OTTAWA

,

December 5, 2023

(press release)

–

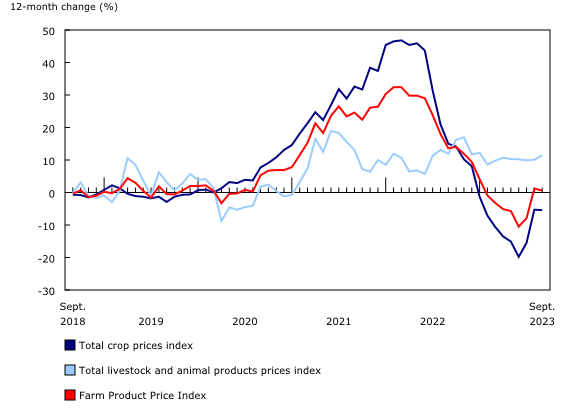

The Farm Product Price Index (FPPI) was almost unchanged in September 2023, up 0.6% compared with the same month in 2022, after recording two consecutive year-over-year double digit increases for the month of September. In September 2023, the total livestock and animal products index increased 11.4% compared with September 2022. The cattle and calves index recorded the largest year-over-year increase among all reported FPPI components, up 30.6% in September 2023. The shrinking cattle herd and continued strong demand for beef products were the main contributors to this gain. The value of cattle exported for immediate slaughter rose 30.0% in the third quarter of 2023 compared with the third quarter of 2022, while the quantity of cattle exported increased 7.0%. Meanwhile, the hogs index decreased 6.4% in September 2023 compared with September of last year, the main contributors being the reduced processing capacity and the continued high feed costs. High feed costs impacted profitability, which may have led producers to reduce herds, putting downward pressure on prices. The eggs index (+0.5%) was almost unchanged year over year, while the dairy index increased 2.9% and the poultry index declined 2.2% in September 2023. The crops index fell 5.4% in September 2023 after three consecutive year-over-year increases for the month of September. The decline in the total crops index was driven by decreases in the oilseeds and grains indexes. The oilseeds index dropped 11.2% in September 2023 compared with the same month last year, as prices were down for canola (-11.0%), flaxseed (-44.2%) and soybeans (-4.6%). Despite robust global and domestic demand for oilseeds, a less restricted supply put downward pressure on oilseed prices compared with September 2022. The grains index decreased 9.9% in September 2023 compared with the same month last year. Higher supply in the 2022/2023 crop year put downward pressure on grain prices. While domestic supply is still recovering from the drought in 2021, stocks remained low because of demand for milling and feed grains. On a year-over-year basis, prices for non-durum wheat (-13.1%), corn (-14.7%) and oats (-15.8%) declined in September 2023. Moderating the decrease in the total crops index, the specialty crops index rose 1.1% in September 2023, mainly on higher prices for lentils (+18.3%). Meanwhile, lower prices for dry peas (-10.9%) mitigated the gain in the specialty crops index. Increases in the price indexes for fresh potatoes (+6.7%), fresh fruits (+5.4%) and fresh vegetables (+4.4%) also mitigated the year-over-year decline in the total crops index in September 2023.Chart 1

12-month change in the Farm Product Price IndexHigher prices drive increases in the cattle and calves index

Lower prices lead to decline in the crops index

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.