ROCHESTER, New York

,

April 4, 2022

(press release)

–

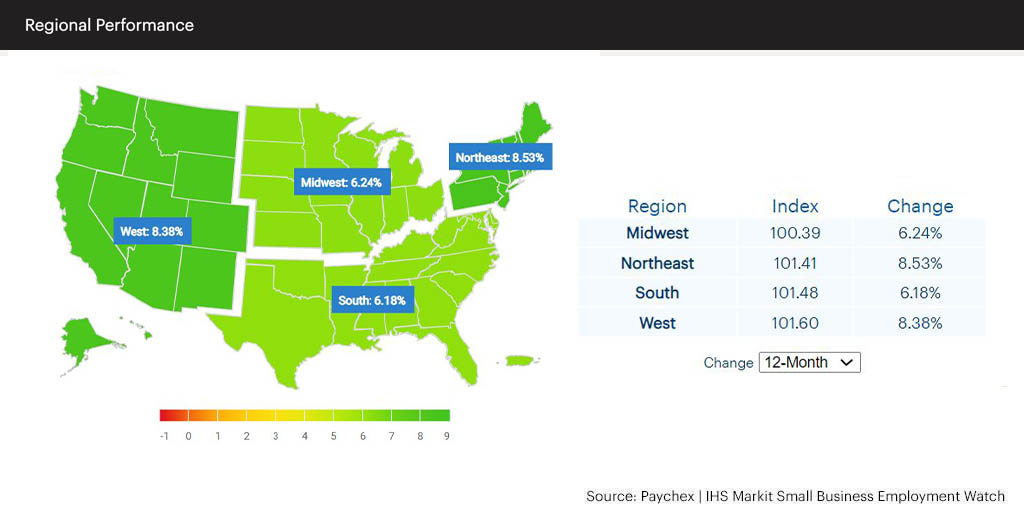

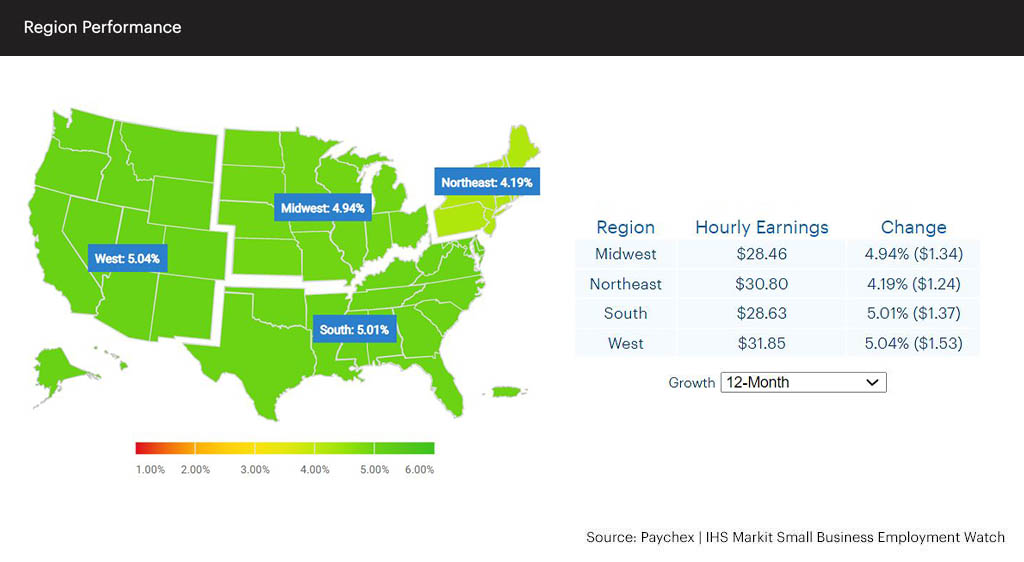

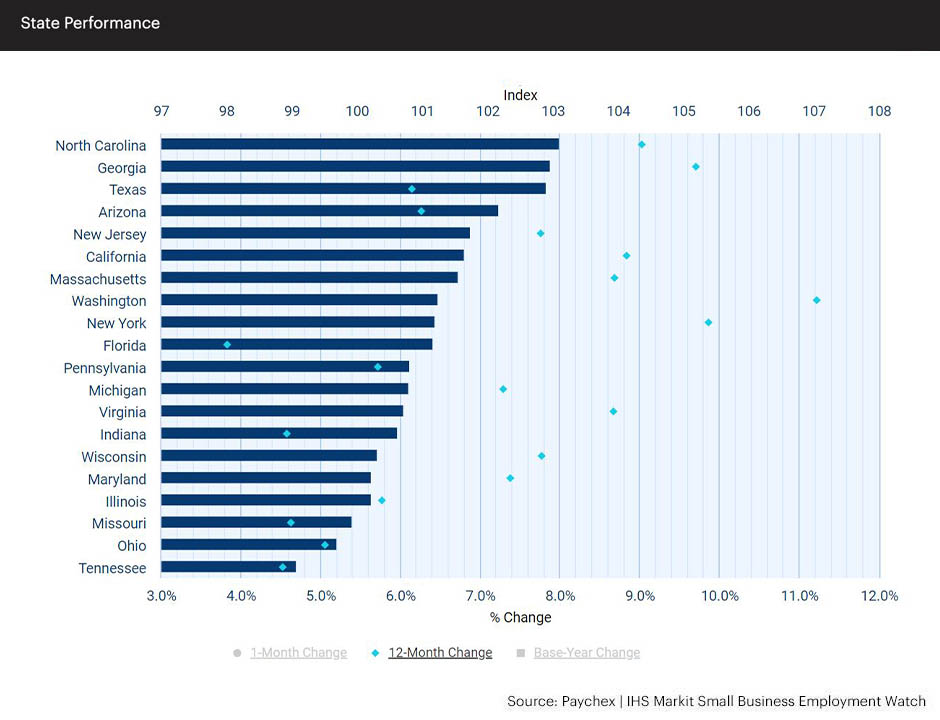

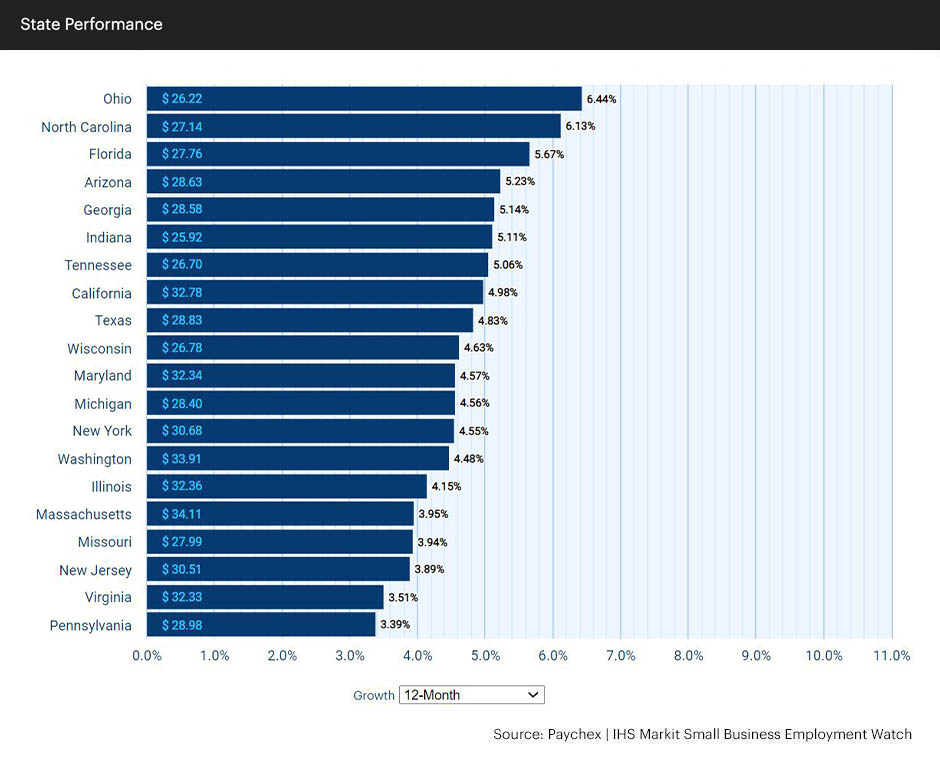

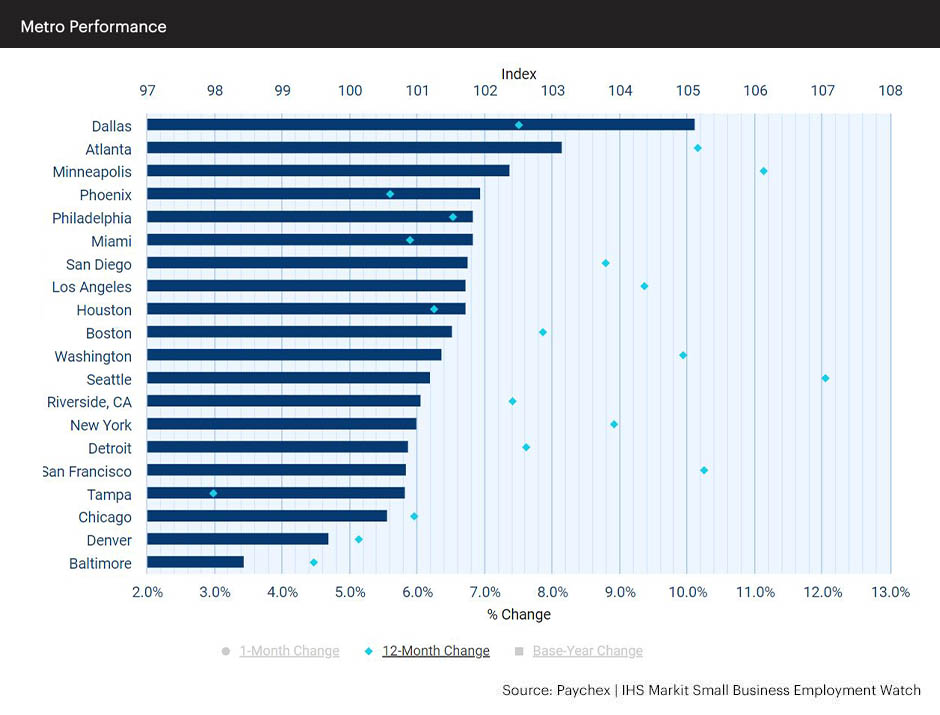

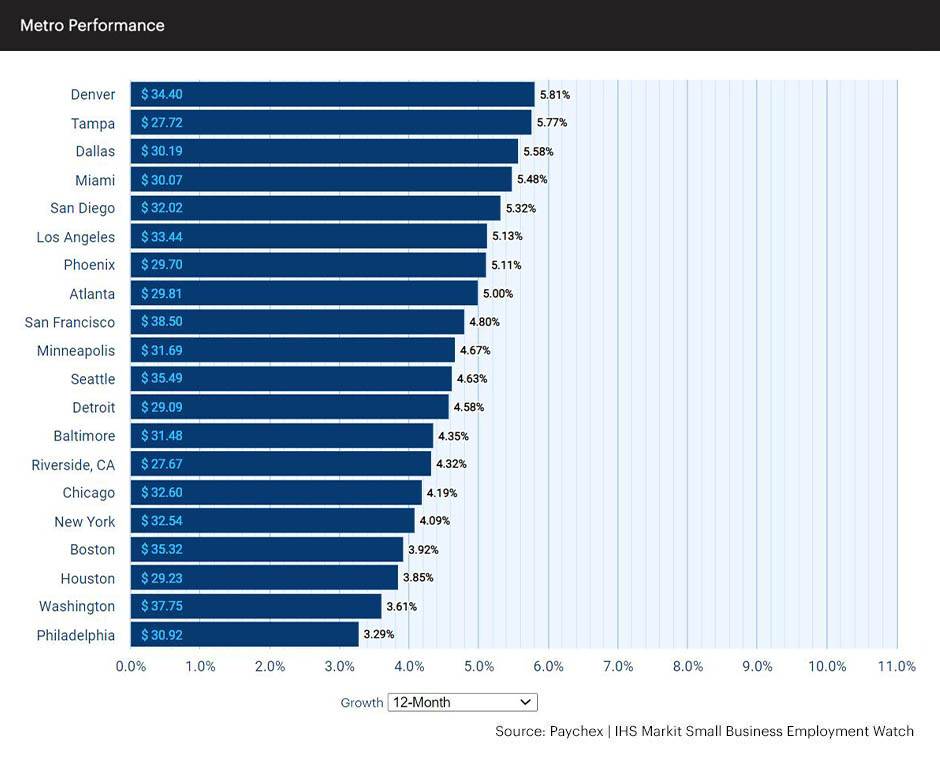

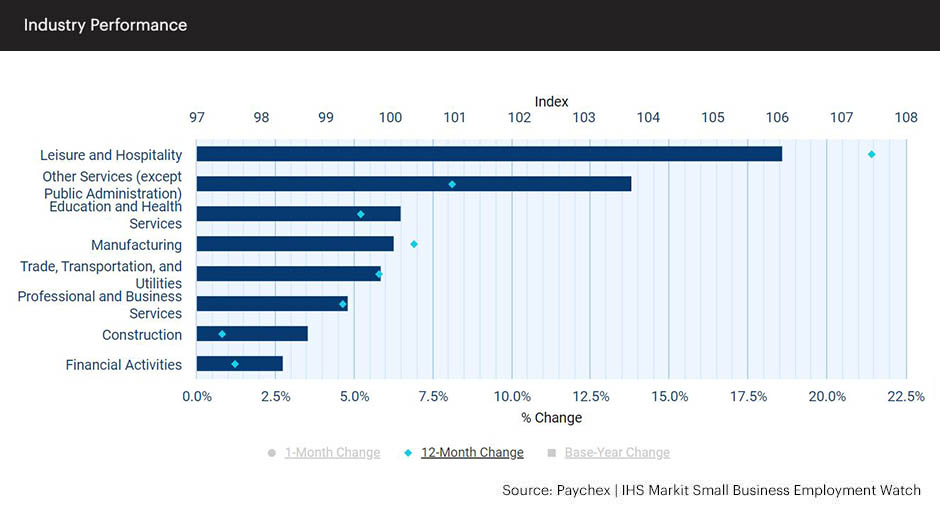

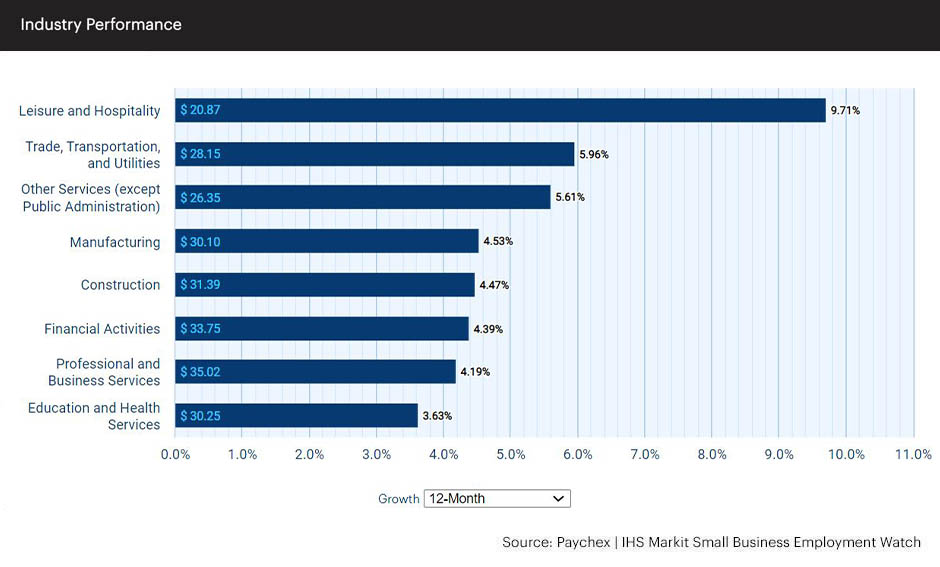

Hourly earnings growth continued to advance for the tenth consecutive month for workers of U.S. small businesses, according to the latest Paychex | IHS Markit Small Business Employment Watch. The report also showed that national small business job growth remained near its recent record high, moderating 0.03 percent in March. The national jobs index stands at 101.29, increasing 7.47 percent over the past year. Hourly earnings growth grew to 4.76 percent year-over-year. “Small business job growth continues to be historically strong,” said James Diffley, chief regional economist at IHS Markit. “Many employees continue to benefit from solid hourly earnings growth. In fact, year-over-year hourly earnings growth has improved more than two percent since May 2021,” said Martin Mucci, Paychex CEO. “This is good news for Americans feeling the pressure of inflation and higher prices at the gas pump.” In further detail, the March report showed: The complete results for March, including interactive charts detailing all data, are available at www.paychex.com/watch. Highlights are available below. March 2022 Paychex | IHS Markit Small Business Employment Watch National Jobs Index National Wage Report Regional Jobs Index Regional Wage Report State Jobs Index State Wage Report Metropolitan Jobs Index Metropolitan Wage Report Industry Jobs Index Industry Wage Report Note: Analysis is provided for seven major industry sectors. Definitions of each industry sector can be found here. The other services (except public administration) industry category includes religious, civic, and social organizations, as well as personal services, including automotive and household repair, salons, drycleaners, and other businesses. More Information *Information regarding the professions included in the industry data can be found at the Bureau of Labor Statistics website. About the Paychex | IHS Markit Small Business Employment Watch Media Contacts Kate Smith Maggie Pryslak

At 101.29, the national index remains near its historic peak set in January 2022.

The West remains the top region for small business job growth, North Carolina the highest-ranking state, and Dallas the top metro.

Nationally, hourly earnings growth improved to 4.76 percent, its tenth consecutive increase.

Annual weekly earnings growth grew to above four percent.

The West and South lead regions with hourly earnings growth above five percent.

Ohio and North Carolina have the highest rates of hourly earnings growth, both above six percent.

Leisure and hospitality leads the industry sectors in both small business jobs growth and hourly earnings growth.

Paychex solutions reach 1 in 12 American private-sector employees, making the Small Business Employment Watch an industry benchmark. Drawing from the payroll data of approximately 350,000 Paychex clients with fewer than 50 employees, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity.

For more information about the Paychex | IHS Markit Small Business Employment Watch, visit the website and sign up to receive monthly Employment Watch alerts.

The Paychex | IHS Markit Small Business Employment Watch is released each month by Paychex, Inc., a leading provider of payroll, human resource, insurance, and benefits outsourcing solutions for small-to medium-sized businesses, and IHS Markit, a world leader in critical information, analytics, and expertise. Focused exclusively on small business, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful tool delivers real-time insights into the small business trends driving the U.S. economy.

Lisa Fleming

Paychex, Inc.

585-387-6402

lfleming@paychex.com

IHS Markit

781-301-9311

katherine.smith@ihsmarkit.com

Mower

585-576-1083

mpryslak@mower.com

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.