May 8, 2023

(press release)

–

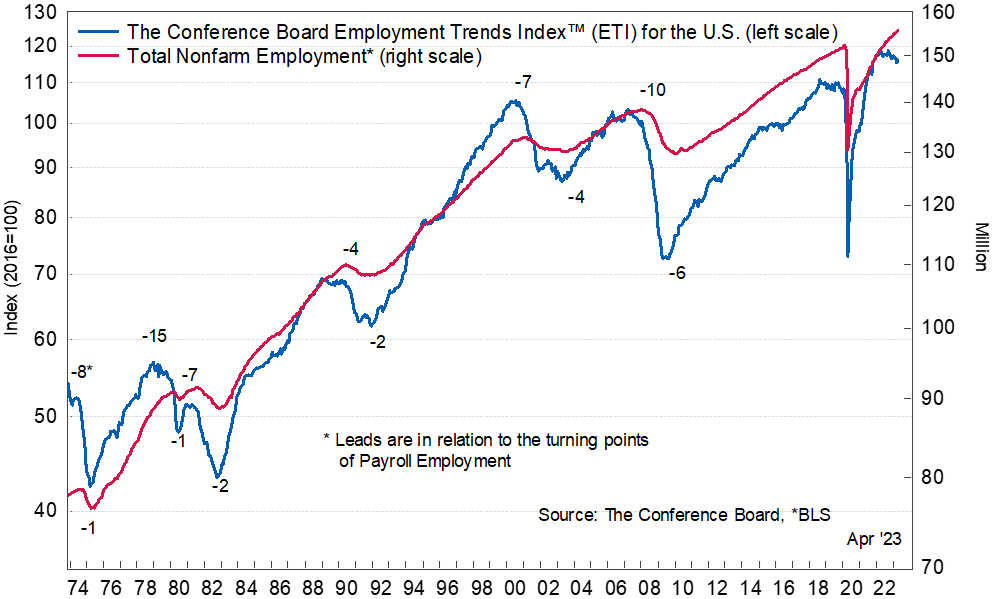

Continued—but Slowing—Job Gains Expected Over the Next Few Months The Conference Board Employment Trends Index™ (ETI) increased in April to 116.18, up from a downwardly revised 115.51 in March 2023. The Employment Trends Index is a leading composite index for employment. When the index increases, employment is likely to grow as well, and vice versa. Turning points in the index indicate that a change in the trend of job gains or losses is about to occur in the coming months. “The ETI ticked up in April and remains elevated, though below the peak it reached in March 2022," said Frank Steemers, Senior Economist at The Conference Board. “The Index signals job gains will likely continue, albeit somewhat slower, over the next few months. We continue to forecast a short and mild recession starting in 2023 although it may take until later in the year to see substantial weakening in job growth, or monthly job losses.” Steemers added: “For now, the labor market remains on strong footing with job growth continuing. However, some softening is visible across several labor indicators. Job openings and quits have declined, layoffs have ticked up, and compensation growth is softening. Still, the labor market remains resilient and tighter than before the pandemic, complicating the Federal Reserve’s efforts to slow inflation. This may prompt the Fed to raise interest rates by an additional 25 basis points to decelerate job growth and wage gains.” The unique combination of labor shortages and recession risk poses difficult dilemmas for employers. Indeed, according to the Q2 2023 results of The Conference Board Measure of CEO Confidence™, 33 percent of CEOs expect to expand their workforce over the next 12 months, while 20 percent expect a net reduction in their workforce and 46 percent expect little change. The Conference Board has published a new Job Loss Risk Index to help business leaders better understand the risk of layoffs in their industry and the unique dynamics that the projected recession exposes them to. April’s increase in the Employment Trends Index was driven by positive contributions from four of its eight components: Ratio of Involuntarily Part-time to All Part-time Workers, Job Openings, Percentage of Firms with Positions Not Able to Fill Right Now, and Percentage of Respondents Who Say They Find “Jobs Hard to Get”. The Employment Trends Index aggregates eight leading indicators of employment, each of which has proven accurate in its own area. Aggregating individual indicators into a composite index filters out “noise” to show underlying trends more clearly. The Conference Board Employment Trends Index ™, January 2000 to Present The eight leading indicators of employment aggregated into the Employment Trends Index include: *Statistical imputation for the recent month **Statistical imputation for two most recent months The Conference Board publishes the Employment Trends Index monthly, at 10 a.m. ET, on the Monday that follows each Friday release of the Bureau of Labor Statistics Employment Situation report. The technical notes to this series are available on The Conference Board website: http://www.conference-board.org/data/eti.cfm. Employment Trends Index (ETI)™ 2023 Publication Schedule Index Release Date (10 AM ET) Data for the Month Monday, January 9 2023 December 2022 Monday, February 6 January 2023 Monday, March 13 February Monday, April 10 March Monday, May 8 April Monday, June 5 May Monday, July 10 June Monday, August 7 July Tuesday, September 5* August Monday, October 9 September Monday, November 6 October Monday, December 11 November * Tuesday release due to holiday The Conference Board Employment Trends Index™ and turning points, November 1973 to Present For further information contact: Joseph DiBlasi

781.308.7935

JDiBlasi@tcb.org

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.