OTTAWA

,

February 23, 2024

(press release)

–

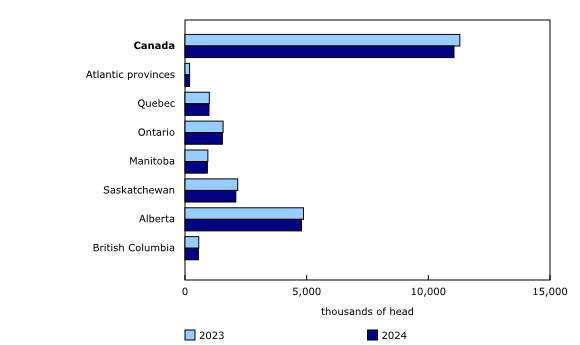

On January 1, 2024, Canadian cattle, hog and sheep inventories were down compared with the same date one year earlier. The Canadian cattle herd fell to the lowest level since January 1, 1989. Record average producer prices of Canadian cattle and calves, drought conditions, and tight feed supply continued to put downward pressure on the cattle sector, and producers responded by sending breeding stock to feedlots. Canadian hog inventories fell for the second consecutive year on January 1, 2024, hindered by rising feed costs, labour shortages, reduced processing capacity, and international market issues, especially in Eastern Canada. On January 1, Canadian sheep inventories declined year over year for the first time since January 1, 2020. Average producer prices of slaughter lambs have weakened since the strong prices during 2021 and early 2022. Lower prices and increased feed costs have contributed to the decline of inventories in the sector. Canadian farmers held 11.1 million cattle and calves on their farms on January 1, 2024, down 2.1% from the same date the previous year and the smallest cattle herd size since January 1, 1989. However, in 2022, average warm carcass weights of cattle increased 18.0% compared with 1999, helping offset any decline in beef production over that period. Canadian cattle producers retained less breeding stock on January 1, 2024, with year-over-year decreases observed in all breeding stock categories. Producers held fewer feeder heifers (-0.7%), steers (-0.2%) and calves (-3.0%) compared with January 1, 2023. From July to December 2023, the total disposition of cattle and calves was up 0.9% compared with July to December 2022, while total supply was down 1.5%. From July to December 2023, international imports of cattle and calves declined 25.7% to 153,400 head, and international exports of cattle and calves increased 14.0% to 389,200 head. Canadian hog producers reported 13.8 million hogs on their farms on January 1, 2024, down 1.0% from the same date one year earlier. Quebec's hog inventories declined 4.8% amid the closure of a Quebec pork plant and herd-reducing program payments, while Manitoba's inventories increased 2.4% year over year. On January 1, 2024, hog producers reported 1.2 million sows and gilts (-2.2%), and the number of boars decreased by 3.1% year over year to 15,500 head. From July to December 2023, the total hog slaughter increased 1.0% to 10.9 million head, and international exports of live hogs increased 7.4% to 3.4 million head during the same period. The pig crop, which represents the number of live piglets after weaning, rose to 14.9 million from July to December 2023, a 2.0% increase compared with July to December 2022. On January 1, 2024, Canadian inventories of sheep and lambs were down 2.2% year over year to 828,300 head. On January 1, 2024, the sheep breeding herd declined 2.3% year over year to 599,300 head, as inventories of ewes (-2.4%), rams (-0.8%) and replacement lambs (-2.0%) decreased. Inventories of market lambs declined 2.0% year over year to 229,000 head. For the second half of 2023 (July to December), sheep and lamb slaughter decreased 1.2% year over year to 382,600 head. For the July to December 2023 period, international exports of live sheep and lambs decreased 38.0% year over year, down to 8,000 head. Meanwhile, international imports of live sheep dropped to zero.Cattle and calves

Chart 1

Total cattle inventories, January 1, 2023, and January 1, 2024Hogs

Chart 2

Total hog inventories, January 1, 2023, and January 1, 2024Sheep and lambs

Chart 3

Total sheep inventories, January 1, 2023, and January 1, 2024

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.