BERKELEY, California

,

February 4, 2022

(press release)

–

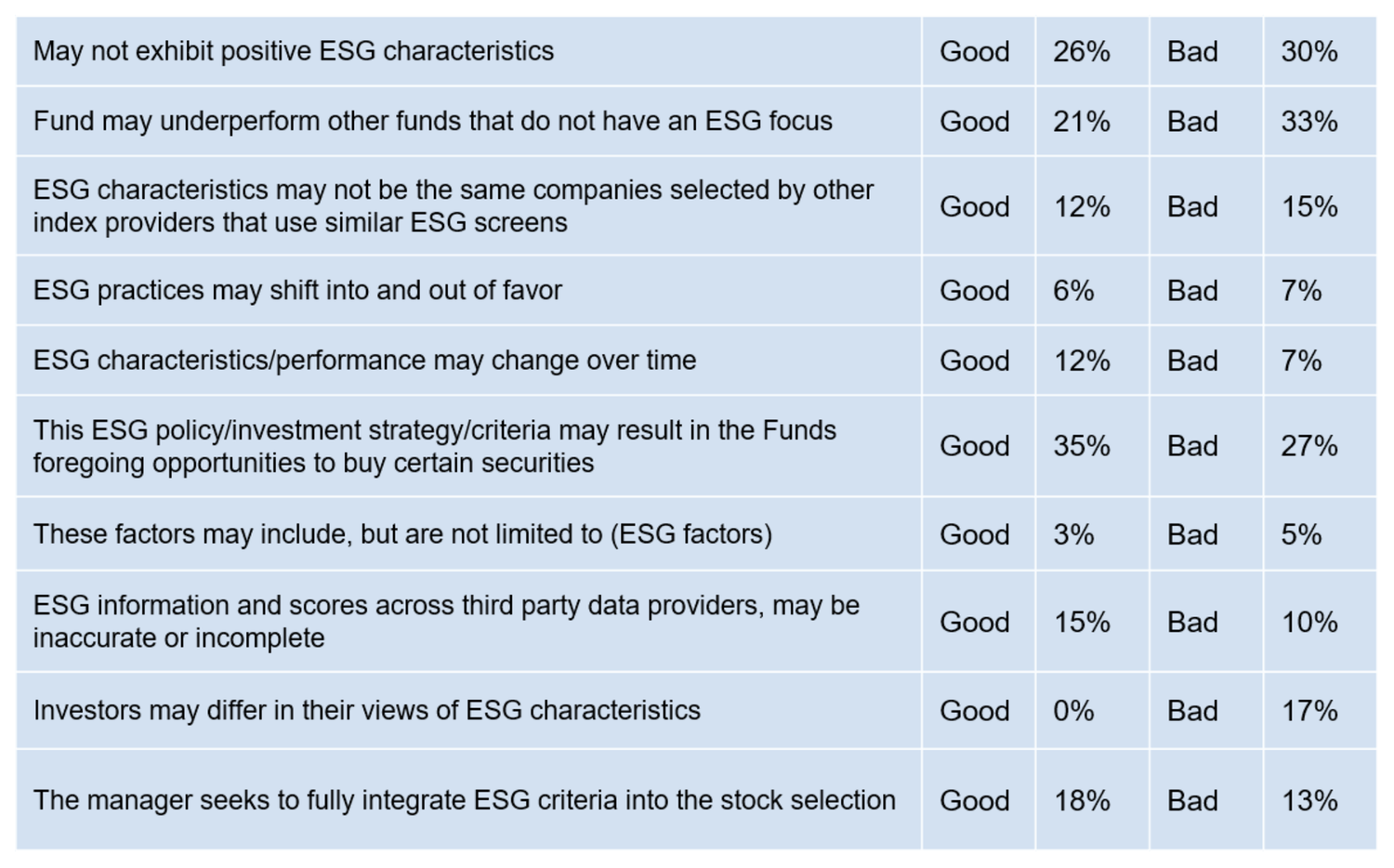

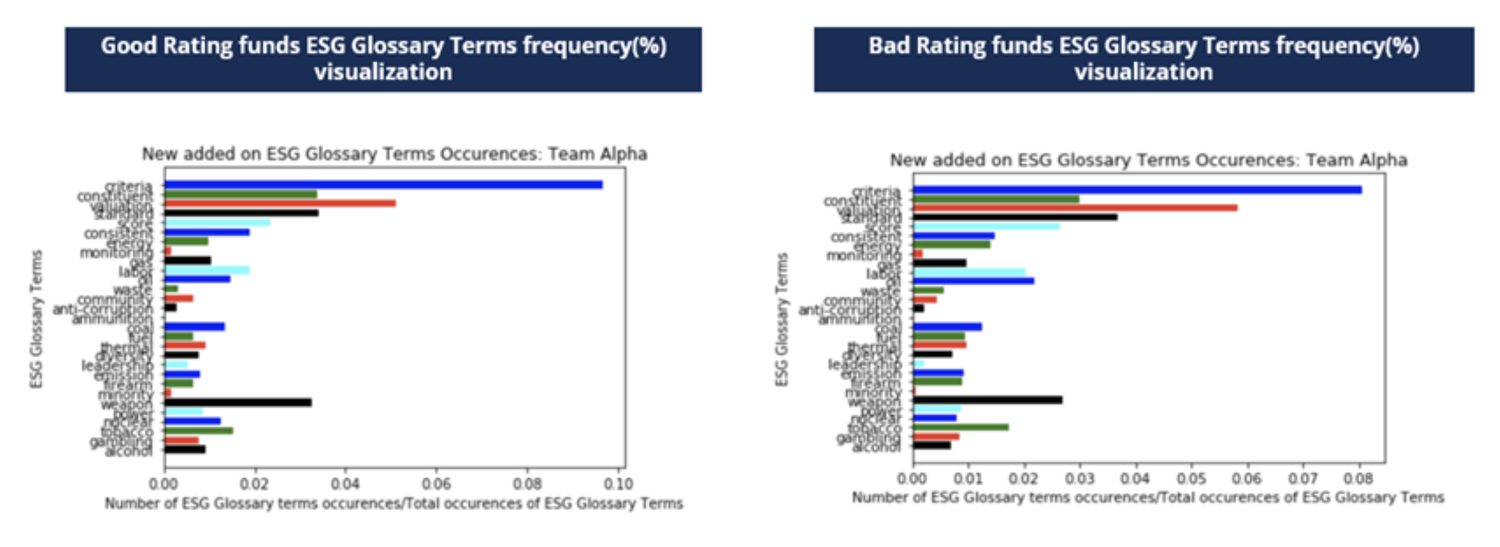

As You Sow and UCSD release new report using advanced data analytics. After a four-month analysis of 94 mutual funds and ETFs with “ESG” (environmental, social, and governance) in their name, a team of University of California, San Diego graduate students concluded that the linguistic patterns found in mutual fund and ETF prospectus language has a relatively low correlation with its ESG rating. Based on empirical methods, the report showed that one cannot tell the difference between a prospectus for true ESG vs. greenwashing mutual funds and ETFs. “Right now ESG investing in funds and ETFs is the Wild West due to the voluntary nature of ESG-related disclosures, absence of widely accepted terminology, and limited to no enforcement,” said As You Sow CEO Andrew Behar. “We see funds with ESG in their names getting F’s on our screening tools because they hold dozens of fossil fuel extraction companies and coal-fired utilities. The intent of this study is to underscore the necessity for the creation of a common glossary of terms and fund classifications subject to SEC enforcement. This will help to eliminate confusion and misleading marketing, fund naming, and prospectus language.” The final report — “Identify ‘Greenwashing’ Funds Using NLP Firms’ Prospectuses” — is the capstone project by Min Yi Li, Qianchen Zheng, Hao-Che Hsu, and Yin Zhu, students of Professor Michael Melvin, executive director of the Master of Finance Program at Rady School of Management at the University of California, San Diego (UCSD), and executive director of the Pacific Center for Asset Management. The study was also advised by Michael Cosack and Henry Shilling of Sustainable Research and Analysis, and Andrew Montes, digital strategies director at As You Sow. As You Sow, a non-profit shareholder advocacy organization, approached UCSD to oversee the data analysis after noticing that of the 3,000 mutual funds and ETFs in its Invest Your Values scorecard, 94 had “ESG” in their names yet 60 of these earned a “D” or an “F” on one or more ESG criteria. They shared this information in a comment to the U.S. Securities and Exchange Commission (SEC), met with the Division of Investment Management, and decided to use analytical science to better understand the state of the ESG-segment of the industry. The UCSD team divided the 94 funds into two groups: 34 “good” funds earning only A, B, or C grades and 60 “bad” funds earning at least one D or F grade, based on the Invest Your Values scorecard. The As You Sow scorecard flags companies in funds along seven issue areas: fossil fuels, deforestation, gender equality, civilian firearms, prison industrial complex, military weapons, and tobacco. The UCSD team used NLTK Python, tokenization, stemming, lemmatization, distillBERT (Bidirectional Encoder Representatives from Transformers), and HuggingFace data analytics to identify whether funds are “real” ESG funds or greenwashing funds based on the prospectus and other information provided by firms. The analysis extracted key ESG terms including: “Carbon”, “Climate”, “Divestment”, “Engagement”, “Environmental”, “ESG”, “Ethical”, “Exclusions, “Fossil”, “Green”, “Impact”, “Integration”, “Moral”, “PRI”, “Religious”, “Responsible”, “SDG”, “Social”, “SRI”, “Sustainable”, “Governance”, “Alcohol”, “Gambling”, “Tobacco”, “Nuclear”, “Power”, “Energy”, “Thermal”, “Fuel”, “Coal”, “Oil”, “Gas”, “Weapons”, “Waste”, “Firearms”, “Ammunition”, “Minority”, “Emissions”, “Diversity”, “Gambling”, “Anti-corruption”, “Labor”, “Human rights”, and “Community.” The analysis also looked at “Wiggle terms” that are often found in prospectus language to make the ESG terms less precise. These included “may consider”, “seek”, “believe”, “pursue”, “only”, “most”, “help”, “always”, “possibly”, “would”, “could”, “used”, “may”, and “might.” The team sorted phrases as seen in the table below to look for discernable patterns. Note how the two types of funds are nearly identical. The charts below also show that “good” and ‘“bad” funds are nearly identical when considering word usage and are therefore not helpful to discern the difference for investors. The analysis also included funds that claimed to be holding non-ESG companies for “engagement” and concluded that some, like Boston Common, used language that was clear while others did not. The report looked at “intent,” noting that “sentences or paragraphs should convey the intent of adding ESG in the investment thesis in the first place and should regard ESG as their core value.” As You Sow met with the SEC Division of Investment Management on Jan. 6, shared the report, and made recommendations to address the issue of confusing and misleading fund naming and prospectus language. Top of the list is standardizing a glossary of ESG terms and a fund classification framework subject to enforcement by the agency. They also recommended a requirement that all prospectus language be disclosed in a machine-readable format to enable automated comparisons of text vs holdings on a publicly available website so investors can spot issues rapidly. Third, they plan to continue the research to examine a much larger set of funds and possibly integrate other ESG rating systems. “Investors need asset managers to establish the philosophy underlying a fund and align the prospectus language and fund name with the intent and the holdings,” Behar said. “The problem is that there is no truth in labeling. If these funds were groceries, then a jar labeled ‘peanut free’ may contain 19% peanuts and people with a nut allergy would end up in the hospital. When investors put their hard-earned money into an ‘ESG’ or ‘fossil free’ fund they expect to reduce their climate risk and not own big oil, coal, and deforestation.” The goal is to enable advisors and investors to have assurance and agreement on what an “ESG,” or “fossil free” fund is. Currently, there are many “fossil free” funds with significant investments in fossil fuel companies, there are “low carbon transition” funds that hold Exxon, Chevron, and fossil-fired utilities like Duke and Southern. In December, Bloomberg published a story — The ESG Mirage — stating that “MSCI, the largest ESG rating company, doesn’t even try to measure the impact of a corporation on the world. It’s all about whether the world might mess with the bottom line.” A recent report by Universal Owner demonstrated how despite Vanguard’s recent climate branding through joining the Net Zero Asset Managers Initiative, it continues to invest its beneficiaries’ capital in the most damaging fossil fuel companies, rendering the impact of its ESG products relatively negligible. The As You Sow-UCSD study adds validation to previously made observations that ESG-related disclosure standards are currently lacking. This condition can be addressed and ESG investing can continue to grow and define the new regenerative economy based on justice and sustainability. # # # As You Sow is a nonprofit organization that promotes environmental and social corporate responsibility through shareholder advocacy, coalition building, and innovative legal strategies. Click here to see As You Sow’s shareholder resolution tracker.

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.