June 1, 2023

(press release)

–

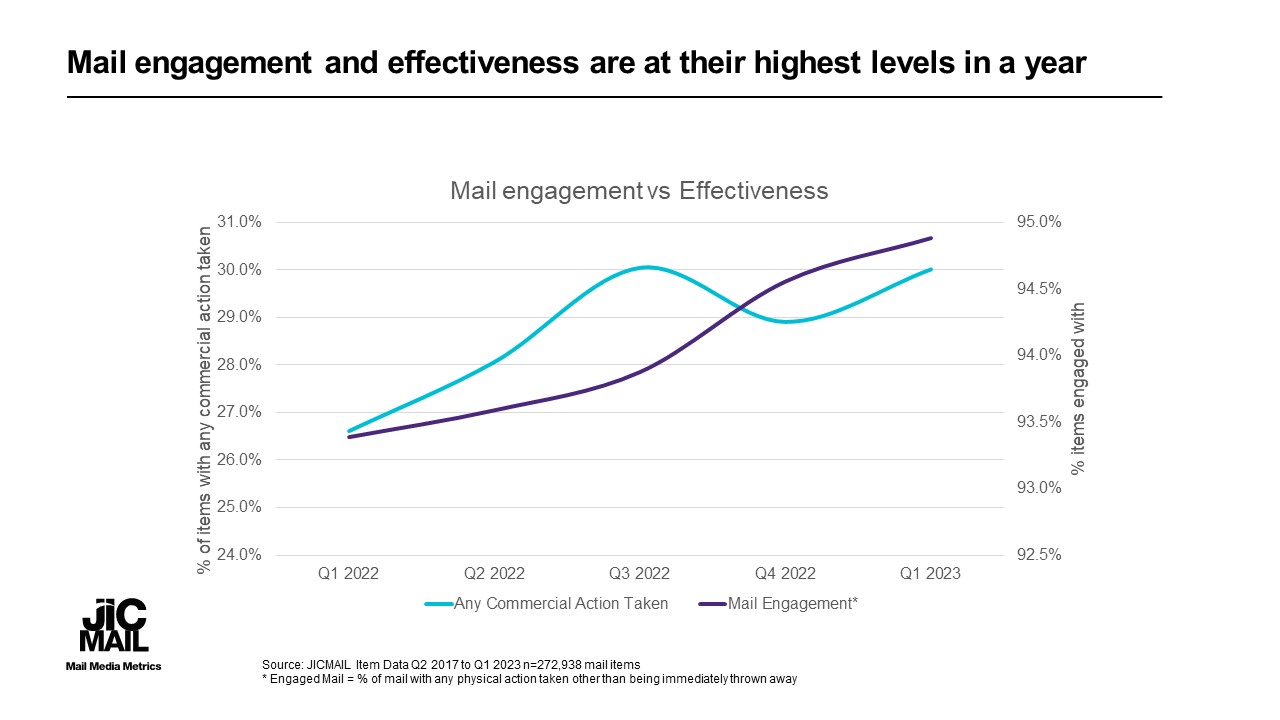

Q1 2023 results reveal that despite another challenging quarter for consumers, a greater proportion of mail was engaged with than at any point in the previous year, and a greater proportion resulted in positive commercial outcomes for advertisers. JICMAIL’s diary-based data captured from a panel of one thousand households every month reveals that in Q1 2023: Q1 2023 KEY MAIL METRICS Frequency Item Reach Lifespan Direct Mail 4.4 interactions 1.1 people 7.1 days Door Drops 3.0 interactions 1.1 people 5.7 days Business Mail 4.8 interactions 1.2 people 8.5 days Partially Addressed 3.8 interactions 1.1 people 6.7 days % of ALL Mail… Read / looked / glanced at Opened Retained in the home Discussed with someone Prompted a purchase Triggered a website visit Q1 2023 74.7% 64.7% 46.4% 15.5% 4.2% 8.3% Q1 2022 72.6% 62.7% 43.7% 12.8% 4.0% 8.0% Source: JICMAIL Item Data Q1 2023 n=11,439 Direct Mail, Door Drop, Partially Addressed and Business Mail items Mail interactions captured by JICMAIL panellists take many forms and range from opening and reading mail, to passing it on to someone else, putting it in the usual place, putting aside to look at later or taking it out of home (amongst a list of many other actions). In addition, JICMAIL captures the industry category and advertiser details of almost every mail item in its 270,000 strong mail item database. Ian Gibbs, Director of Data Leadership and Learning commented, “Despite stubbornly high levels of inflation, there have been a few rays of sunshine in Q1 with the IPA Bellwether report pointing towards increased advertiser confidence in 2023 and PwC reporting that high street store closures have slowed. Against this backdrop mail continues to be a vital channel in efficiently delivering key messages to consumers when times are tough; and for those advertisers that are active in the channel, they have seen the reward of improved commercial effectiveness throughout the customer journey.” Mark Cross, Engagement Director of JICMAIL added, “The opportunity for practitioners is to appreciate the mindset of their audiences – who in Q1 have yet again demonstrated commercially savvy behaviour as well as high engagement with mail.”

* All content is copyrighted by Industry Intelligence, or the original respective author or source. You may not recirculate, redistrubte or publish the analysis and presentation included in the service without Industry Intelligence's prior written consent. Please review our terms of use.