WASHINGTON

,

March 21, 2022

(press release)

–

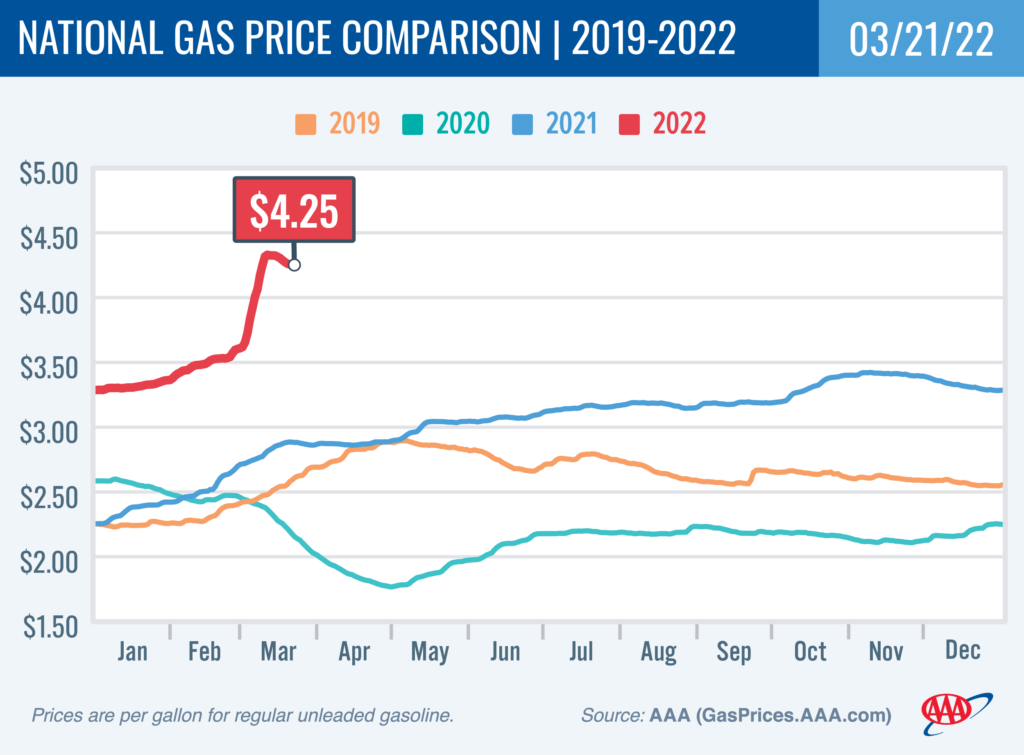

After hitting a record $4.33 on March 11, the national average for a gallon of gasoline has fallen to $4.25. The primary reason is the lower global price of crude oil, which peaked shortly after Russia launched its war in Ukraine, but is now more than $20 lower and hovering near $105/bbl. Domestically, gasoline demand is defying seasonal trends and has dipped slightly, perhaps in response to higher prices at the pump. “Usually this time of year, with warmer weather and longer days, we’d see an uptick in gasoline demand as more people hit the road,” said Andrew Gross, AAA spokesperson. “But we had a slight drop in demand last week, which may be due to higher pump prices. In our new survey of drivers, 59% said they would change their driving habits or lifestyle if the cost of gas hit $4 per gallon. And if gas were to reach $5, which it has in the Western part of the country, three-quarters said they would need to adjust their lifestyle to offset the pump price.” For more information on the latest AAA gasoline survey, visit here. According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks fell by 3.6 million bbl to 241 million bbl last week. Gasoline demand also decreased slightly from 8.96 million b/d to 8.94 million b/d. The drop in gas demand is contributing to price decreases, but the recent reversal in oil prices is creating downward pressure on pump prices. If the oil price continues to decline, pump prices will likely follow suit. However, should oil prices start to climb again, pump prices will likely follow. Today’s national average for a gallon of gas is $4.25, which is seven cents less than a week ago, 72 cents more than a month ago, and $1.37 more than a year ago. Quick Stats The nation’s top 10 largest weekly decreases: Maryland (−46 cents), Delaware (−20 cents), Florida (−18 cents), Georgia (−17 cents), Washington, D.C. (−14 cents), Connecticut (−13 cents), Virginia (−13 cents), Rhode Island (−13 cents), New Jersey (−12 cents) and Alabama (−10 cents). The nation’s top 10 most expensive markets: California ($5.85), Nevada ($5.11), Hawaii ($5.08), Washington ($4.72), Oregon ($4.70), Alaska ($4.69), Arizona ($4.61), Illinois ($4.50), New York ($4.36) and Washington, D.C. ($4.36). Oil Market Dynamics At the close of Friday’s formal trading session, WTI increased by $1.72 to settle at $104.70. After crude prices spiked in response to Russia’s invasion of Ukraine, crude prices changed course in reaction to China announcing new lockdowns alongside rising COVID-19 infection rates last week. However, crude prices could increase further this week as E.U. foreign ministers, who will meet Monday in Brussels, decide whether the 27-nation bloc should join the United States in banning Russian energy imports, including crude oil. Additionally, EIA reported that total domestic crude stocks increased by 4.3 million bbl to 415.9 million bbl last week. Drivers can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.