July 11, 2022

(press release)

–

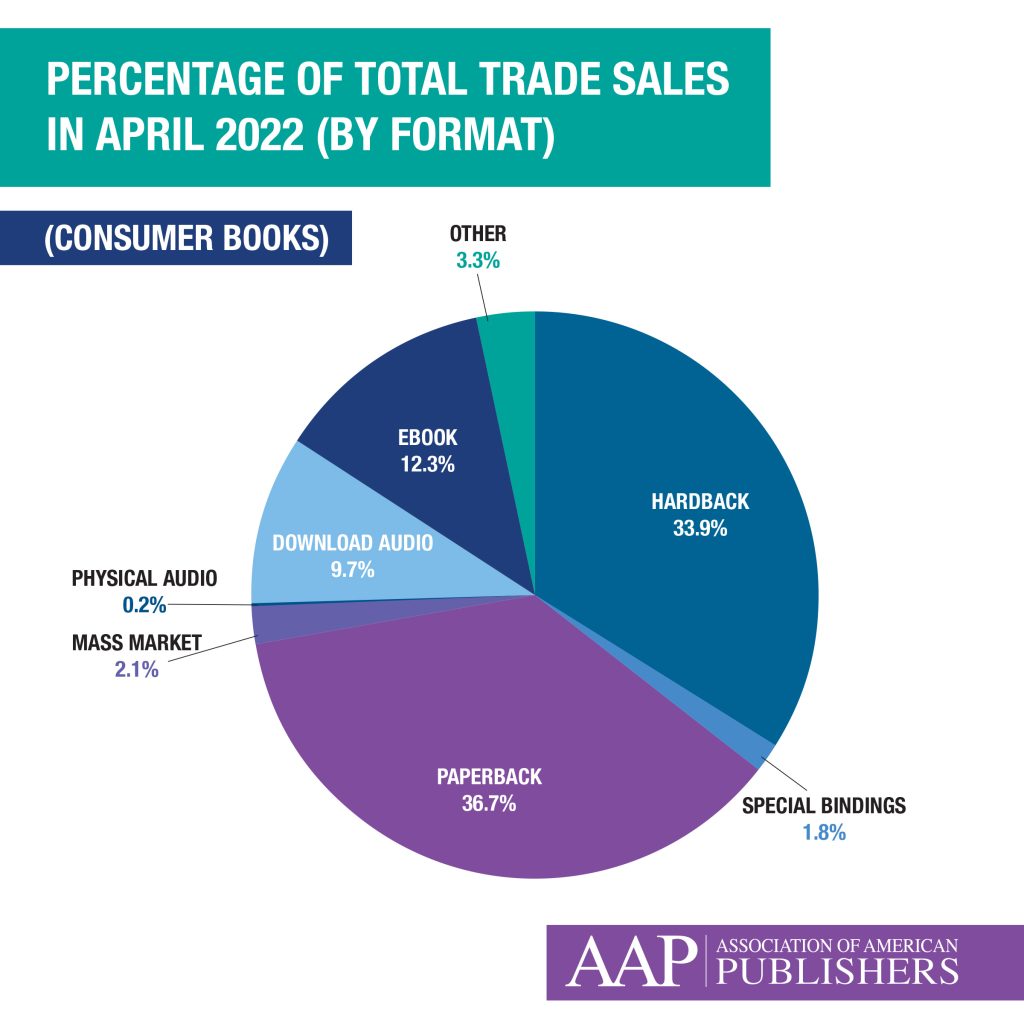

Trade (Consumer Book) Revenues fall 8.9% in April, and 1.0% Year-to-Date The Association of American Publishers (AAP) today released its StatShot report for April 2022 reflecting reported revenue for Trade (Consumer Books), Higher Education Course Materials, and Professional Publishing. The report does not include Pre-K revenue due to delays in data collection but will be updated as soon as that data becomes available. Total revenues across all categories, excluding PreK-12, for April 2022 were down 12.6% as compared to April 2021, coming in at $788.3 million. Year-to-date revenues were down 2.3%, at $3.8 billion for the first four months of the year. Trade (Consumer Books) Revenues Trade (Consumer Books) sales were down 8.9% in April, coming in at $685.7 million. In terms of physical paper format revenues during the month of April, in the Trade (Consumer Books) category, Hardback revenues were down 16.8%, coming in at $232.4 million; Paperbacks were down 2.8%, with $251.9 million in revenue; Mass Market was down 22.0% to $14.1 million; while Special Bindings were up 2.1%, with $12.5 million in revenue. eBook revenues were down 8.3% for the month as compared to April 2021 for a total of $84.3 million. The Downloaded Audio format was up 5.6% for April, coming in at $66.6 million in revenue. Physical Audio was down 47.9% coming in at $1.2 million. Year-to-date Trade revenues were down 1.0%, at $2.8 billion for the first four months of the year. Hardback revenues were down 6.8%, coming in at $974.0 million; Paperbacks were up 9.6%, with $1.0 billion in revenue; Mass Market was down 20.5% to $63.6 million; and Special Bindings were down 2.0%, with $56.1 million in revenue. eBook revenues were down 9.7% as compared to the first four months of 2021 for a total of $338.1 million. The Downloaded Audio format was up 3.4%, coming in at $261.1 million in revenue. Physical Audio was down 31.5% coming in at $4.9 million. Religious Presses Religious press revenues were down 13.1% in April, coming in at $48.6 million. Hardback revenues were down 15.4% to $26.4 million in revenue, Paperback revenues were down 13.1% to $7.0 million, eBook revenues were down 12.6% coming in at $5.2 million, and Downloaded Audio revenues were up 4.2% at $3.2 million. On a year-to-date basis, religious press revenues were down 6.9%, reaching $235.6 million. Hardback revenues were down 10.0% at $133.5 million in revenue, Paperback revenues were up 4.2% to $38.7 million, eBook revenues were down 13.3% at $21.7 million, and Downloaded Audio revenues were down 7.4% at $13.1 million. Education During April 2022 revenues from Higher Education Course Materials were $59.9 million, down 43.2% compared with April 2021. Year-to-date Higher Education Course Materials revenues were $797.4 million, down 5.5% compared to the first four months of 2021. The performance of the Education categories during this month may reflect multiple factors, including rebounding business post-COVID. Professional Books Professional Books, including business, medical, law, technical and scientific, were down 2.4% during the month, coming in at $34.2 million. Year-to-date Professional Books revenues were $124.6 million, down 8.6% as compared to the first four months of 2021. AAP’s StatShot AAP StatShot reports the monthly and yearly net revenue of publishing houses from U.S. sales to bookstores, wholesalers, direct to consumer, online retailers, and other channels. StatShot draws revenue data from approximately 1,366 publishers, although participation may fluctuate slightly from report to report. StatShot reports are designed to give ongoing revenue snapshots across publishing sectors using the best data currently available. The reports reflect participants’ most recent reported revenue for current and previous periods, enabling readers to compare revenue on both a month-to-month and year-to-year basis within a given StatShot report. Monthly and yearly StatShot reports may not align completely across reporting periods, because: a) The pool of StatShot participants may fluctuate from report to report; and b) Like any business, it is common accounting practice for publishing houses to update and restate their previously reported revenue data. If, for example, a business learns that its revenues were greater in a given year than its reports first indicated, it will restate the revenues in subsequent reports to AAP, permitting AAP in turn to report information that is more accurate than previously reported.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.