OTTAWA

,

April 8, 2022

(press release)

–

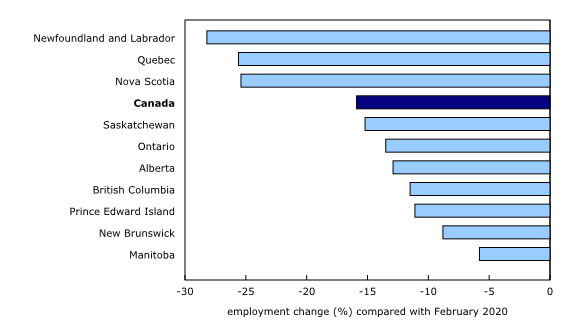

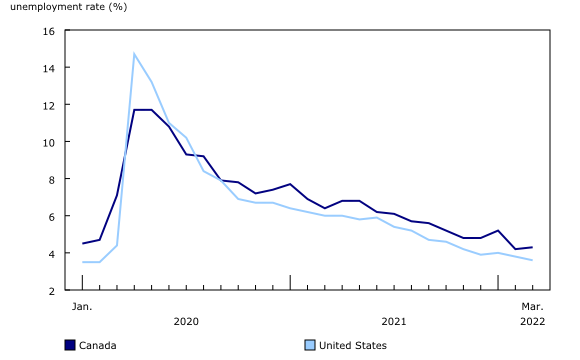

Employment rose by 73,000 (+0.4%) in March. The unemployment rate fell 0.2 percentage points to 5.3%, the lowest rate on record since comparable data became available in 1976. Employment gains were driven by women aged 55 and older and men aged 25 to 54. Employment increased in both the goods- and services-producing sectors. Gains were concentrated in Ontario and Quebec. Total hours worked rose 1.3% in March. Average hourly wages increased 3.4% on a year-over-year basis. March Labour Force Survey (LFS) data reflect labour market conditions during the week of March 13 to 19. Since the February reference week, provinces have continued to ease public health restrictions. Most notably, all capacity limits and proof-of-vaccination requirements were lifted in Ontario, Manitoba, Alberta and Quebec prior to the March reference week. Chart 1: Employment growth continues in March 2022 Employment growth continues to outpace population growth as labour market tightens In the six months since September 2021, when employment first returned to its pre-pandemic level, Canada's economy and labour market have adapted and evolved in response to a number of challenges, including the gradual easing of public health measures, record-high job vacancies and supply chain disruptions. During this period, employment has increased by 463,000 (+2.4%), with retail trade (+122,000), construction (+110,000), health care and social assistance (+62,000), and information, culture and recreation (+62,000) being the leading contributors to the six-month increase. The labour market impacts of COVID-19, and the strong employment growth observed since September 2021, have occurred against the backdrop of long-term demographic trends which are placing downward pressure on the supply of labour. Illustrating the potential for imbalances between labour supply and demand, employment gains since September (+463,000; +2.4%) have outpaced growth in the size of the population aged 15 and older (+236,000; +0.8%) during the same period. March employment increases led by older women and core-aged men While the employment rate for those aged 55 and older remained lower (-1.2 percentage points) in March 2022 than in February 2020, this is not an indication of a slower recovery from pandemic-related employment losses. It is the continuation of a long-term trend in the employment rate for this age group. As the population continues to age, a growing share of those aged 55 and older are, in fact, aged 65 and older. Since the employment rate is much lower for people aged 65 and older, having more people in this part of the age group lowers the employment rate for the entire 55 and older age group. For a narrower age group, those aged 55 to 64, the employment rate first recovered to its pre-pandemic rate in March 2021 and remained on par with that rate in March 2022 (63.6%). Employment among men in the core working age group of 25 to 54 was also up (+35,000; +0.5%) in March, primarily in part-time work (+24,000; +6.5%). Among core-aged women, total employment was little changed. Employment held steady in March for both male and female youth aged 15 to 24. Growth in average wages continues to accelerate The year-over-year growth in average hourly wages in March was driven in part by the high-wage professional, scientific and technical services industry, where both the number of employees (+13.3%; +153,000) and average wages (+7.5%; +$2.74 to $39.15) have increased over the past year (not seasonally adjusted). By province, year-over-year wage growth was highest in March in Prince Edward Island (+8.4%; +$2.10), New Brunswick (+7.6%; +$1.90) and Quebec (+5.5%; +$1.57); meanwhile, it was lowest in Manitoba (+0.8%; +$0.21) and Alberta (+1.4%; +$0.44) (not seasonally adjusted). Changes in average wages in a province or region can be the result of many factors, including regional variations in the balance between labour supply and demand, as well as changes over time in the composition of employment by industry in a region. In Alberta, for example, wage gains in several industries, including natural resources and retail trade, were partially offset by declines in others, such as educational services. Continued increase in hybrid work arrangements At the same time, the share of workers who report hybrid work arrangements continued to grow, up 1.4 percentage points from February to 5.9% in March. Hybrid work remained more common in professional, scientific and technical services, with just over 1 in 10 (10.9%) usually working part of the week from home and part from a location outside the home, up 2.2 percentage points from February. The proportion of workers with a hybrid work arrangement also increased in the finance, insurance, real estate, rental and leasing (+2.9 percentage points to 10.5%) and information, culture and recreation (+2.8 percentage points to 9.2%) industries (15-to-69 year-olds, not seasonally adjusted). Some recovery in own-account self-employment, with gains limited to men Total self-employment—which includes both own-account workers with no paid help and business owners with employees—remained 215,000 (-7.5%) below its pre-COVID February 2020 level and has not seen any monthly growth since March 2021. For own-account workers, there has been some indication of employment recovery in recent months, primarily among men. Although it remains below its pre-COVID level, the number of self-employed men without employees was up 35,000 (+3.2%) on a year-over-year basis in March, with much of the net growth being in the professional, scientific, and technical services industry (not seasonally adjusted). Unemployment rate falls to record low With the exception of an increase in January 2022, the unemployment rate has fallen consistently in recent months, mirroring the situation in other countries with increasingly tight labour markets, including the United States, Australia, and the United Kingdom. The share of the population aged 15 and older participating in the labour market—who were either employed or unemployed—was 65.4% in March 2022, little changed from February 2022. Excluding a dip in January 2022, the participation rate has hovered around its pre-COVID February 2020 level since September 2021. Chart 2: Unemployment rate continues downward trend, falls to record low in March Unemployment rate falls sharply for male youth The decline in male youth unemployment was largely the result of a one-month drop in the group's labour force participation rate (-1.3 percentage points to 63.4%). The male youth labour force participation rate recovered to its pre-pandemic level in the summer of 2020 and has hovered around that level in recent months, suggesting that the March drop is not yet indicative of a long-term trend. At 66.7%, the participation rate was little changed among young women in March. Record low unemployment rate for core-aged men The participation rate for the core-aged population reached a record high of 88.6% in March 2022. The rate for core-age women (84.8%) was the highest on record, while it was the highest for men (92.3%) since August 1991. Among people aged 55 and older, the unemployment rate held steady for both men (5.4%) and women (4.5%). Similarly, there was little change in the participation rate for both men (42.4%) and women (31.6%) in this age group. Unemployment rate among very recent immigrants at historic low The unemployment rate for core-aged immigrants who landed in Canada within the previous five years was 8.3% in March 2022, the lowest March rate on record since comparable data became available in 2006, and similar to the rates observed in March 2018 (8.4%) and March 2019 (8.7%). However, the unemployment rate of core-aged very recent immigrants remained 3.8 percentage points above the rate of their Canadian-born counterparts (4.5%), the same gap as before the pandemic in March 2019 (three-month moving averages, not seasonally adjusted). Unemployment rate higher among Black and Arab Canadians Chart 3: Core-age unemployment rates higher for visible minority groups Long-term unemployment remains elevated despite more unemployed finding work Among those who were unemployed in March 2022, 225,000 had been continuously searching for work for 27 weeks or more, little changed from February 2022 and 45,000 (+24.9%) higher than in February 2020. Labour underutilization remains low, with less potential for new workers In both the short term and longer term, the ability of Canadian employers to succeed in a competitive labour market will depend in part on their ability to tap into all available sources of labour supply, including those Canadians who report that they want to work but are not looking. As the labour market tightens, this pool of potential workers continues to shrink. After reaching an all-time peak of 1.5 million in April 2020, at the beginning of the pandemic, the number of people in this group has been on a downward trend. In March 2022, both the absolute size of this group (377,000) and its size as a proportion of the potential labour force (1.8%) were similar to the average observed in the month of March from 2017 to 2019. Newfoundland and Labrador had the highest proportion of people who did not search but wanted work as a share of their potential labour force (5.4%), while it was the lowest in Quebec (1.0%), indicating that employers in Quebec may have the least scope for filling unmet labour demand from this group (not seasonally adjusted). Nationally, more that than one-quarter (27.7%; 104,000) of those who wanted to work in March but were not looking cited illness or disability as their reason for staying out of the labour market (not seasonally adjusted). An additional 20.5% (77,000) reported reasons for not looking that suggest they would readily re-enter the workforce given the right opportunity. This included 14.2% (54,000) who were waiting for recall or reply from an employer and 6.3% (24,000) who were discouraged from searching because they believed no work was available (not seasonally adjusted). A further group of potential workers cited reasons for not looking for work which suggest the importance of balancing employment with other responsibilities, including 17.3% (65,000) who cited personal and family responsibilities and 16.7% (63,000) who said attending school was the reason they did not search (not seasonally adjusted). Employment up in both the services- and goods-producing sectors The rise in the services-producing sector was spread across accommodation and food services (+15,000), "other services" (+14,000)—which includes repair and maintenance services and personal care services—and public administration (+12,000). In the goods-producing sector, March employment gains were driven by construction (+14,000), natural resources (+8,800) and agriculture (+5,800). The overall gain in the goods-producing sector marks the fourth consecutive monthly increase in the sector. Total hours worked increased 1.3% in March, with increases in both the goods-producing (+2.7%) and services-producing (+0.8%) sectors. Accommodation and food services (+5.6%), construction (+2.6%) and manufacturing (+2.5%) were among industries with notable increases in total hours worked. Employment growth in accommodation and food services slows in March Chart 4: Accommodation and food services employment remains below its pre-COVID-19 level in most provinces More people working in "other services" in March There were fewer people working in the industry compared with both March 2021 (-33,000) and with February 2020 (-87,000). All of the decline in the last 12 months is attributable to repair and maintenance services, which includes repair services for household goods, automotive and commercial machinery (not seasonally adjusted). Employment gain in public administration partially offsets February losses The number of people working in construction continues its upward trend The recent upward trend in the number of people working in the industry has occurred alongside steady growth in investment in building construction since the fall of 2021. First employment increase in agriculture since November 2020 The number of workers also rose in natural resources (+8,800; +2.7%) in March, almost entirely due to an increase in Ontario. Employment in the industry returned to its May 2021 level, equalling its highest level since the beginning of the pandemic, 27,000 (+8.6%) above its February 2020 level. Employment up in four provinces For more information on key province and industry level labour market indicators, see "Labour Force Survey in brief: Interactive app." In Ontario, employment rose by 35,000 (+0.5%) in March, following a decline in January and a substantial increase in February. The gain in March was largely in construction and natural resources, while the number of people working in transportation and warehousing fell. The Ontario unemployment rate was 5.3%, little different from February 2020. On a year-over-year basis, employment in the Toronto census metropolitan area (CMA) grew by 243,000 (+7.3%). Gains were widespread in several industries, particularly wholesale and retail trade, finance, insurance, real estate, rental and leasing, as well as accommodation and food services (three-month moving average, not seasonally adjusted). Coinciding with the lifting of public health measures, employment in Quebec increased by 27,000 (+0.6%) in March, building on gains in February. Increases in March were mostly in accommodation and food services, public administration, and educational services, while employment in professional, scientific and technical services decreased. The unemployment rate fell 0.4 percentage points to 4.1%, the lowest on record. Compared with March 2021, employment in the Montréal CMA increased by 90,000 (+4.0%). Gains were largest in information, culture and recreation, and professional, scientific and technical services (three-month moving averages, not seasonally adjusted). In Atlantic Canada, employment increased in New Brunswick (+4,100; +1.1%) and Prince Edward Island (+800; +1.0%) in March. The unemployment rate held steady at 7.7% in New Brunswick, while it declined 0.9 percentage points to 8.1% in Prince Edward Island. After notable gains in February, Newfoundland and Labrador was the only Atlantic province where employment fell (-2,900; -1.3%) in March. At 12.9%, the unemployment rate continued to be the highest among all provinces. The employment declines were among core-aged and older women as well as young men, and were mainly in wholesale and retail trade. Both Saskatchewan (-4,500; -0.8%) and Manitoba (-4,200; -0.6%) had notable employment losses in March. The unemployment rate was little changed at 5.0% in Saskatchewan, while it increased 0.5 percentage points to 5.3% in Manitoba. Quarterly update for the territories Employment in Yukon fell by 1,200 in the three months ending in March 2022, to 23,000. The employment rate decreased from 71.7% in the fourth quarter of 2021 to 68.1% in the first quarter of 2022, and the unemployment rate rose 3.0 percentage points to 5.8%. Employment in Nunavut averaged 13,900 for the 12 months ending in March, up 800 compared with the 12 months ending in December 2021. Over the same period, the employment rate was up 3.0 percentage points to 55.2%. The unemployment rate averaged 11.5% in the 12 months ending in March 2022. Employment rate in Canada higher than in the United States A frequent point of comparison between Canada and the United States is the employment rate, defined as the number of people who are employed as a percentage of the working-age population, which is typically higher in Canada. Adjusted to US concepts, and for the population aged 16 and older, the employment rate was 62.4% in Canada and 60.1% in the United States in March. The rate was unchanged from February 2020 in Canada, compared with a decline of 1.1 percentage points in the United States. The labour force participation rate, also adjusted to US concepts, was 65.2% in Canada in March, down 0.3 percentage points from February 2020. In the United States, the participation rate was 62.4%, and remained below the February 2020 rate by a full percentage point. The unemployment rate, adjusted to US concepts, was 4.3% in Canada in March 2022, 0.7 percentage points higher than in the United States (3.6%). The rate in Canada was 0.4 percentage points lower than in February 2020, while in the United States it was little changed from the pre-pandemic rate. Chart 5: Unemployment rate on steady downward trend in Canada and the United States Spotlight on: Quality of employment The likelihood of a worker changing jobs is influenced by a number of factors, including aspects of the quality of their employment, such as the extent to which jobs offer the possibility of career advancement. New data from the LFS show that in March 2022, 6 in 10 employees (60.1%) agreed that their current job afforded good prospects for career advancement, compared with 51.9% in 2016, when the same question was asked in the General Social Survey (15-to-69 year-olds, not seasonally adjusted). Employees in jobs typically requiring a bachelor's degree or above (69.4%) were more likely than those in jobs typically requiring a high school diploma or no specific level of education (48.5%) to agree that their job offers good career prospects (15-to-69 year-olds, not seasonally adjusted). The number of employees working in jobs typically requiring a bachelor's degree or above has increased by 22.7% (+704,000) since March 2019, compared with a decline of 2.9% (-180,000) for those that usually require a high school diploma or no specific level of education (not seasonally adjusted). This suggests that trends in the composition of employment—an increasing share of employees in jobs that typically require a bachelor's degree or above—are likely to support increases in the extent to which workers have good career prospects. In April, the LFS will continue to examine aspects of quality of employment, with new questions about work-life balance. LFS results for the week of April 10 to 16 will be released on May 6, 2022. Note to readers The LFS estimates are based on a sample and are therefore subject to sampling variability. As a result, monthly estimates will show more variability than trends observed over longer time periods. For more information, see "Interpreting Monthly Changes in Employment from the Labour Force Survey." This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level. LFS estimates at the Canada level do not include the territories. The LFS estimates are the first in a series of labour market indicators released by Statistics Canada, which includes indicators from programs such as the Survey of Employment, Payrolls and Hours (SEPH); Employment Insurance Statistics; and the Job Vacancy and Wage Survey. For more information on the conceptual differences between employment measures from the LFS and those from the SEPH, refer to section 8 of the Guide to the Labour Force Survey (Catalogue number71-543-G). Since March 2020, all LFS face-to-face interviews have been replaced by telephone interviews conducted by interviewers working from their home to protect the health of both respondents and interviewers. While this has resulted in a decline in the LFS response rate, more than 48,000 interviews were completed in March and in-depth data quality evaluations conducted each month confirm that the LFS continues to produce an accurate portrait of Canada's labour market. The suspension of face-to-face interviewing has had a larger impact on response rates in Nunavut than in other jurisdictions. Due to the larger decline in response rates for Nunavut, and resulting changes in the composition of the responding sample, data for Nunavut (table 14-10-0292-01) should be used with caution. To reduce the risks associated with declining data quality for Nunavut, users are advised to use 12-month averages (available upon request) rather than 3-month averages when possible. Statistics Canada will continue to monitor the quality of LFS data for Nunavut each month and provide users with updated guidelines as required. The employment rate is the number of employed people as a percentage of the population aged 15 and older. The rate for a particular group (for example, youths aged 15 to 24) is the number employed in that group as a percentage of the population for that group. The unemployment rate is the number of unemployed people as a percentage of the labour force (employed and unemployed). The participation rate is the number of employed and unemployed people as a percentage of the population aged 15 and older. Full-time employment consists of persons who usually work 30 hours or more per week at their main or only job. Part-time employment consists of persons who usually work less than 30 hours per week at their main or only job. Total hours worked refers to the number of hours actually worked at the main job by the respondent during the reference week, including paid and unpaid hours. These hours reflect temporary decreases or increases in work hours (for example, hours lost due to illness, vacation, holidays or weather; or more hours worked due to overtime). In general, month-to-month or year-to-year changes in the number of people employed in an age group reflect the net effect of two factors: (1) the number of people who changed employment status between reference periods, and (2) the number of employed people who entered or left the age group (including through aging, death or migration) between reference periods. Supplementary indicators used in the March 2022 analysis Employed, worked less than half of their usual hours includes both employees and self-employed, where only employees were asked to provide a reason for the absence. This excludes reasons for absence such as 'vacation,' 'labour dispute,' 'maternity,' 'holiday,' and 'weather.' Also excludes those who were away all week. Not in labour force but wanted work includes persons who were neither employed, nor unemployed during the reference period and wanted work, but did not search for reasons such as 'waiting for recall (to former job),' 'waiting for replies from employers,' 'believes no work available (in area, or suited to skills),' 'long-term future start,' and 'other.' Unemployed, job searchers were without work, but had looked for work in the past four weeks ending with the reference period and were available for work. Unemployed, temporary layoff or future starts were on temporary layoff due to business conditions, with an expectation of recall, and were available for work; or were without work, but had a job to start within four weeks from the reference period and were available for work (don't need to have looked for work during the four weeks ending with the reference week). Labour underutilization rate (specific definition to measure the COVID-19 impact) combines all those who were unemployed with those who were not in the labour force but wanted a job and did not look for one; as well as those who remained employed but lost all or the majority of their usual work hours for reasons likely related to COVID-19 as a proportion of the potential labour force. Potential labour force (specific definition to measure the impact of COVID-19) includes people in the labour force (all employed and unemployed people), and people not in the labour force who wanted a job but didn't search for reasons such as 'waiting for recall (to former job),' 'waiting for replies from employers,' 'believes no work available (in area, or suited to skills),' 'long-term future start,' and 'other.' Information on population groups Seasonal adjustment The seasonally adjusted data for retail trade and wholesale trade industries presented here are not published in other public LFS tables. A seasonally adjusted series is published for the combined industry classification (wholesale and retail trade). Next release Products The product "Labour Force Survey in brief: Interactive app" (Catalogue number14200001) is also available. This interactive visualization application provides seasonally adjusted estimates by province, sex, age group and industry. The product "Labour Market Indicators, by province and census metropolitan area, seasonally adjusted" (Catalogue number71-607-X) is also available. This interactive dashboard provides customizable access to key labour market indicators. The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (Catalogue number71-607-X) is also available. This dynamic web application provides access to labour market indicators for Canada, province, territory and economic region. The product Labour Force Survey: Public Use Microdata File (Catalogue number71M0001X) is also available. This public use microdata file contains non-aggregated data for a wide variety of variables collected from the Labour Force Survey. The data have been modified to ensure that no individual or business is directly or indirectly identified. This product is for users who prefer to do their own analysis by focusing on specific subgroups in the population or by cross-classifying variables that are not in our catalogued products. Contact information Industry Intelligence Editor's Note: This press release omits select charts and/or marketing language for editorial clarity. Click here to view the full report.

Total employment rose by 73,000 (+0.4%) in March, driven by an increase of 93,000 (+0.6%) in full-time work.

In March, employment growth was led by workers aged 55 and older, a group often identified as a potential source of increased labour supply. Employment in this group increased by 39,000 (+0.9%) in March, including an increase of 25,000 (+1.3%) among women aged 55 and older.

In the context of a tightening labour market, average hourly wages for employees rose 3.4% (+$1.03) on a year-over-year basis in March, up from 3.1% in February. In February, the Consumer Price Index was up 5.7% on a year-over-year basis. Year-over-year wage growth among all employees (+3.4%) remains lower than the average recorded during the second half of 2019 (+4.3%) when similarly tight labour market conditions were observed (not seasonally adjusted).

Employment growth in the past six months has coincided with the continued easing of public health restrictions, which has allowed more businesses to make plans for workers to return to in-person work. In this context, the proportion of workers who report that they usually work exclusively from home continued to decline in March, down 1.8 percentage points to 20.7% (15-to-69 year-olds, not seasonally adjusted).

Employment growth in March (+73,000; +0.4%) was spread across private sector employees and the self-employed, with neither group recording a significant increase in the month.

The unemployment rate fell 0.2 percentage points to 5.3% in March, the lowest level since comparable data became available in 1976. The previous record low was observed in May 2019 (5.4%). The adjusted unemployment rate—which includes people who wanted a job, but did not look for one—was below its pre-pandemic level for the first time at 7.2%.

The drop in the overall unemployment rate in March was driven in large part by a decline of 2.1 percentage points in the unemployment rate for male youth, which fell to a low of 10.2%. In contrast, the unemployment rate for female youth was little changed in March at 9.3%.

Fewer core-aged men were unemployed in March (-18,000; -6.0%) and their unemployment rate was at a record low of 4.1%. The unemployment rate for core-aged women increased 0.5 percentage points to 4.9% as the number of unemployed increased by 32,000 (+11.4%). The unemployment rate for core-aged women was similar to its pre-pandemic February 2020 level (4.7%).

After declining earlier in the pandemic due to international travel restrictions, the number of very recent immigrants to Canada has increased in recent months. As of March 2022, there were an estimated 1.1 million people aged 15 and older who landed in Canada within the previous 5 years, on par with the average in 2019 (three-month moving average).

Historically, unemployment rates have been higher among certain population groups designated as visible minorities in Canada. This continued to be the case in March. Among those in the core working age group of 25 to 54, the unemployment rate was higher among the overall visible minority population (6.1%) compared with those who were not a visible minority (4.5%). The rates were higher among Black (8.4%) and Arab (8.2%) Canadians, and lower among Filipino Canadians (4.2%) (three-month moving averages, not seasonally adjusted).

The total number of unemployed people fell by 35,000 (-3.1%) in March to 1.1 million. Of those who had been unemployed in February, about 1 in 5 (21.0%) transitioned into employment in March, slightly higher than the average rate observed for the same months in 2017, 2018, and 2019 (17.9%) (not seasonally adjusted).

The labour underutilization rate—the proportion of people in the potential labour force who are unemployed; want a job but have not looked for one; or are employed but working less than half of their usual hours—held steady at 12.1% in March 2022. This was above the rate of 11.4% in February 2020, but within the range observed through 2018 and 2019.

Employment rose in both the services-producing (+42,000; +0.3%) and goods-producing (+31,000; +0.8%) sectors in March.

Following an increase of 114,000 (+12.6%) in February, employment grew by 15,000 (+1.5%) in accommodation and food services in March. Despite the recent gains, the number of people working in the industry remains below its February 2020 pre-COVID-19 level in all provinces except New Brunswick and Manitoba.

The "other services" industry, which includes repair and maintenance services, personal care services, as well as civic and religious organizations, posted an employment increase of 14,000 (+2.0%) in March 2022, bringing employment in the industry back up to the level recorded in December 2021.

The number of people working in public administration rose by 12,000 (+1.1%) in March, following a decline of 18,000 in February. Most of the increase was in Quebec.

Employment rose by 14,000 (+0.9%) in construction in March, the fourth consecutive monthly increase in the industry. Nearly all of the gains were in Ontario. From January to March, construction (+24,000) accounted for just under half of the net employment gains (+49,000) among core-aged men who belong to a population group designated as a visible minority (not seasonally adjusted).

Employment in agriculture has followed a long-term downward trend since November 2020, declining by 44,000 over the 12 months to November 2021. In March 2022, employment in the industry increased for the first time since November 2020, rising 5,800 (+2.4%).

In March, employment increased in New Brunswick (+1.1%; +4,100), Prince Edward Island (+1.0%; +800), Quebec (+0.6%; +27,000) and Ontario (+0.5%; +35,000). These increases were partially offset by declines in Newfoundland and Labrador (-1.3%; -2,900), Saskatchewan (-0.8%; -4,500) and Manitoba (-0.6%; -4,200). There was little change in Nova Scotia, Alberta and British Columbia.

Employment in the Northwest Territories increased by 1,500 in the first quarter of 2022 to 25,000. Over the same period, the unemployment rate was little changed at 5.2% as more people participated in the labour market. The employment rate rose to 74.3% in the three months ending in March from 70.3% in the three months ending in December 2021.

While international comparisons of labour markets are challenging due to differences in concepts, comparisons between the labour market situation in Canada and in the United States can be made by adjusting Canadian data to US concepts. For more information, see "Measuring Employment and Unemployment in Canada and the United States – A comparison."

Despite employment and unemployment trends suggesting tightening labour market conditions, the job-changing rate—the proportion of workers who remain employed from one month to the next, but who change jobs between months—held steady in March at 0.7%.

The Labour Force Survey (LFS) estimates for March are for the week of March 13 to 19, 2022.

Employed, worked zero hours includes employees and self-employed who were absent from work all week, but excludes people who have been away for reasons such as 'vacation,' 'maternity,' 'seasonal business,' and 'labour dispute.'

A new data table (14-10-0373-01) presenting labour force characteristics of population groups designated as visible minorities, i.e., South Asian, Chinese, Black, Filipino, Arab, Latin American, Southeast Asian, West Asian, Korean, and Japanese, is now available on the Statistics Canada website.

Unless otherwise stated, this release presents seasonally adjusted estimates, which facilitate comparisons by removing the effects of seasonal variations. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The next release of the LFS will be on May 6, 2022. April data will reflect labour market conditions during the week of April 10 to 16, 2022.

More information about the concepts and use of the Labour Force Survey is available online in the Guide to the Labour Force Survey (Catalogue number71-543-G).

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.