WASHINGTON

,

May 11, 2023

(press release)

–

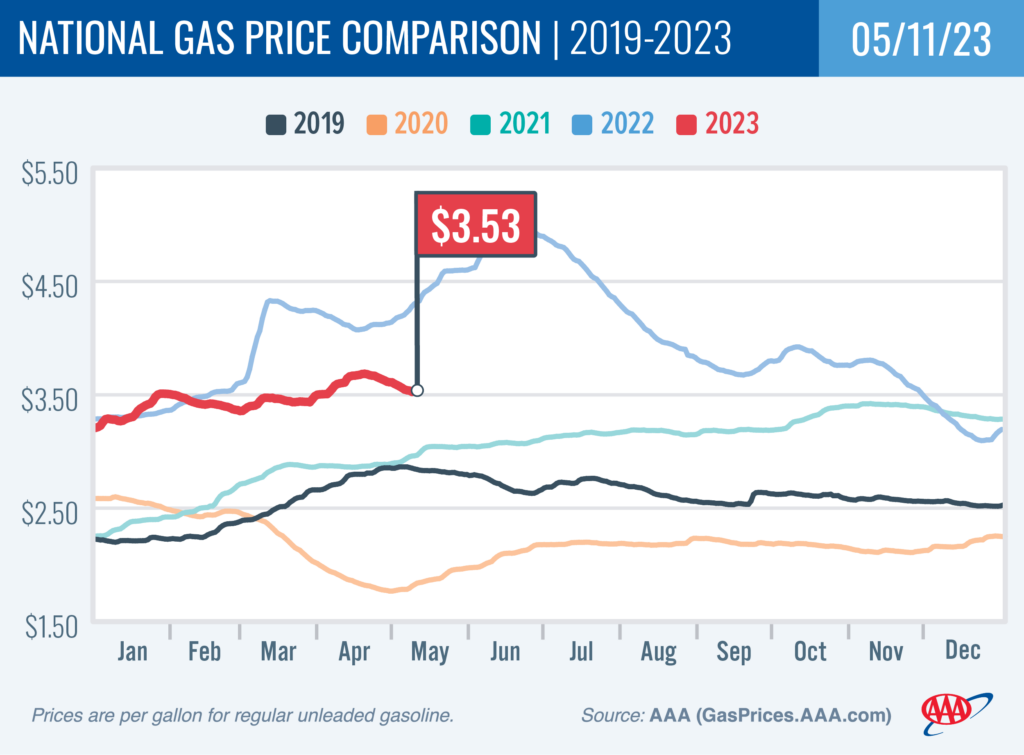

The national average for a gallon of gas drifted lower by just four cents since last week to $3.53. The lackluster movement can be attributed to higher demand for gasoline but a lower cost for oil canceling each other out. “Increasing demand for gasoline would usually drive pump prices higher,” said Andrew Gross, AAA spokesperson, “but the cost for oil has remained low lately, so drivers should benefit from stable pump prices as Memorial Day drawers near.” According to new data from the Energy Information Administration (EIA), gas demand grew substantially from 8.62 to 9.30 million b/d last week. The spike is higher than some market observers expected; the estimate could be revised when EIA releases final demand measurements for May. Meanwhile, total domestic gasoline stocks decreased by 3.2 million bbl to 219.7 million bbl. Higher demand and a reduction in stocks have slowed pump price decreases. Today’s national average of $3.53 is seven cents less than a month ago and 87 cents less than a year ago. Quick Stats Since last Thursday, these 10 states have seen the largest changes in their averages: Ohio (+13 cents), Indiana (+11 cents), Oklahoma (−10 cents), Florida (−9 cents), Nebraska (−8 cents), Michigan (−8 cents), Colorado (−8 cents), Missouri (−8 cents), North Dakota (−8 cents) and North Carolina (−7 cents). The nation’s top 10 least expensive markets: Mississippi ($2.99), Louisiana ($3.08), Texas ($3.09), Alabama ($3.09), Arkansas ($3.11), South Carolina ($3.15), Oklahoma ($3.16), Tennessee ($3.16), Missouri ($3.21) and Georgia ($3.24). Oil Market Dynamics At the close of Wednesday’s formal trading session, WTI decreased by $1.15 to settle at $72.56. Oil prices declined yesterday amid ongoing market uncertainty regarding stalled U.S. debt ceiling negotiations. The market is concerned that if the debt limit is breached, it could contribute to the economy tipping into a recession. If a recession occurs, crude demand and prices would likely decline. Additionally, the EIA reported that total domestic commercial crude inventories increased by 3 million bbl to 462.6 million bbl last week. Drivers can find current gas prices along their route using the AAA TripTik Travel planner.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.