ROGGWIL, Switzerland

,

May 30, 2023

(press release)

–

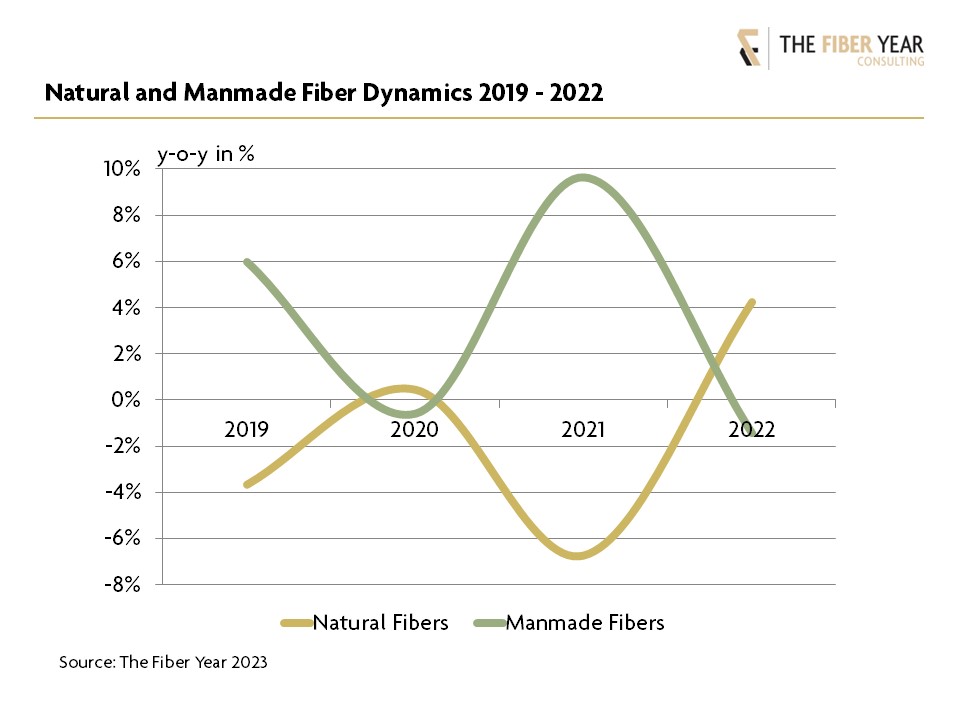

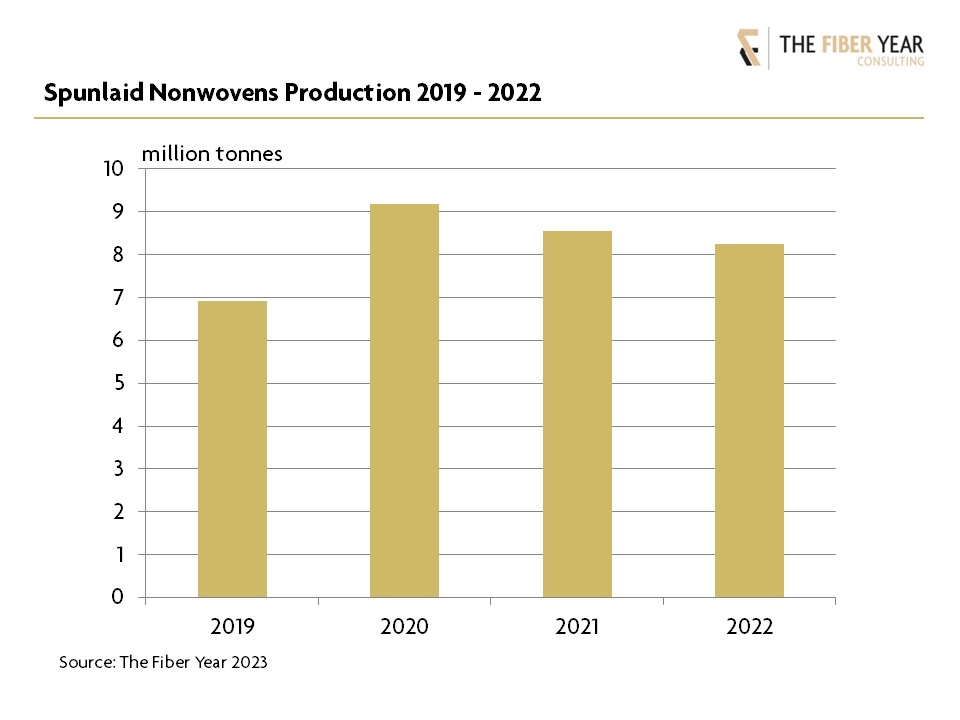

Opposing dynamics remained in the fourth consecutive year with natural fibers increasing and manmade fibers shrinking for the third time in the century. Improvements in natural fiber segments were visible across the board and in particular in the three largest sectors of cotton, jute and wool with a cumulative share of 94%. The manmade fiber business saw losses in both wood-based cellulosic and synthetic fibers. All mainstream subsectors suffered from negative growth. Identification of segments with expanded manufacturing volume required to dig deep into small-scale fiber types such as aramid, carbon and lyocell fibers. Aramid benefited from high demand in optical fiber cable markets, an improvement in automotive applications after almost 6% growth in world vehicle production and an uptick in protective clothing. Carbon fibers experienced surging demand from wind energy and robust recovery in the commercial aerospace market as consequence of an improvement in air traffic, fleet replenishment and the launch of composite-rich freighters and business jets. Lyocell fibers were again the best performing fiber sector to achieve a double-digit growth rate following the successful ramp-up of new projects. Superior fiber properties, growing awareness of plastic waste and of consumers for environmentally safe clothing are to deliver bright prospects for future growth. Main reason for opposing dynamics of the both fiber categories is that manmade fibers quickly can be controlled to match demand unlike natural fibers that have a time lag between planting decision and harvesting for subsequent processing. Using both sector’s average annual growth rate between 2000 and 2019 and extrapolate their pre-pandemic volumes accordingly leads to a theoretical 3-year loss of 5 million tonnes natural fibers and even 15 million tonnes manmade fibers. The precise rate of change for all fiber types will be available in The Fiber Year 2023. Polymer-based Nonwovens Nevertheless, pandemic has also caused a significant deceleration of growth momentum from more than 8% between 2000 and 2019 to a 3-year growth rate during pandemic at about 6%. World Health Organization declared an end to the COVID-19 global health emergency in May. This will further normalize the consumption of such hygiene products but leads to the question about future applications for machinery and equipment installed for face mask production. Outlook Strong labor markets with U.S. unemployment rate at 3.5% in March and in the European Union at century’s record low of 6.0% in February and wages that have been rising at a historically rapid pace might justify a rebound of consumer spending. It seems to be noticeable already for holidays and airline tickets, entertainment and restaurants while consumers rather cut spending on non-essentials like apparel with wardrobes mostly overfull. Demand for clothing has seen some improvement in segments like formal and corporate wear as an increasing number of people have returned to office. Casual wear and fast fashion seem to underperform reflected by an increasing number of store closures of major retailers and brands. Demand for outdoor and sportswear reportedly has not yet picked up as such recreational activities were in great demand during home office. Home textile end-uses are expected to remain extremely weak as home improvement projects were brought forward at the beginning of pandemic when people all of a sudden spent much more time at home. Automotive and aircraft manufacturing recorded gradual expansions with volumes still below pre-pandemic levels. Crisis-proof hygiene demand is not anticipated to experience noticeable growth due to lower disposable incomes; it may rather see some material shifts in an attempt to reduce production costs. The lifting of pandemic restrictions has caused higher spending on services which is expected to remain with positive effects for the refurbishment of hotels, restaurants and cruise ships. In addition, social events, fairs and conferences returning to normal will stimulate event textiles and the necessity of more frequently using formal wear. A more detailed analysis will provide further information and will throw light on specific country risks, for example arising from international reserves in Pakistan shrinking to 9-year low in February 2023 and standing at two-week import coverage, or the impact of massive polyester feedstock investments on supplying industries. The full picture of latest market developments will be available in The Fiber Year 2023 from late May including a wealth of information from feedstocks to fibers, yarns, nonwovens and trade data including Q1 2023 update.

The spunlaid business witnessed its second straight annual decrease after 33% boost in 2020. Contrary to fiber industries, spunlaids achieved a 3-year gain of more than one million tonnes as result of outsized demand for face masks and hygiene articles despite falling short half a million tonnes last year.

Surrounding conditions for a sustained recovery are not yet in place with the ongoing war in Ukraine, geopolitical tensions, elevated inflation, high cost of living and food prices, uncertainties in semiconductor supply, increasing interest rates, shortage of workers and still weak demand in many applications.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.