WASHINGTON

,

April 7, 2023

(press release)

–

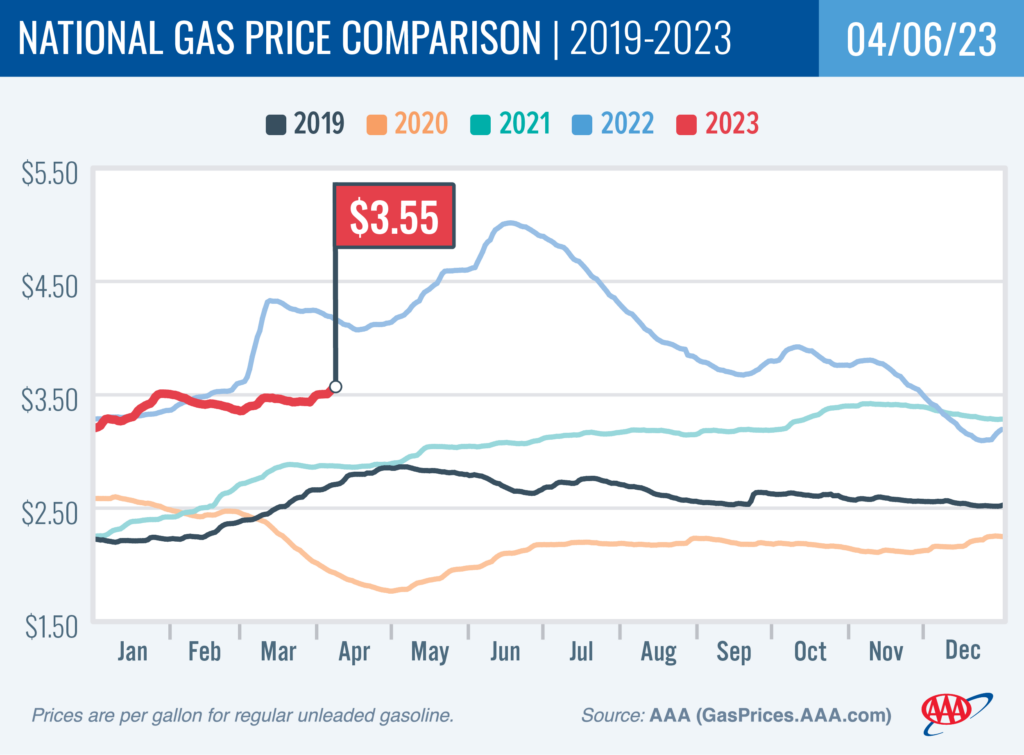

OPEC’s announcement last weekend that it will cut production by over a million barrels per day starting in a month took the oil market by surprise. In response, crude immediately surged well above $80 a barrel, although it has since struggled to stay above that mark. Meanwhile, the national average for a gallon of regular gasoline rose seven cents since last week to hit $3.55. “The oil market has had a few days to digest the OPEC news and speculate about the reason. This has led to the price of oil stabilizing for now,” said Andrew Gross, AAA spokesperson, “but the cost of oil accounts for more than 50% of what we pay at the pump, so drivers may not catch a break at the pump any time soon.” According to new data from the Energy Information Administration (EIA), gas demand increased slightly from 9.15 to 9.3 million b/d last week. Meanwhile, total domestic gasoline stocks decreased substantially by 4.1 million bbl to 222.6 million bbl. Increased demand amid tighter supply has contributed to pushing pump prices higher. If demand continues to rise, pump prices will likely follow suit. Today’s national average of $3.55 is 15 cents more than a month ago but 61 cents less than a year ago. Quick Stats Since last Thursday, these 10 states have seen the largest increases in their averages: Ohio (+25 cents), Delaware (+16 cents), Maryland (+14 cents), Georgia (+12 cents), Oklahoma (+11 cents), Illinois (+11 cents), South Carolina (+10 cents), Wisconsin (+10 cents), Minnesota (+10 cents) and Washington, D.C. (+10 cents). The nation’s top 10 most expensive markets: California ($4.85), Hawaii ($4.79), Washington ($4.34), Arizona ($4.34), Nevada ($4.22), Oregon ($3.95), Illinois ($3.92), Alaska ($3.83), Utah ($3.68) and Washington, D.C. ($3.66). Oil Market Dynamics At the close of Wednesday’s formal trading session, WTI decreased by 10 cents to settle at $80.61. Oil prices declined slightly yesterday due to market concerns that a recession could occur this year, which could push oil demand and prices down. Earlier in the week, crude prices spiked after the Organization of Petroleum Exporting Countries and its allies, including Russia, collectively known as OPEC+, announced it would cut production by 1.6 million bbl starting next month for the remainder of 2023. Additionally, the EIA reported that total domestic commercial crude inventories decreased by 3.7 million bbl to 470 million bbl last week. Drivers can find current gas prices along their route using the AAA TripTik Travel planner.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.