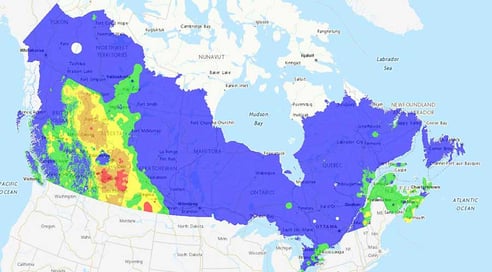

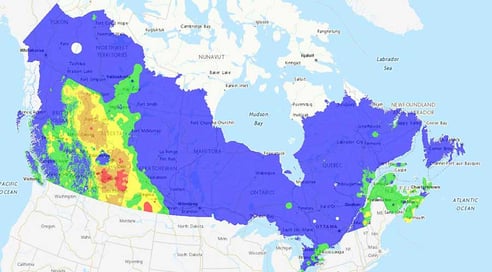

Fires continue to burn even into the autumn months, moving the risk primarily to western Canada. Maps from National Resources Canada shows the story:

Wildfire Dangers: June 2023

(Source: National Resources Canada)

Wildfire Dangers: October 2023

(Source: National Resources Canada)

As the maps show, Canada saw perhaps the worst of it in the earlier months of summer. Even though much of the smoke cleared in the subsequent weeks, the fires did not stop. They are still burning as of this blog's publication.

The fires also yielded several negative effects on the Canadian population and economy.

Millions of valuable forestlands were burned, impacting both forestry and old-growth conservation. Evacuations displaced populations and uprooted daily life for thousands (some permanently). And the carbon impacts have yet to be fully determined.

2023 Fires Flip Canada from Carbon Sink to “Super-Emitter”

Speaking of carbon, the smoke output from burnt forests flipped what was once a vast carbon sink into what is now known as a "super-emitter" of CO2.

Canadian forests are comprised of larch, pine, and spruce all capture and store a vast amount of carbon. The fires led to the release of 2.2 billion tons of that carbon into the atmosphere.

Related: What are the 5 Types of Carbon Stores in Forests?

To put this in perspective, managed Canadian forests conserved around 175 million tons of carbon back in the 1990s. The amount of carbon released this year alone amplifies carbon output by at least a factor of 10. Although the season has not officially concluded, experts say this will likely triple Canada's typical yearly carbon output.

How Will Prices Respond to Canada’s Wildfires?

The effects go beyond carbon within the forestry industry, as well. Fewer trees and more dangerous conditions mean ambiguity in harvest estimates and amounts. The risk of future fires in subsequent seasons also leaves Canadian lumber uncertain.

Of course, uncertainty in production could lead to instability in market prices. Because the season is ongoing and the numbers are still coming in, the exact amount of damage has yet to be determined.

As we learn more, we can get a better picture of how this will impact wood prices and supply availability in global markets.

Canada Wood Output Down 25% Over 5 Years

In addition to price insecurity, Canada’s drop in overall supply could also seriously impact its position in the global wood products market.

Canada remains the second-largest global producer of softwood lumber, behind the US. However, production in the country has dipped significantly in the last five years.

ResourceWise data reports a drop at nearly 25% over five years. Output is now around 60% of production totals from Canada’s heyday 20 years ago.

Despite the amount of timber grown and harvested in the US, the country’s softwood demand exceeds what it can produce. Canada historically would cover this gap—usually about 30%. But the decreased production means that Canada can’t cover the US demand like it once did.

The reason Canada’s production has dwindled comes down to two major factors:

- The pine beetle infestation which devastated BC harvests.

- The aforementioned wildfires impacting forestlands and harvesting processes in other provinces.

European sawmills have an opportunity here. Continued pushing in the global wood markets has shifted European market share up to 15%. Until Canada can catch their exports back up, Europe will likely cover the demand gap for the US.

Learn more about the Canadian lumber market.

Download our Market Insights report, from Hakan Ekstrom, Director of the ResourceWise International Forest Products Sector.

Download Report